Tom Lee’s January Bitcoin Prediction In Focus As $100,000 Nears — New ATH Soon?

Bitcoin is finally showing follow-through. Price has pushed above the $95,000 zone and is holding there at press time, up roughly 3.8% on the day and around 6.5% over the past 30 days. That strength is shifting the tone.

As momentum builds and key resistance levels approach, Tom Lee’s January call for a fresh all-time high is starting to look less speculative and more technically grounded. But risks remain!

Cup-and-Handle Breakout Aligns With Favorable On-Chain Supply

Bitcoin has confirmed a breakout from a cup-and-handle pattern, clearing resistance near $94,800 with strong volume. That volume matters because it signals real demand defending the breakout, not just thin liquidity pushing the price higher. The measured move from this structure points toward $106,600, making it the first major upside target.

Yet, BTC must first reclaim the psychological $100,000 level ($100,200 level per the chart) to make any higher predictions worth noting.

Crossing that level could put the Tom Lee Prediction for January-end back on track.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Tom Lee predicts $BTC will hit a new ATH before the end of January 2026.

What do you think? pic.twitter.com/cwXU3RtSfN

— Ted (@TedPillows) December 1, 2025

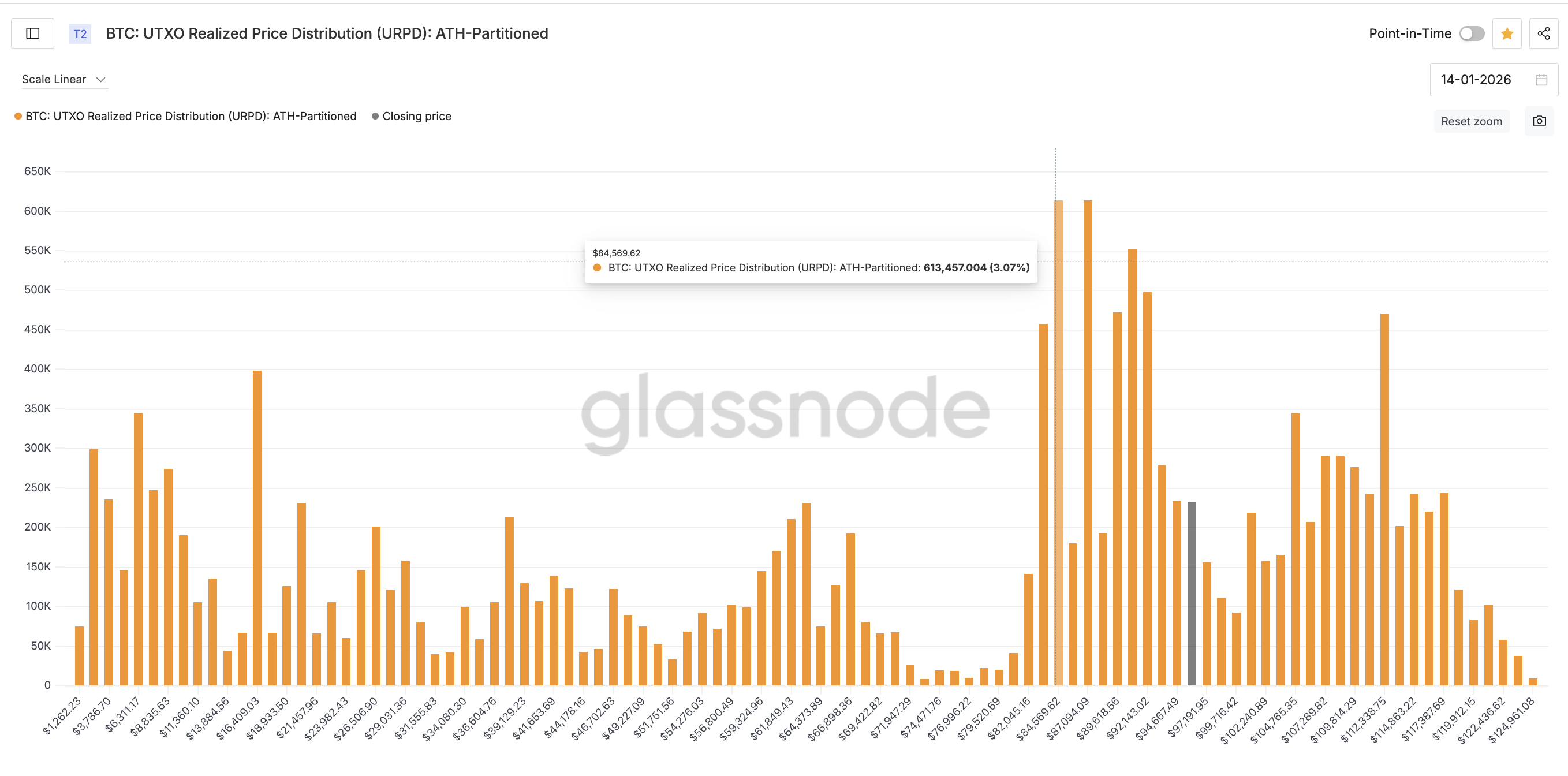

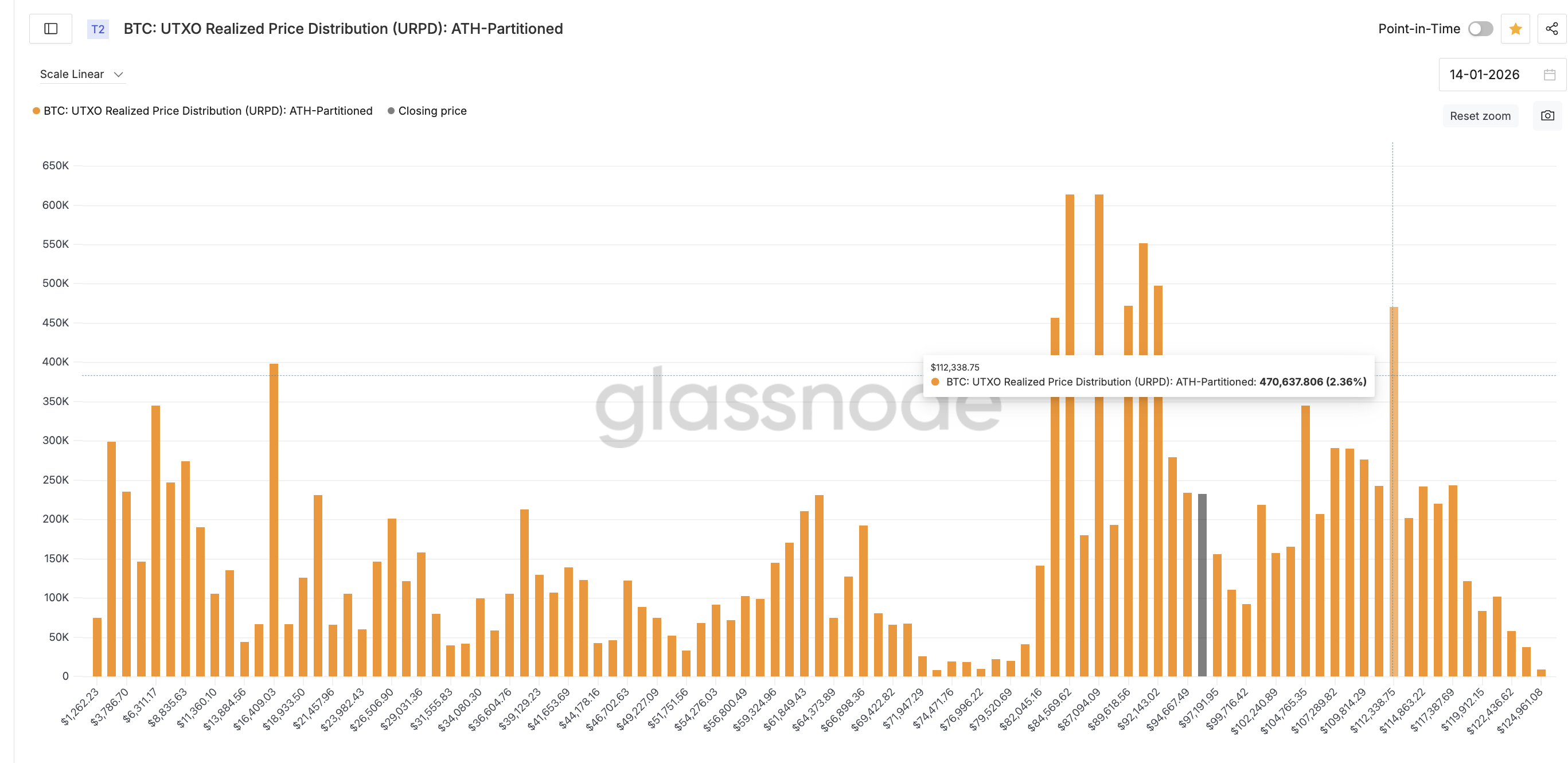

On-chain supply data strengthens the setup. The heaviest realized price clusters now sit below the current Bitcoin price, meaning most holders bought lower and are sitting on profits. This reduces immediate selling pressure.

This combination of a confirmed bullish pattern and supportive on-chain supply suggests the move higher is not just a possibility. It reflects the underlying positioning.

Whales Accumulate as Retail Joins, but Leverage Risk Remains

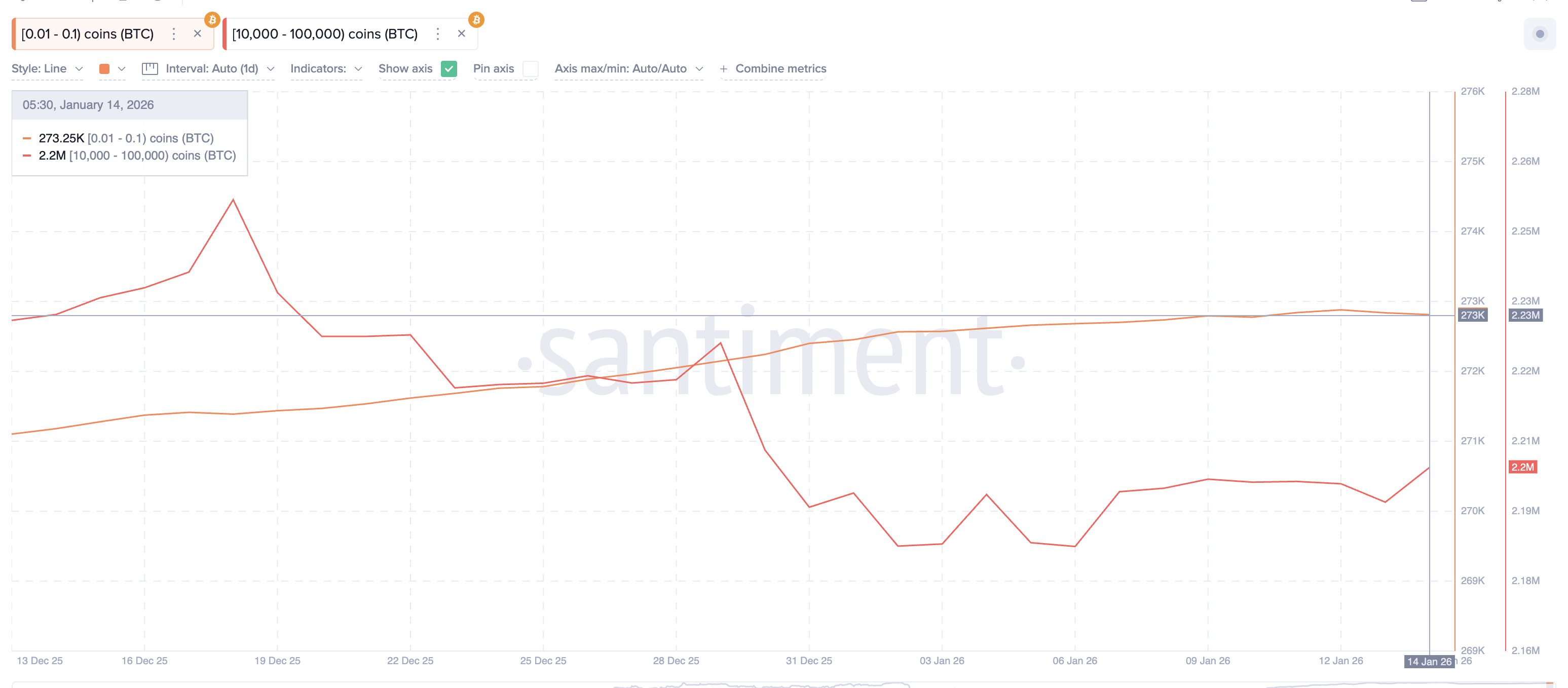

Holder behavior continues to favor the upside. Wallets holding between 10,000 and 100,000 BTC have steadily added since January 2, increasing their combined holdings from roughly 2.18 million BTC to about 2.20 million BTC. That quiet accumulation signals conviction from large players.

What has changed recently is retail behavior. The early January BTC rally possibly failed because retail sold aggressively into strength.

📊 Crypto markets typically follow the path of key whale & shark stakeholders, and move the opposite direction of small retail wallets. In our chart below:

🟥 Whales dumping, Retail accumulating (VERY BEARISH)

🟧 Whales dumping, Retail unpredictable (BEARISH)

🟨 Whales & Retail… pic.twitter.com/yoC0H1keBT— Santiment (@santimentfeed) January 5, 2026

This time, retail wallets have turned net positive. Since January 5, retail holdings (0.01-0.1 BTC) have increased modestly, from approximately 273,080 BTC to 273,250 BTC. The size of the increase is small, but the direction matters. Retail is no longer distributing into rallies, removing a key headwind from earlier moves.

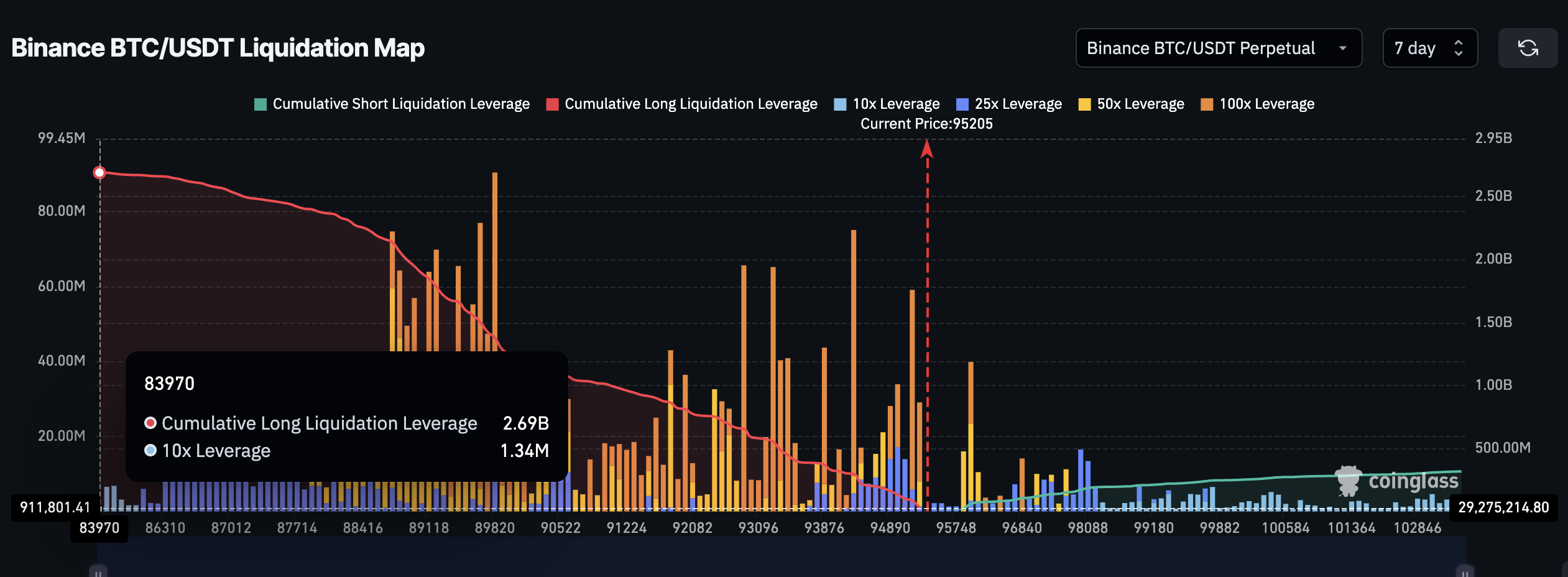

The main risk lies in derivatives positioning. Long exposure remains heavily skewed, with far more capital positioned on the long side (2.69 billion) than shorts (around 320 million). That 9x imbalance creates vulnerability if the BTC price slips back below the breakout zone of the cup.

A move under $94,800 could trigger long liquidations, potentially pushing Bitcoin toward the low $90,000s. Still, the strong spot buying near support suggests buyers may step in before leverage-driven selling can fully unwind.

Bitcoin Price Levels That Decide Whether a New High Is Next

From here, Bitcoin’s structure is clear. Holding above the $94,500-$94,800 range (near the cup breakout level) keeps the breakout intact and protects the bullish setup. The psychological $100,200 level sits directly ahead (discussed earlier), but the more important technical objective remains $106,600, the cup-and-handle projection. That’s the first key target.

If the BTC price can clear that level and absorb supply above $112,000 (the strongest near-term supply zone), the market enters a zone with limited historical resistance.

That is where acceleration beyond the previous all-time high near $126,200 becomes realistic rather than theoretical.

Bitcoin does not need a perfect environment to move higher. It only needs to hold its breakout and continue attracting spot demand. If that happens, Tom Lee’s January all-time high prediction stops looking bold and starts looking like a natural outcome of the current market structure.

Above current levels, the most meaningful supply pocket appears above $112,000. Beyond that zone, realized supply thins out sharply. If momentum carries Bitcoin through $106,600 and later $112,000, the path toward prior highs becomes structurally cleaner.

On the downside, losing $94,500 could weaken the structure, and a dip under $91,600 can bring in the bears again.

The post Tom Lee’s January Bitcoin Prediction In Focus As $100,000 Nears — New ATH Soon? appeared first on BeInCrypto.

Leave a Reply

You must be logged in to post a comment.