Dow Jones down, S&P near records as markets focus on U.S.-China talks

After the U.S. negotiated a favorable deal with the EU, traders are now bracing for an update in U.S. trade talks with China.

- The U.S. made a favorable trade deal with the EU

- EU carmakers, pharma firms biggest losers of the deal

- Markets are now focused on China, with a deadline looming

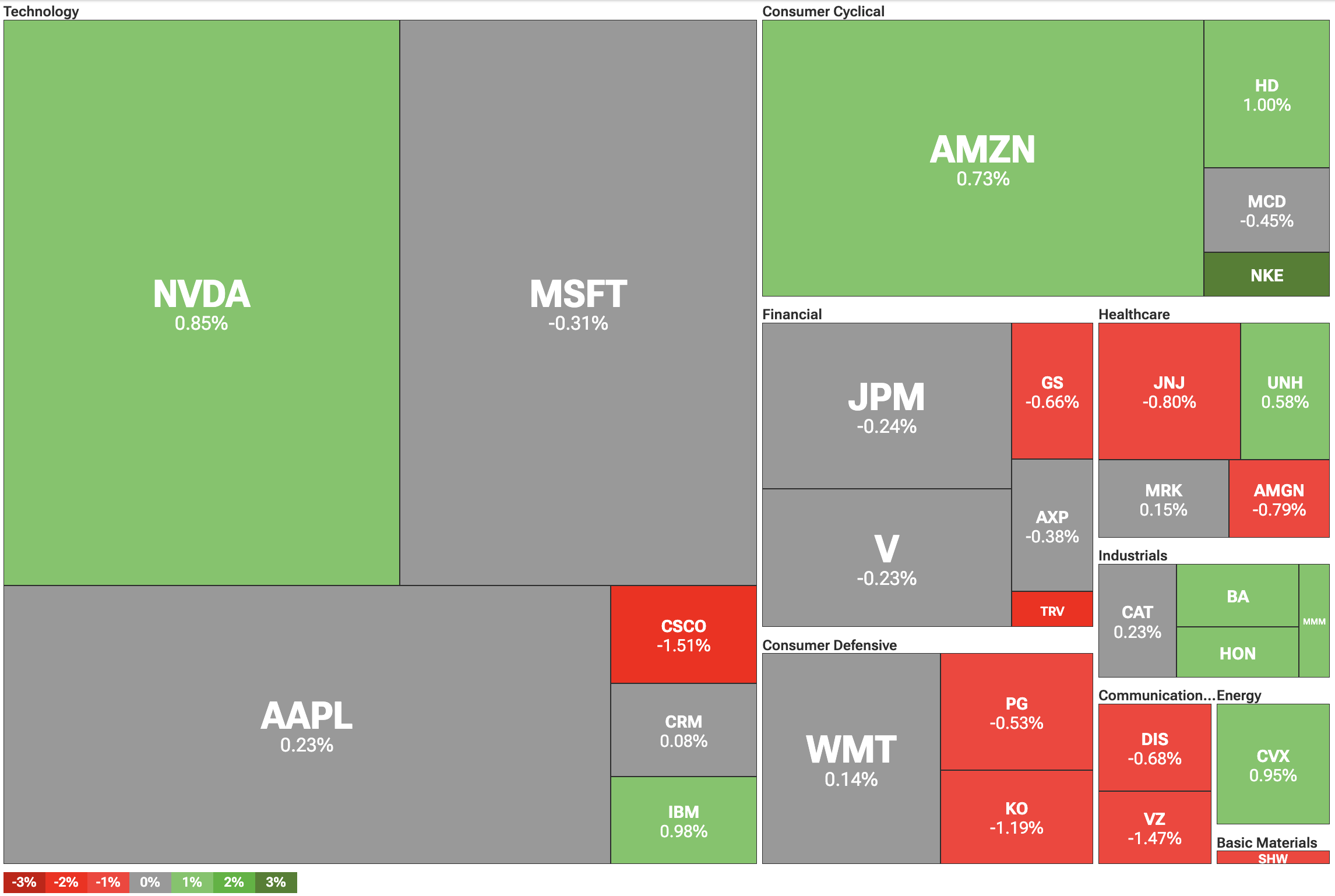

Major U.S. stock indices were mixed after an initial rally following a U.S. trade deal with the EU. On Monday, July 28, Dow Jones was down 0.10%, while the S&P 500 was hovering near all-time highs, up 0.03%. The tech-focused Nasdaq saw the biggest gains, up 0.29%.

Markets saw a wave of positive sentiment after the U.S. concluded a favorable trade deal with the EU on Sunday. The deal imposed a 15% baseline tariff on EU goods entering the U.S. On the other hand, most US goods entering the EU market will be subject to a 0% rate.

The lopsided deal, which France called a “submission,” still helped the EU avert a costly trade war with the U.S. Still, the U.S. tariff will likely cost the EU’s carmakers and pharmaceutical companies billions annually, eating into their export profits.

U.S. and China likely to extend trade talks deadline

Now, all eyes are on the U.S. deal with China, its largest trading partner. As the August 1 deadline approaches, a deal is still far from sight. Markets are concerned that, if a deal is not made by then, there’s a likelihood of a return to mutual punitive tariffs, with effective rates at embargo levels.

Still, there is hope that the U.S. and China can agree to another 90-day extension of their negotiations. According to the Washington Post, this extension is likely to come. Both Beijing and Washington are de-escalating their rhetoric, and there are signs that a China deal could be more balanced.

According to reports so far, trade talks will focus on access to Chinese markets. On Monday, President Donald Trump stated he would “love to see China open up their country.”