Bitcoin Price Analysis: is BTC About to Hit $120K or $110K Next?

Bitcoin continues to consolidate above the $116K level as bulls attempt to defend critical support following a pullback from the $123K all-time high.

While the broader uptrend remains intact, recent price action reflects uncertainty and tightening range dynamics. With macroeconomic tensions rising and risk sentiment mixed, BTC’s next major move could be triggered by key technical levels.

Technical Analysis

By Shayan

The Daily Chart

Bitcoin’s daily structure shows a breakdown and pullback to the ascending channel that’s been respected for months. After the drop from $123K, and the midline of the channel, BTC has finally broken the channel to the downside and is consolidating below it. This is a concerning development, as it might lead to deeper corrections.

The price is currently attempting to hold above the 100-day moving average, which is located near the $110K support level. The RSI also sits around 51, signaling a neutral momentum state.

Yet, if a bearish shift occurs following a rejection from the channel’s lower boundary, and the $110K level breaks down, the next high-confluence zone lies around the psychological $100K level. This zone also aligns with the key 200-day moving average.

The 4-Hour Chart

The 4-hour chart shows BTC declining inside a descending channel since the price dropped from the $123K level. The cryptocurrency is now trying to break the channel to the upside, as it broke through the $116K short-term resistance.

The price is rebounding from the 50% area of the Fibonacci retracement tool, which also adds to the probability of a bullish continuation to begin from this zone.

Moreover, the RSI is showing a bullish shift in momentum as it has risen above the 50% level. As a result, if the price holds above the $116K level, it will likely break out of the descending channel and rally toward the $123K all-time high and beyond in the coming weeks.

Onchain Analysis

Exchange Whale Ratio

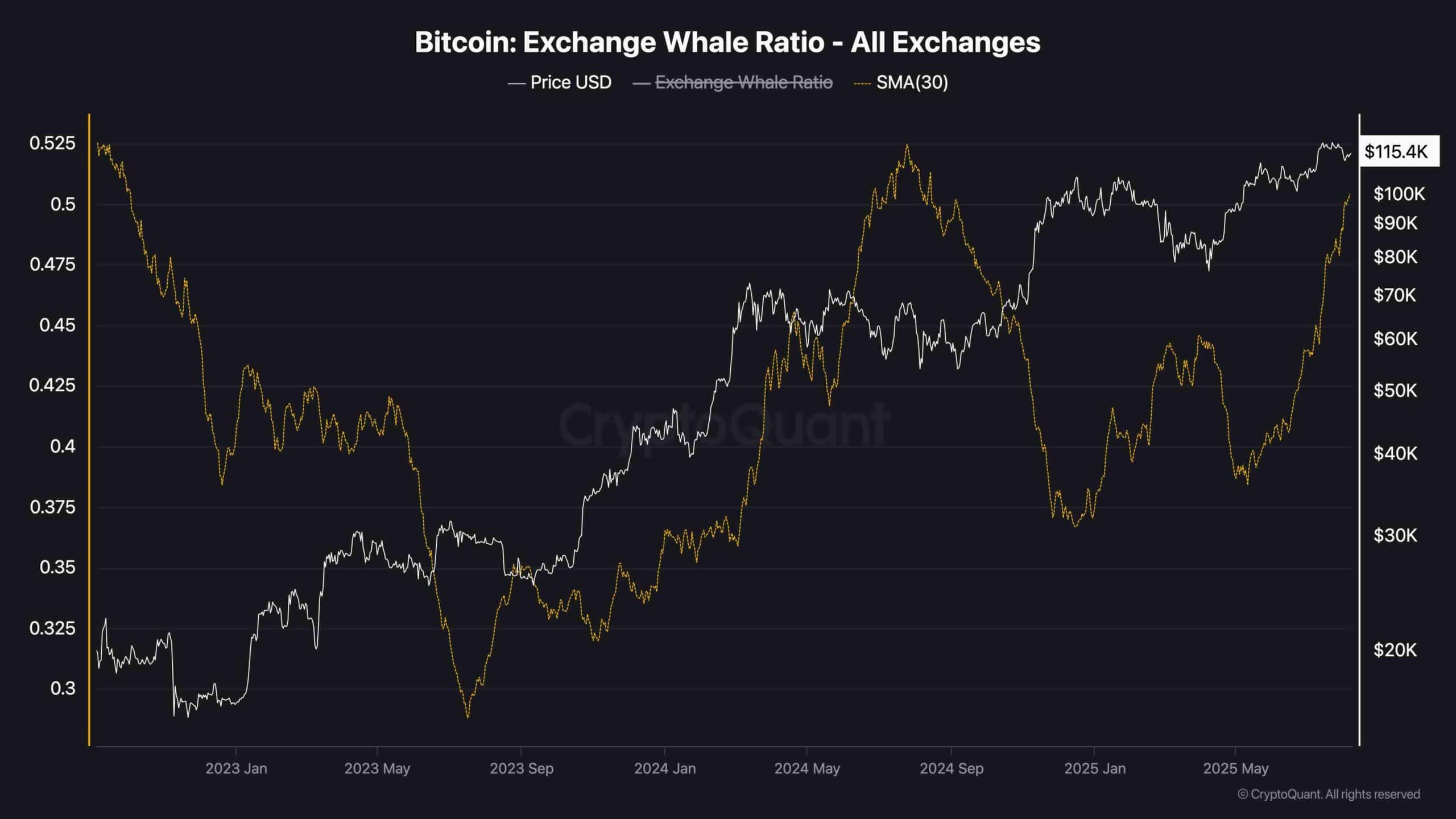

The Exchange Whale Ratio is flashing a warning signal. It has been steadily climbing and is now at its highest level since early 2023. Historically, such spikes, especially above 0.5, tend to precede either distribution events or significant profit-taking, as large holders increasingly dominate inflows to exchanges.

This rise, combined with the stalled momentum in price, suggests whales may be preparing to offload into strength.

While it doesn’t guarantee a reversal, it typically marks local tops or slower price progress until new demand kicks in. Traders should watch closely for on-chain outflows and derivatives positioning to see if the current uptick in whale activity turns into real selling pressure.