Stablecoin Volumes Hit Record $33 Trillion Amid Policy Tailwinds

Stablecoin transaction volumes jumped to a record $33 trillion in 2025, driven by favorable U.S. policy and growing institutional adoption. Data shows USDC leading transaction flows, while USDT continues to dominate market value.

Record Activity for Stablecoins in Pro- Crypto U.S. Climate

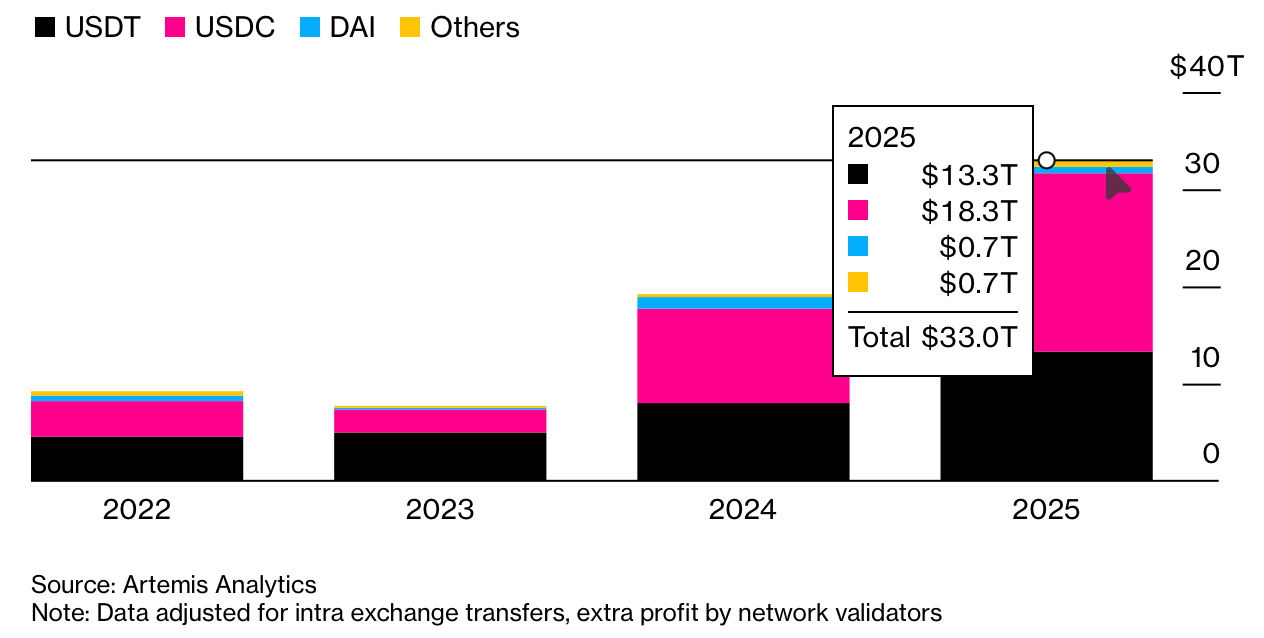

Stablecoin usage surged to new highs in 2025, with transaction volumes climbing 72% year over year to $33 trillion, according to data compiled by Artemis Analytics. The growth was fueled in part by a more supportive regulatory environment in the United States under President Donald Trump’s pro- crypto administration.

USDC accounted for the largest share of activity, with $18.3 trillion in transactions over the year. Tether’s USDT followed with $13.3 trillion. Together, the two tokens dominated global stablecoin flows as adoption expanded beyond crypto-native users.

Policy changes played a key role. The passage of the Genius Act in July established a clear legal framework for stablecoins, encouraging broader institutional interest. Companies including Walmart and Amazon have explored stablecoin initiatives, while World Liberty Financial, a Trump family-linked venture, launched its own token, USD1, in March.

Artemis data also shows a shift in where stablecoins are being used. While overall volumes rose, the share of transactions on decentralized crypto platforms declined, suggesting increased mainstream and real-world usage.

Despite USDT being the largest stablecoin by market capitalization at $187 billion, USDC dominates transaction flows due to its heavy use in DeFi. USDT, by contrast, is more commonly used for payments, business transfers, and as a store of value.

Read more: Trump-Linked World Liberty Financial Seeks National Trust Bank Charter for USD1 Stablecoin

Growth shows little sign of slowing. Stablecoin transactions reached $11 trillion in the fourth quarter alone, up from $8.8 trillion in the previous quarter. Bloomberg Intelligence estimates total stablecoin payment flows could reach $56 trillion by 2030.

FAQ 💵

• Why did stablecoin transaction volumes surge in 2025?

Pro- crypto U.S. policy and rising institutional adoption pushed annual volumes to a record $33 trillion.

• Which stablecoin led global transaction activity?

USDC dominated transaction flows with $18.3 trillion, outpacing USDT in on-chain usage.

• Why does USDT still lead in market value?

USDT remains the largest by market cap due to its widespread use in payments and value storage.

• How are stablecoins being used beyond crypto markets?

Growing real-world and institutional use is shifting activity away from DeFi toward mainstream payments.

Leave a Reply

You must be logged in to post a comment.