Coinbase (NASDAQ: COIN) reported a sharp drop in quarterly profit on Thursday, July 31, that sent shares tumbling, with the crypto exchange posting adjusted net income of $33 million, or 12 cents per share, compared to $294 million, or $1.10 per share, in the same quarter last year.

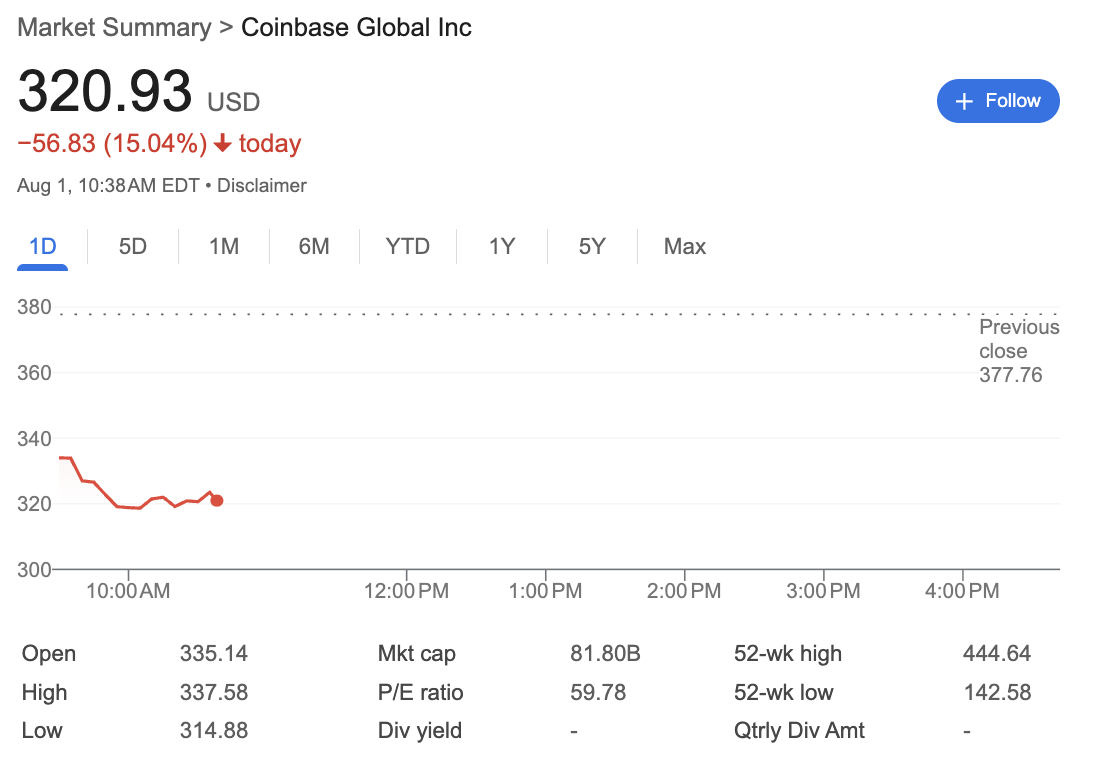

Shares were trading at $320.93, down 15.04% at press time Friday.

Why is Coinbase stock down?

Coinbase’s troubles centered on weak trading activity as crypto market volatility dropped and retail investors held onto their digital assets rather than trading. Consumer spot trading volume was $43 billion, down 45%, while consumer trading revenue fell 41% to $650 million. Total trading volume declined 40%.

Adjusted net income came in at $33 million, or 12 cents per share, in the three months ended June 30, compared with $294 million, or $1.10 apiece, a year earlier, an 89% drop that caught investors off guard. Total revenue was $1.5 billion with adjusted EBITDA of $512 million.

The earnings miss was brutal. Wall Street had expected $1.51 per share, making the 12-cent result a 92% shortfall. Revenue of $1.5 billion also missed forecasts of $1.59 billion.

Not everything was grim. Revenue from the company’s subscription and services unit rose 9.5% to $656 million, mainly driven by stablecoin-related activities.

Stablecoin revenue came in at $332.5 million in the second quarter, up from $240.4 million in the year-earlier. The company got a boost from new legislation, with the U.S. House passing the GENIUS Act to create a regulatory framework for stablecoins.

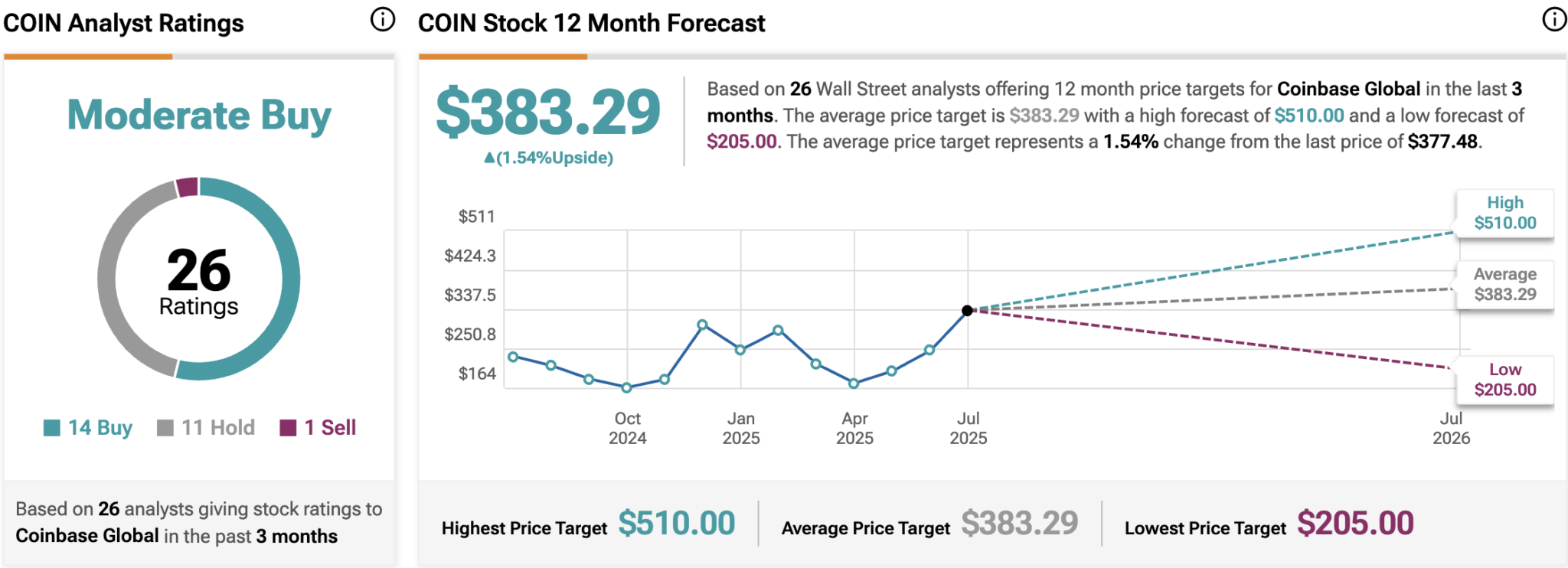

COIN stock 12-month price target

Despite the poor results, Citizens JMP maintained its $440 price target and Market Outperform rating after the earnings results, suggesting the stock could climb 36% from current levels.

Citizens JMP’s model primarily considers Coinbase’s existing business operations and does not factor in potential contributions from the concept of the “everything exchange,” which could potentially support significant growth in coming years. The firm noted that investors who can handle volatility may benefit from what it called “tremendous optionality” in the stock.

According to market analysis platform TipRanks, the average target price for COIN is $383.29 for the next 12 months, with the most optimistic analysts predicting it could reach $510.00. The most bearish outlook sees the stock falling to $205.00.

Featured image via Shutterstock.