Bitcoin suddenly dips under $90K, triggering over $100M in long liquidations in past hour

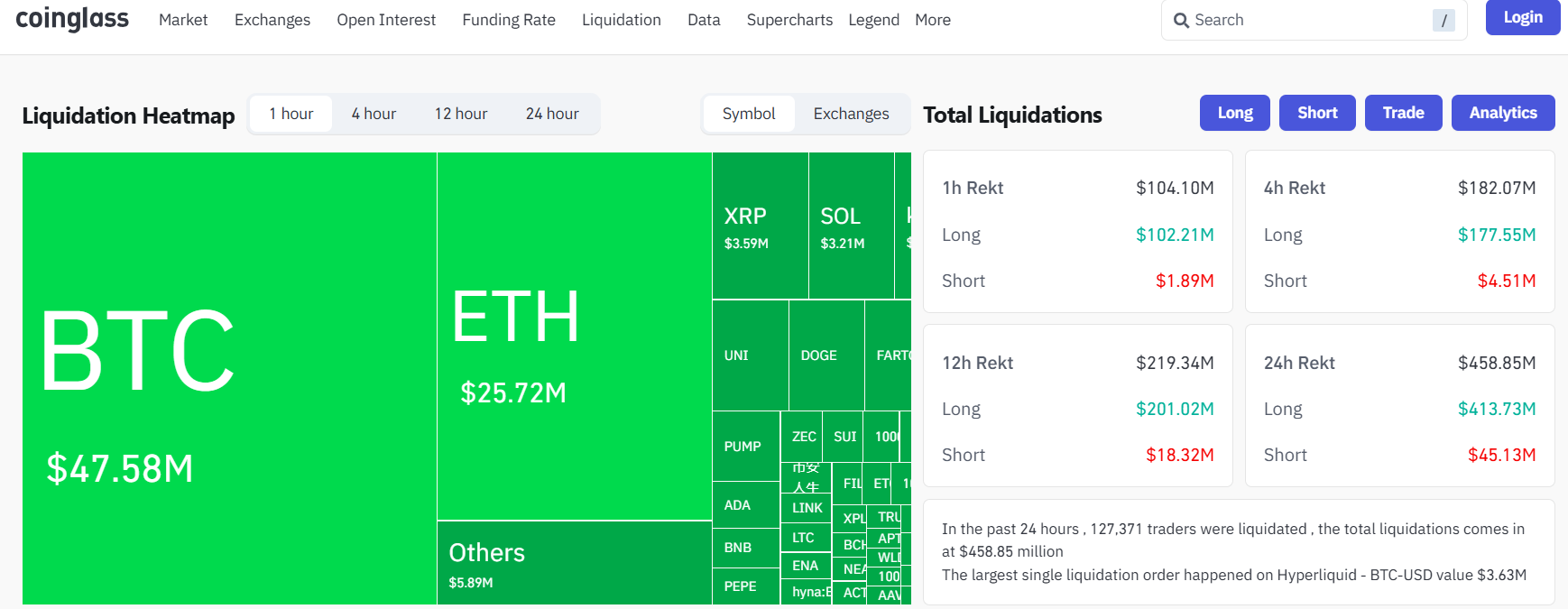

- Bitcoin’s price fell below $90,000, leading to long liquidations exceeding $100 million within an hour.

- This decline in value is attributed to substantial outflows from Bitcoin investment products, with US spot Bitcoin ETFs witnessing $486 million in redemptions, marking the largest single-day outflow since late November.

Bitcoin fell under $90,000 in the early hours of Thursday, triggering more than $100 million in long liquidations. At press time, the asset was hovering around $90,000, down about 3% in the last 24 hours, per CoinGecko.

The decline follows reports of heavy outflows of Bitcoin investment products. Data from Farside Investors shows US spot Bitcoin ETFs recorded $486 million in net redemptions on Wednesday, their largest single-day outflow since November 20.

Fund flows turned negative on Tuesday as $243 million exited during the session, following a strong start to the year.

Bitcoin’s price action in recent days has largely moved in step with ETF activity, even as debate continues over the underlying trigger for its climb to $94,000.

While institutional demand is seen as a key driver, many analysts say that if geopolitical changes around Venezuela result in lower oil prices, it could reduce inflation and mining costs, creating a more supportive backdrop for Bitcoin.

Commenting on Bitcoin’s recent price action, CryptoQuant analyst Cauê Oliveira said on-chain demand has yet to recover meaningfully and that current activity levels remain insufficient to sustain a rally toward $100,000.

“With still mixed sentiment and low trading volume in the market, demand for a return to on-chain movement has not yet shown solid signs of improvement,” Oliveira noted. “However, this could happen now with the end of the holiday period, where many investors reduce trading.”

Leave a Reply

You must be logged in to post a comment.