Bitcoin Stays Above $95,000, But the Real Test Begins Now

Bitcoin is attempting to recover recent losses after reclaiming the $95,000 level, a move that restored short-term optimism. The rally pushed BTC to a two-month high, but the recovery is far from complete.

In reality, Bitcoin now faces a far larger test ahead. The zone between $98,000 and $110,000 represents its toughest resistance yet.

Bitcoin Holders Have Opportunities To Sell

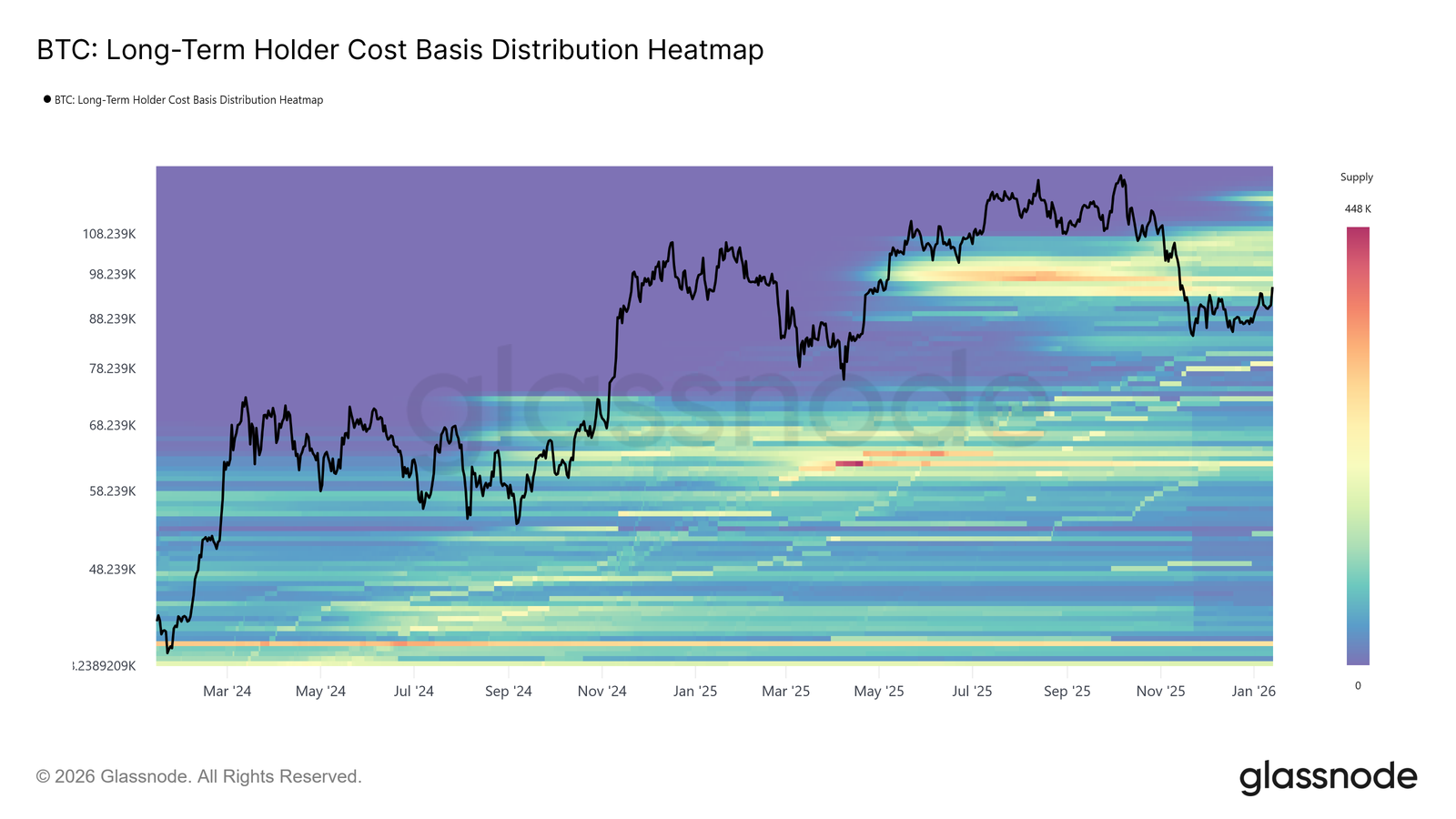

Bitcoin’s struggle becomes clearer when examining the Long-Term Holder Cost Basis Distribution Heatmap. Since November 2025, every rebound has stalled within a dense supply cluster stretching from roughly $93,000 to $110,000. This area contains coins acquired during previous peaks, creating persistent sell pressure when the price revisits it.

Each upward attempt into this range has triggered renewed distribution from long-term holders. As a result, Bitcoin has failed to sustain structural recoveries despite repeated breakouts. With price once again pressing into this overhead supply, the market faces a familiar resilience test. Absorbing this distribution remains essential for any durable trend reversal.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

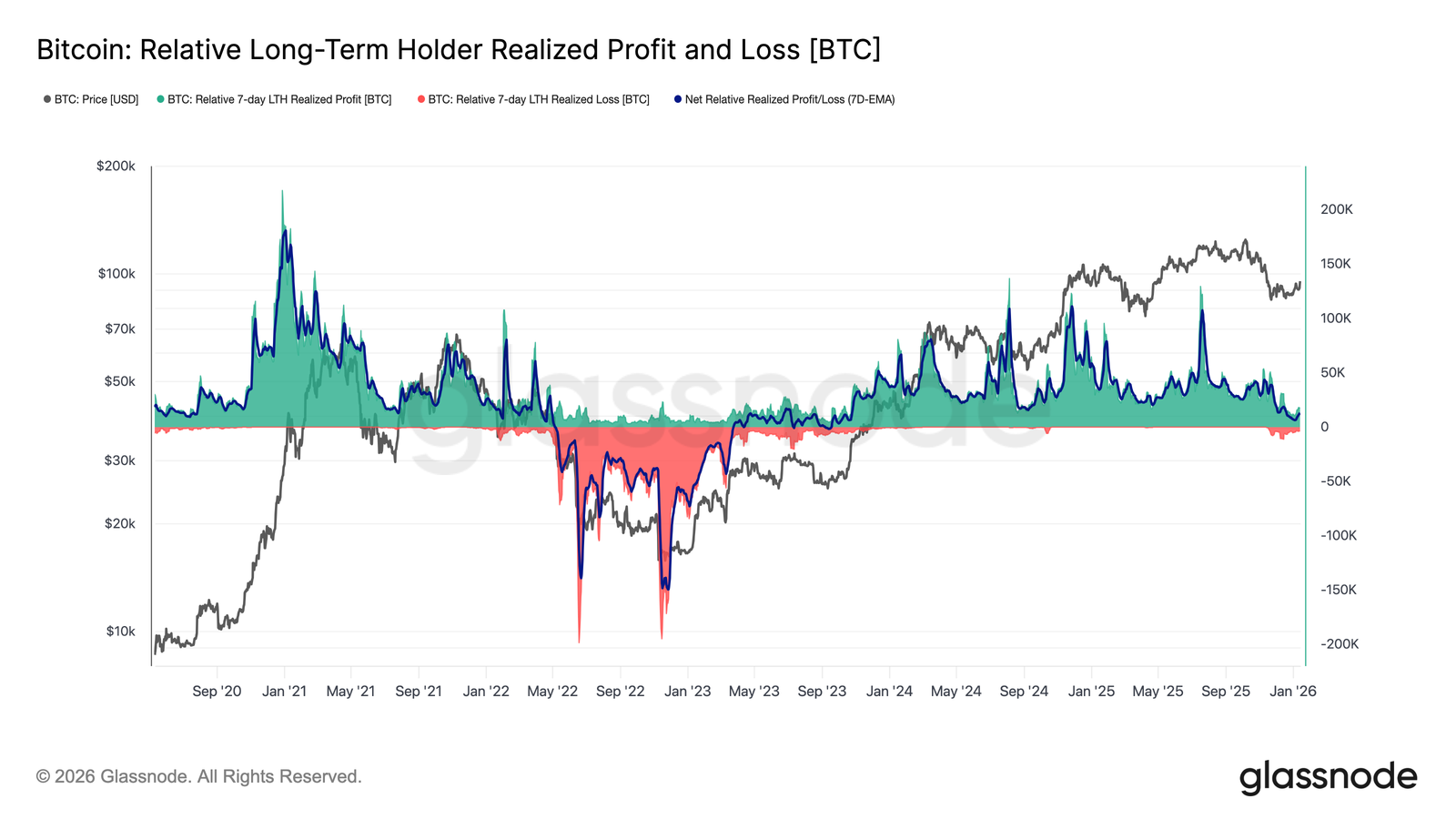

On a broader scale, Net Realized Profit and Loss for long-term holders paints a more tempered picture. Current data shows long-term holders realizing about 12,800 BTC per week in net profit. This figure is sharply lower than prior cycle peaks, which exceeded 100,000 BTC per week.

The slowdown indicates profit-taking remains active but far less aggressive. This moderation reduces immediate downside risk, yet it does not eliminate selling pressure. Market direction now depends on demand strength, particularly from buyers who accumulated Bitcoin during Q2 2025. If demand fails to absorb supply, upside momentum will weaken.

A key long-term reference remains the True Market Mean near $81,000. Sustained trading above this level supports a constructive macro outlook. Failure to hold it over time would significantly raise capitulation risk, echoing the prolonged drawdown seen between April 2022 and April 2023.

BTC Price Needs Strength To Cross $98,000

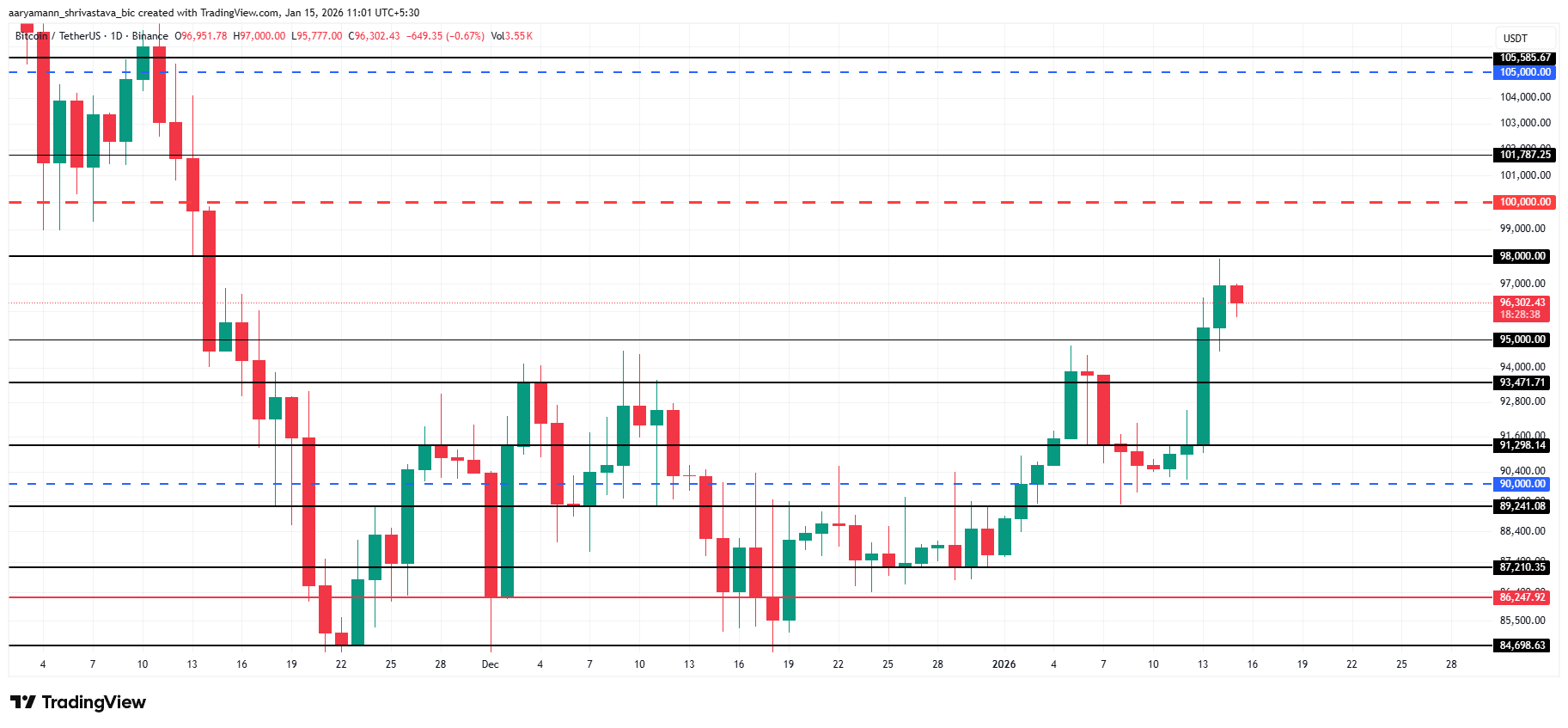

Bitcoin trades near $96,302 at the time of writing, marking its highest level in two months. The move above $95,000 lifted sentiment and positioned BTC closer to the $98,000 resistance. Short-term momentum remains constructive as long as price holds above recently reclaimed supports.

However, breaching $98,000 and sustaining levels above $95,000 will prove difficult. Overhead supply remains heavy, and any resurgence in selling could quickly reverse gains. If investors choose to lock in profits, Bitcoin could slip back below $95,000. A deeper pullback toward $91,471 would then become likely.

A bullish scenario remains possible if long-term holders reduce selling further. Should distribution dry up, Bitcoin could break above $98,000 and challenge $100,000. Flipping that psychological level into support would significantly improve sentiment. From there, BTC would have a realistic path toward $110,000, although new resistance dynamics would emerge beyond six figures.

The post Bitcoin Stays Above $95,000, But the Real Test Begins Now appeared first on BeInCrypto.

Leave a Reply

You must be logged in to post a comment.