Short squeeze hits top 500 cryptos as traders unwind bearish bets

Cryptocurrency markets staged their largest short squeeze since the sharp selloff in early October, as a rebound in prices forced bearish traders to unwind positions and fueled hopes of a broader recovery.

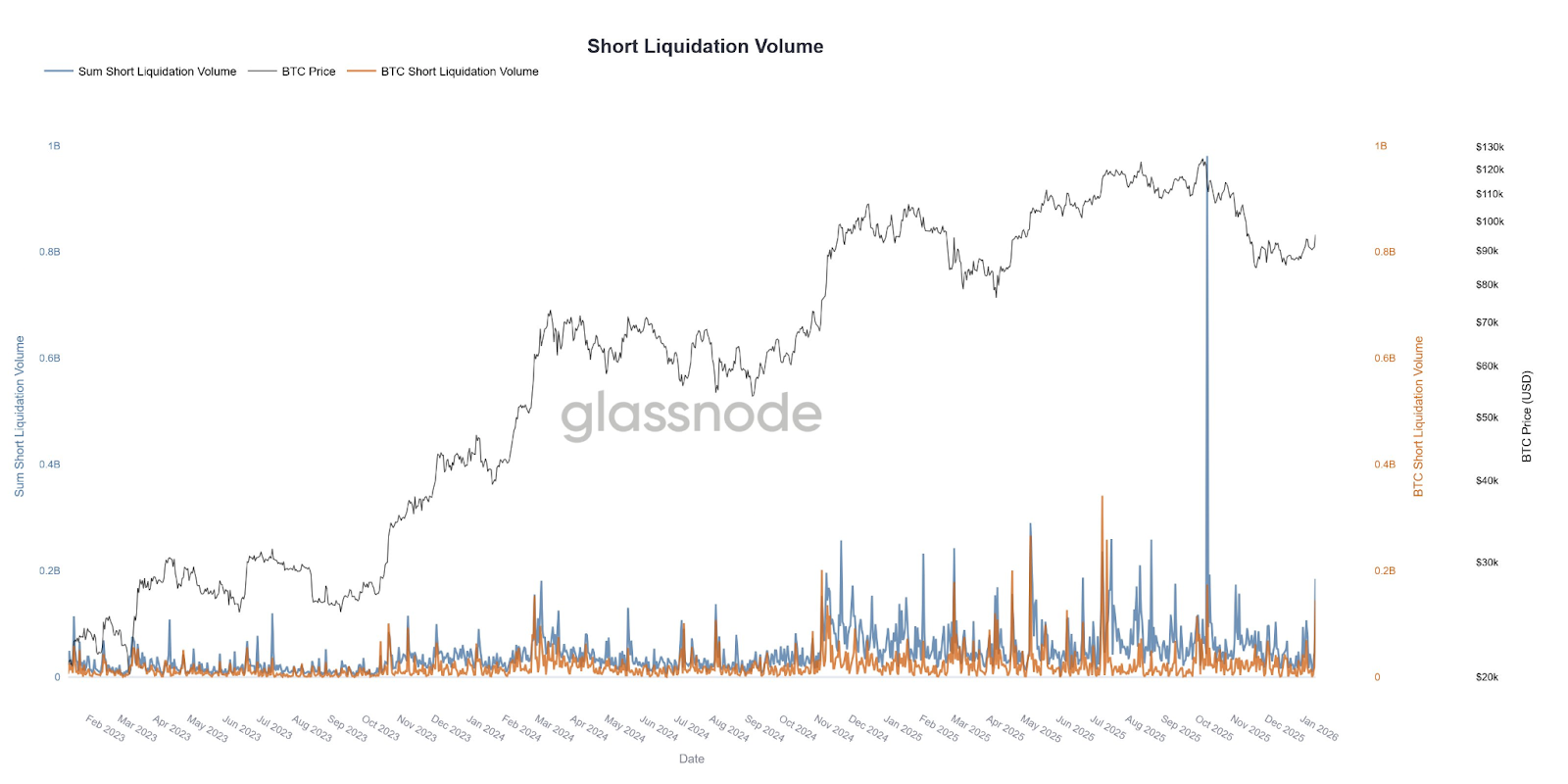

Short liquidations across crypto futures and perpetual contracts climbed to about $200 million on Wednesday, the highest level since roughly $1 billion in short positions were wiped out during the October market crash, according to data shared by analytics firm Glassnode. The firm said it was the biggest short liquidation event across the 500 largest cryptocurrencies since the Oct. 10 selloff.

The rebound follows a significant recovery in investor sentiment, which flipped from fear to greed for the first time since early October, Cointelegraph reported earlier on Thursday.

Some analysts say the short squeeze and sentiment improvement is a signal for improving market conditions preceding a wider market recovery. A short squeeze occurs when the price of an asset makes a sharp increase, forcing short sellers to buy the asset to avoid greater losses.

Bitcoin (BTC) accounted for the largest share of liquidations, with $71 million in shorts liquidated in the past 24 hours. Ether (ETH) followed with $43 million, and privacy token Dash (DASH) had $24 million in shorts liquidated, according to Glasnode’s dashboard.

Related: Bitcoin ETFs on rollercoaster as traditional funds pull in $46B in 2026

Geopolitics add fuel to recovery

Other analysts are pointing to early signs of a market recovery as Bitcoin starts to outperform the US dollar amid heightened uncertainty around the Federal Reserve’s independence and growing geopolitical concerns after the US capture of Venezuelan President Nicolás Maduro on Jan. 3.

”One structural tailwind for Bitcoin as a reserve asset is the rise in geopolitical volatility, which has so far been a headwind for the US dollar,” Nicolai Sondergaard, research analyst at crypto intelligence platform Nansen, told Cointelegraph.

”While precious metals remain the primary beneficiaries in this environment, Bitcoin is increasingly part of the conversation as an alternative reserve asset and could benefit from this trend, even if to a lesser extent,” he added.

Related: 2025 crypto bear market was ‘repricing’ year for institutional capital: Analyst

Bitcoin’s price rose 10.6% year-to-date, while the US Dollar Index (DXY) rose 0.75% during the same period, according to TradingView.

Bitcoin may also benefit from other fundamental tailwinds, including the criminal investigation into US Federal Reserve Chair Jerome Powell. Which may introduce a ”risk premia” for BTC, analysts from crypto exchange Bitunix said on Monday.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari — Crypto Kid

Leave a Reply

You must be logged in to post a comment.