Analysts Spot Bitcoin Price Rebound Window — Could Trump’s 10% Credit Cap Trigger It?

The Bitcoin price may be approaching a short-term rebound, according to on-chain analyst Willy Woo, as macroeconomic policy developments in the US could accelerate crypto adoption.

Woo’s>Bitcoin Flows Signal Rebound as Trump’s Credit Card Cap Looms

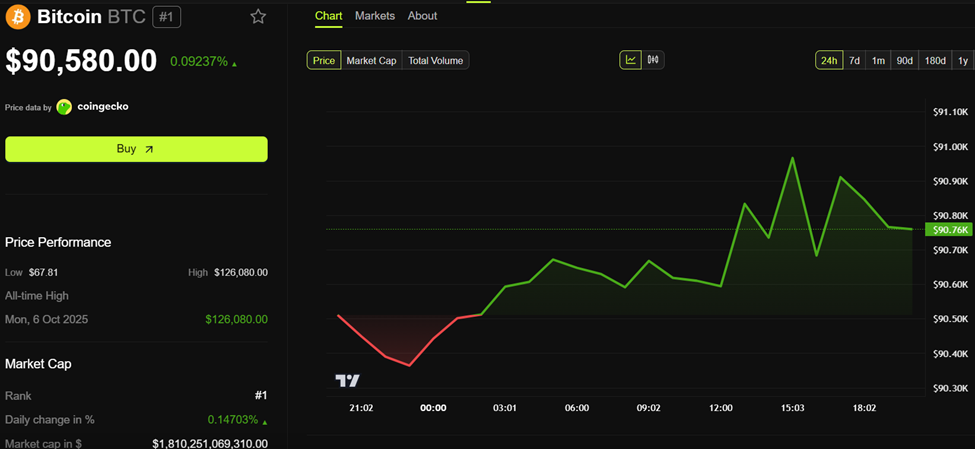

Bitcoin is currently trading around $90,580, below the estimated miner production costs of approximately $101,000 per BTC.

According to analyst Wimar.X, trading below the miner cost historically does not trigger panic selling. Instead, miners slow production and wait for better prices, creating what is often a zone of low activity that acts as a temporary floor.

“BTC is cheap relative to what it takes to produce it…Most people panic sell here. Then, BTC pushes back above the miner’s cost, and everyone suddenly turns bullish again. Same story every cycle,” Wimar.X said.

Elsewhere, on-chain analyst Willy Woo emphasizes that actual spot inflows, rather than narratives or equity market correlations, are the key drivers of Bitcoin’s price recovery.

“The entire market can perfectly rally upwards without BTC if investors aren’t allocating,” he noted. “Our work centers on measuring the actual flows real investors put into BTC… not imaginary flows from narrative.”

The technical and flow-driven picture may intersect with a potential macro catalyst: President Donald Trump’s recent proposal to cap credit card interest rates at 10% for one year, effective January 20, 2026.

HUGE: President Donald J. Trump announces a one year cap on Credit Card Interest Rates of 10% effective January 20, 2026. 💸 pic.twitter.com/WKJ4Fk4SnC

— The White House (@WhiteHouse) January 10, 2026

Trump’s Credit Cap Could Push Consumers Toward Bitcoin and DeFi

President Donald Trump’s recent push to cap credit card interest rates at 10% aims to ease the financial burden on millions of Americans. It could restrict access to traditional credit for consumers with scores below 780.

Analysts and crypto commentators warn that this move may inadvertently drive these users toward alternative financial systems, including Bitcoin.

🚨 THIS COULD TURN OUT TO BE VERY BULLISH FOR BITCOIN!

Tomorrow, markets react to Trump’s call for a 10% cap on credit card interest rates. Visa & Mastercard could take a hit.

Anyone with a credit score below 780 might lose access to their cards.

This could push more people… https://t.co/PUfdf7w4GS pic.twitter.com/KfL5l6URUW

— Crypto | Stocks | News (@Wealthmanager) January 11, 2026

Others highlighted that banks such as Visa and Mastercard could face short-term volatility as they adjust to potential restrictions on higher-risk credit users.

“Tomorrow, we will see the market reaction to Trump’s call for a 10% cap on credit card interest rates, which could significantly impact Visa and Mastercard,” wrote analyst Crypto Rover.

Industry analysts have noted that the policy could result in banks offloading low credit-rated customers, who may then enter DeFi lending platforms like Aave or Compound.

Crypto theorists suggest this could create a “seamless adoption cycle,” with stablecoins, Bitcoin, and Ethereum-based DeFi infrastructure benefiting from increased demand for DeFi services.

While Woo sees a short-term rebound possibility, he remains cautious about the broader outlook for 2026. Liquidity flows have been declining relative to price momentum since January 2025, indicating that while temporary rallies may occur, they may lack the support necessary for sustained upside.

Nevertheless, the convergence of miner-cost support, strengthening flows, and potential policy-driven demand sets up a high-volatility environment for Bitcoin.

As markets brace for the policy to take effect on January 20 and for ongoing liquidity trends to unfold, the coming weeks may prove critical in testing whether Bitcoin can capitalize on both flow-driven fundamentals and macroeconomic shocks.

This creates a rare inflection point where short-term bullish forces meet structural uncertainty.

The post Analysts Spot Bitcoin Price Rebound Window — Could Trump’s 10% Credit Cap Trigger It? appeared first on BeInCrypto.

Leave a Reply

You must be logged in to post a comment.