Liquidity Paradox: Credit Markets Hit Record Health While Bitcoin Starves

US credit markets have never been healthier, yet Bitcoin finds itself starved of fresh capital—a paradox that encapsulates crypto’s current predicament.

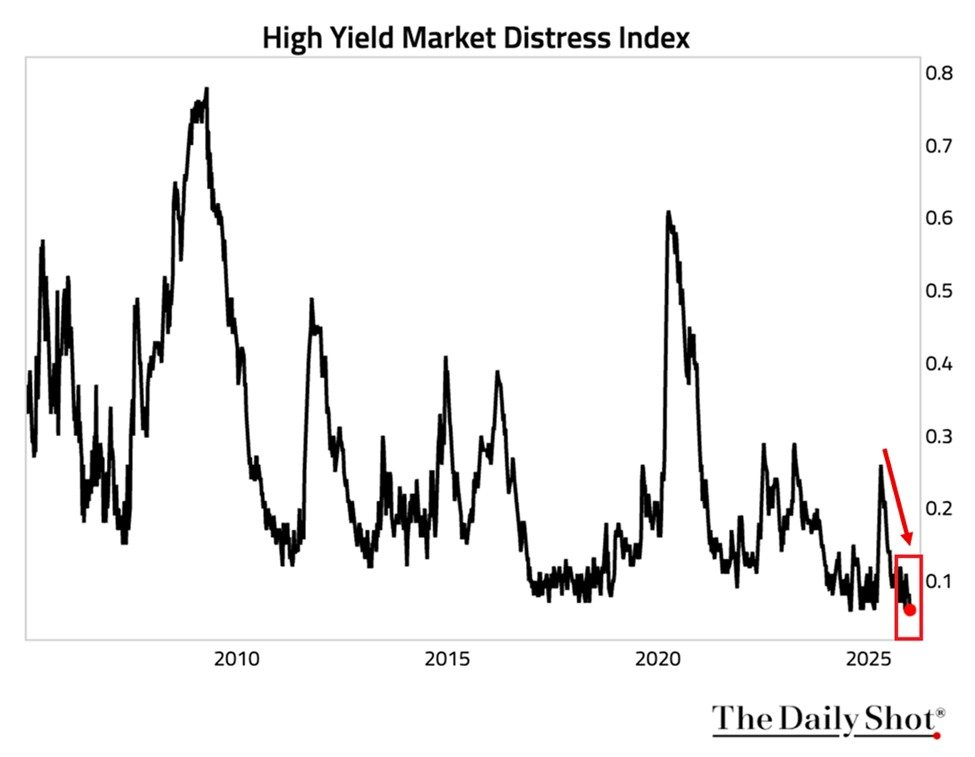

The New York Federal Reserve’s high-yield distress index has plunged to 0.06 points, the lowest reading in the metric’s history. The index measures stress levels in the junk bond market by tracking liquidity conditions, market functioning, and the ease of corporate borrowing.

Credit Markets All-Clear: The Money Went Elsewhere

For context, the index surged above 0.60 during the 2020 pandemic market turmoil and approached 0.80 during the 2008 financial crisis. Today’s reading suggests remarkably benign conditions for risk assets.

The high-yield corporate bond ETF (HYG) reflects this optimism, rallying for a third consecutive year with approximately 9% returns in 2025, according to iShares data. By traditional macro logic, such abundant liquidity and healthy risk appetite should benefit Bitcoin and other crypto assets.

Yet on-chain data tells a different story. CryptoQuant CEO Ki Young Ju noted that capital inflows into Bitcoin have “dried up,” with money rotating instead to equities and gold.

Capital inflows into Bitcoin have dried up.

Liquidity channels are more diverse now, so timing inflows is pointless. Institutions holding long-term killed the old whale-retail sell cycle. MSTR won’t dump any significant chunk of their 673k BTC.

Money just rotated to stocks and… pic.twitter.com/Ha866TP857

— Ki Young Ju (@ki_young_ju) January 8, 2026

The diagnosis aligns with broader market dynamics. US equity indices continue to hover near all-time highs. AI and Big Tech stocks absorb much of the available risk capital. For institutional allocators, the risk-adjusted returns from equities remain compelling enough to bypass crypto entirely.

This creates an uncomfortable reality for Bitcoin bulls: systemic liquidity is abundant, but the crypto market sits downstream in the capital allocation hierarchy.

Sideways Consolidation Replaces Crash Scenarios

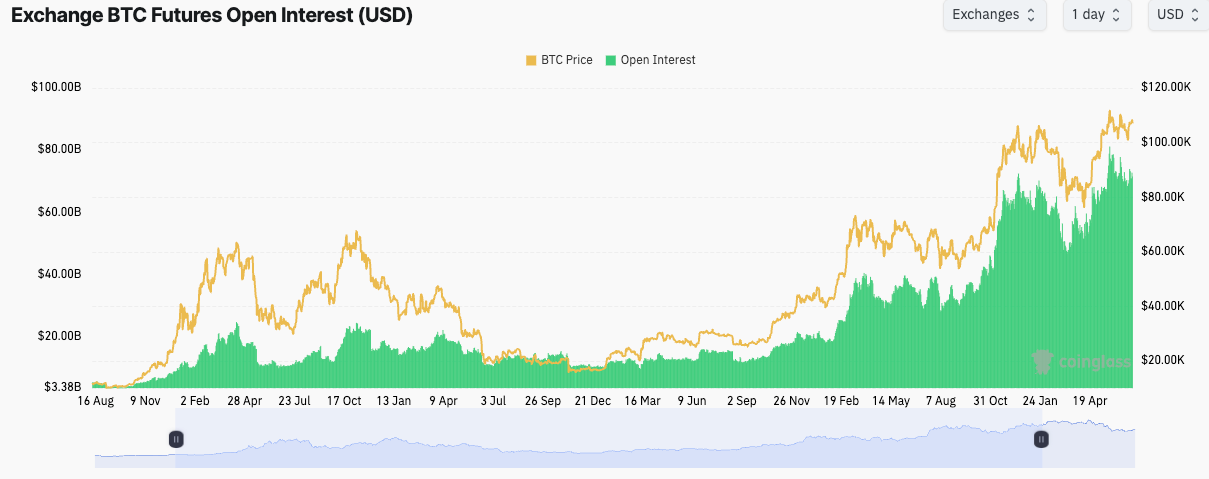

Derivatives data reinforces the stagnation narrative. Total Bitcoin futures open interest stands at $61.76 billion across 679,120 BTC, according to Coinglass. While open interest rose 3.04% over the past 24 hours, price action remains range-bound near $91,000, with $89,000 serving as near-term support.

Binance leads with $11.88 billion in open interest (19.23%), followed by CME at $10.32 billion (16.7%) and Bybit at $5.90 billion (9.55%). The steady positioning across exchanges suggests participants are adjusting hedges rather than building directional conviction.

The traditional whale-retail sell cycle has also broken down as institutional holders adopt long-term strategies. MicroStrategy now holds 673,000 BTC with no indication of significant selling. Spot Bitcoin ETFs have created a new class of patient capital, compressing volatility in both directions.

“I don’t think we’ll see a -50%+ crash from ATH like past bear markets,” Ki predicted. “Just boring sideways for the next few months.”

Short sellers face poor odds in this environment. The absence of panic selling among large holders limits the chance of cascading liquidations. Meanwhile, longs lack immediate catalysts for upside momentum.

What Could Change the Equation

Several potential triggers could redirect capital flows toward crypto: equity valuations reaching levels that prompt rotation to alternative assets; a more aggressive Fed rate-cutting cycle that maximizes risk appetite; regulatory clarity that provides institutional investors with new entry points; or Bitcoin-specific catalysts such as post-halving supply dynamics and ETF options trading.

Until such triggers materialize, the crypto market may remain in extended consolidation—healthy enough to avoid collapse, but lacking the momentum for meaningful appreciation.

The paradox stands: in a world flush with liquidity, Bitcoin waits for its share.

The post Liquidity Paradox: Credit Markets Hit Record Health While Bitcoin Starves appeared first on BeInCrypto.

Leave a Reply

You must be logged in to post a comment.