This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

M&A hasn’t slowed as Congress mulls crypto legislation and efforts to get more real-world assets onchain continue.

I chatted with Ondo Finance CEO Nathan Allman last month about the RWA space ahead of the company’s tokenization platform launch slated for this summer (Ondo doesn’t yet have a go-live date).

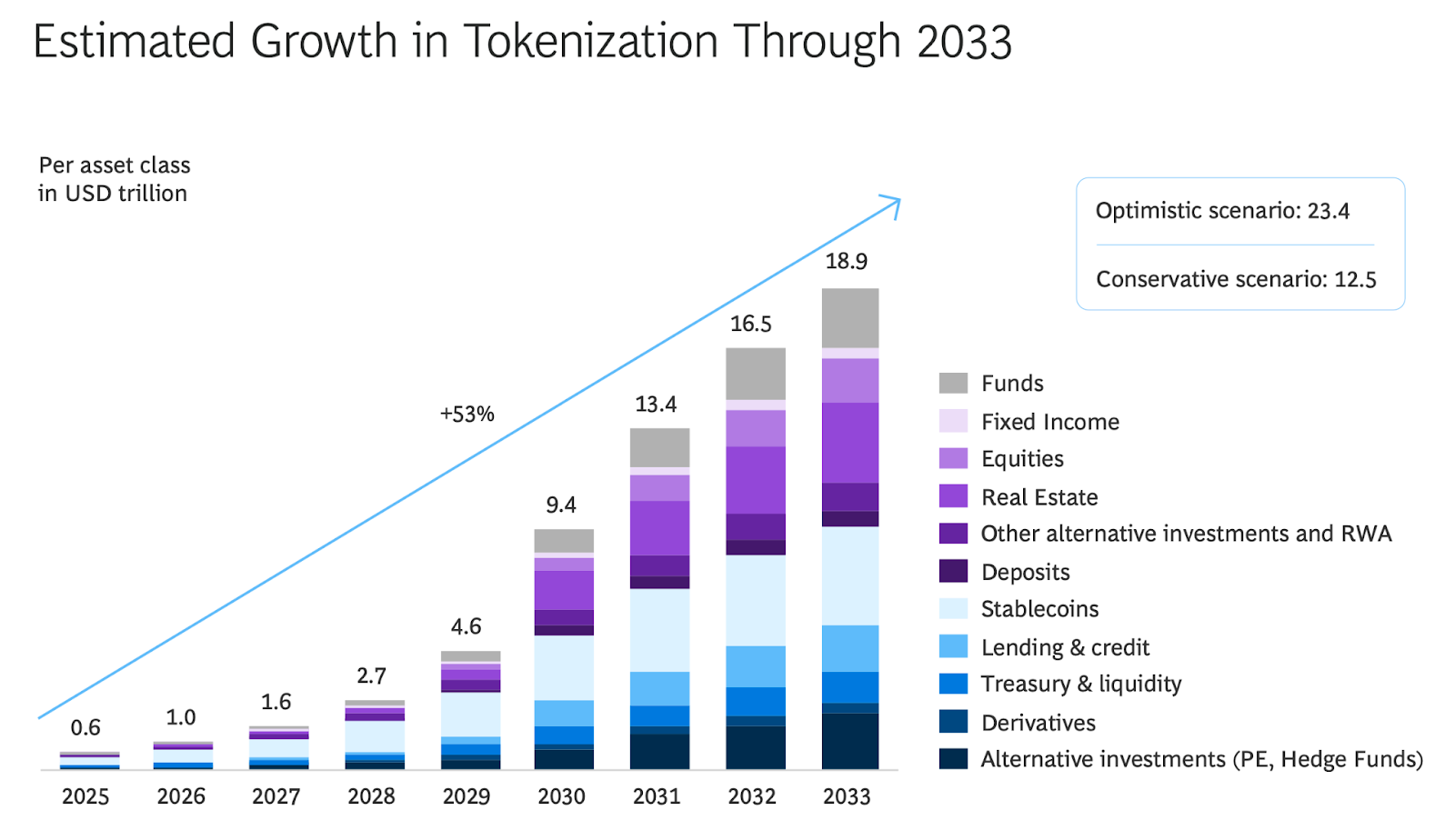

Saying the vast majority of regulated financial assets will ultimately settle on blockchain rails is “not a crazy prediction” anymore, Allman told me. Others agree, including Larry Fink (the man leading the world’s largest asset manager) and Franklin Templeton’s Sandy Kaul (check outmy Q&A with her here).

Fast forward to Monday and Ondo said it acquired Strangelove, which focuses on designing and deploying open-source infrastructure across multiple blockchains. This deal was done “strategically” ahead of the aforementioned tokenization platform launch, said Ondo chief strategy officer Ian De Bode.

Called Ondo Global Markets, it’ll initially offer access to 100+ stocks and ETFs — starting on Ethereum and expanding to BNB Chain and Solana.

Strangelove CEO Jack Zampolin said his company’s work on cross-chain communication protocols, permissioned/unpermissioned validator frameworks and modular consensus architecture (that’s a lot of big words) will help Ondo’s platform evolve from a centralized one to a distributed network where institutions can participate in tokenized asset ops.

All told: What stablecoins did for dollars, Ondo is looking to do for securities, De Bode added. At least for the most liquid ones, to start.

Others, like Apollo Global Management, are focusing on tokenization within less liquid segments like private credit.

It’s worth noting that Ondo earlier this month said it would buy Oasis Pro, gaining access to its SEC-registered broker-dealer, alternative trading system and transfer agent. We know how coveted US digital asset licenses are.