3 Key Signals Suggest Bitcoin Could Be Primed for a Short Squeeze

Bitcoin (BTC) is experiencing a volatile January. The coin climbed to a nearly four-week high earlier this week before briefly slipping below $90,000 yesterday.

Amid these fluctuations, analysts are pointing to several key signals that could indicate the possibility of an upcoming short squeeze.

Bitcoin Derivatives Data Points to Rising Short Squeeze Risk

According to BeInCrypto Markets data, the largest cryptocurrency continued to post green candles for the first five days of January. The price surged over $95,000 on Monday, a level last seen in early December, before reversing course.

On January 8, BTC briefly dropped below $90,000, reaching a low of $89,253 on Binance. At the time of writing, Bitcoin was trading at $91,078, representing a 0.157% increase over the past day.

Looking ahead, three key signals are suggesting that market conditions may be aligning for a potential short squeeze in Bitcoin’s price. For context, a short squeeze occurs when prices move higher against bearish positions.

Leverage amplifies the pressure, as traders face forced liquidations and have to buy Bitcoin, which propels prices further upward. This buying can quickly cascade across the market.

1. Negative Funding Rate Reflects Bearish Sentiment

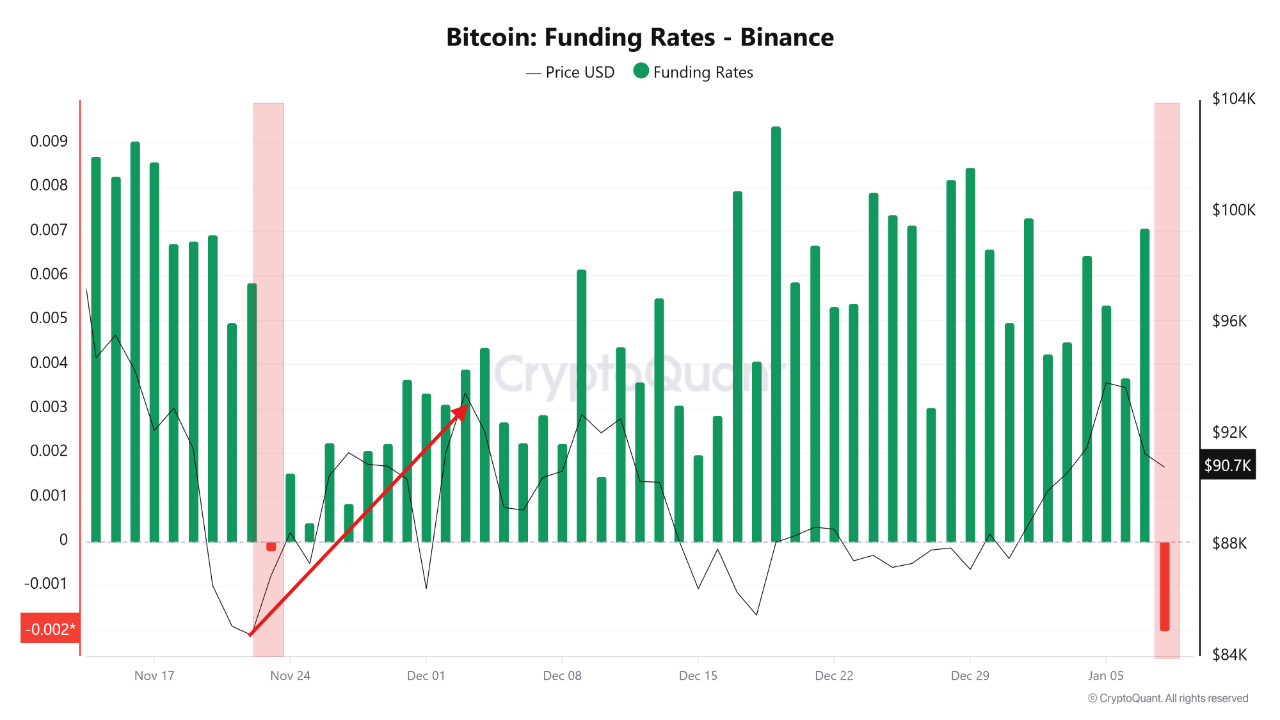

The first sign comes from Binance’s Bitcoin funding rate. In a recent analysis, Burak Kesmeci highlighted that the funding rates have flipped negative on the daily chart for the first time since November 23, 2025.

This figure tracks the cost to maintain perpetual futures positions. When the funding rate is negative, short positions dominate, and short sellers pay funding fees to long position holders to maintain their positions.

The current funding rate stands at -0.002, which is significantly deeper than the -0.0002 recorded during the previous negative period in November. That earlier shift came before a rally in which Bitcoin climbed from $86,000 to $93,000. January’s more pronounced negative rate signals even stronger bearish sentiment among derivatives traders.

“Funding is more deeply negative, while price remains under pressure. This combination increases the probability of a much stronger short squeeze. A sharp upside bounce in Bitcoin would not be surprising here,” Kesmeci wrote.

2. Open Interest Climbs as Bitcoin Price Drops

Secondly, another analyst noted that Bitcoin’s price has been trending lower. At the same time, Open Interest continues to rise, a combination that the analyst interpreted as a sign of a potential short squeeze.

“This is a textbook sign of an incoming Short Squeeze!,” the post read.

Open interest reflects the number of outstanding derivative contracts. When it increases as prices fall, it typically suggests new positions are being opened in the direction of the move, often indicating growing short exposure rather than longs closing.

This can create asymmetric risk, as a crowded short positioning may leave the market vulnerable to rapid liquidations if prices rebound.

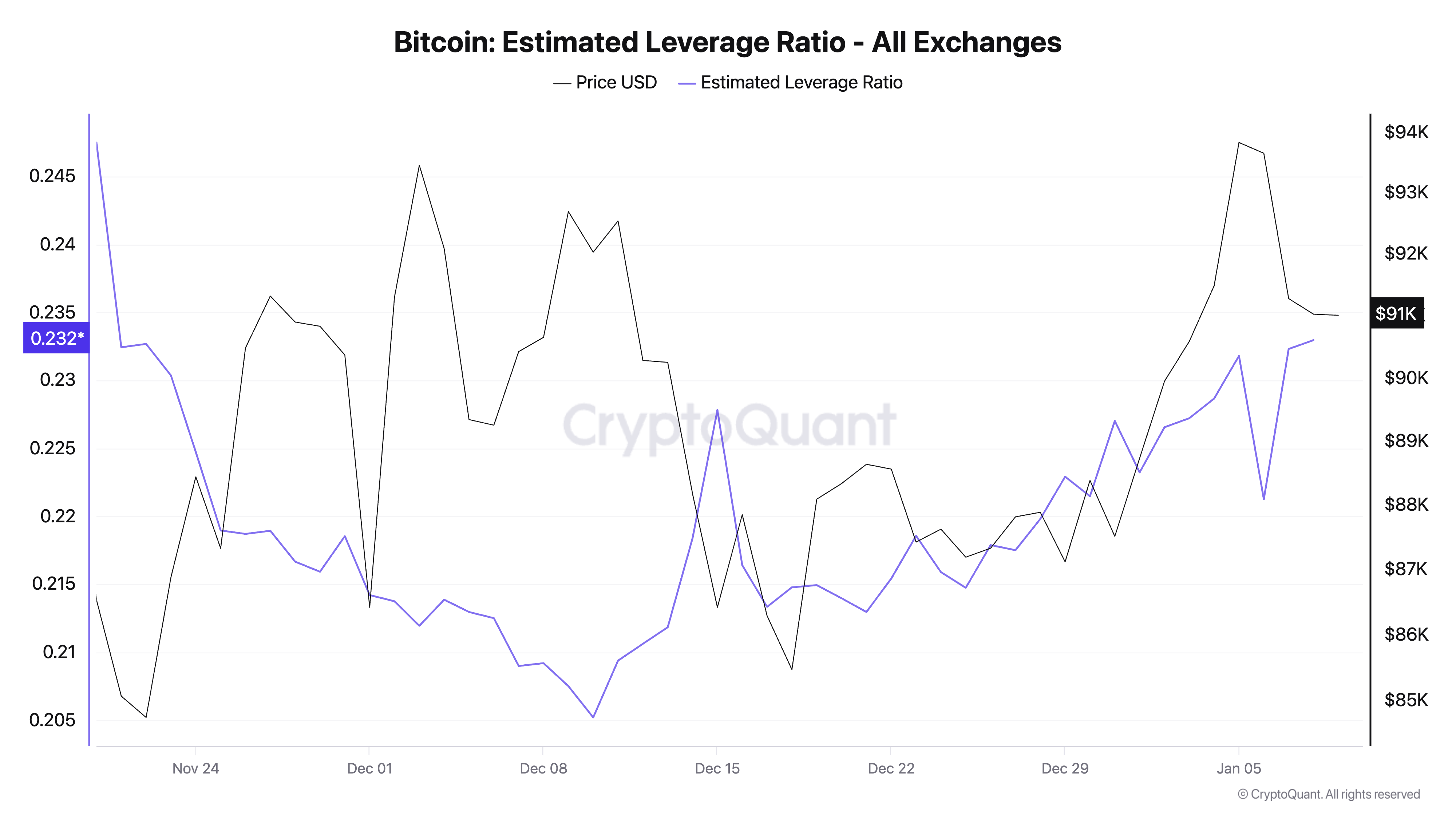

3. High Leverage Adds to Liquidation Risks

Lastly, Bitcoin’s Estimated Leverage Ratio has moved to a one-month high, according to CryptoQuant metrics. This measure tracks the level of borrowed capital in traders’ positions. High leverage magnifies both potential profits and losses, so even small price moves can trigger broad liquidations.

Traders using 10x leverage, for example, can be liquidated if Bitcoin moves just 10% the wrong way. The current ratio indicates that many in the market have increased their risk, wagering on continued downside momentum. High leverage is risky if Bitcoin’s price suddenly bounces.

With these three indicators converging, Bitcoin may be increasingly vulnerable to a sharp upside move if price rebounds trigger cascading liquidations among overleveraged short positions.

However, whether a short squeeze actually materializes will depend on broader market catalysts, including macroeconomic developments, spot market demand, and overall risk sentiment. Without a decisive bullish trigger, bearish positioning could persist, delaying or weakening any potential squeeze.

Leave a Reply

You must be logged in to post a comment.