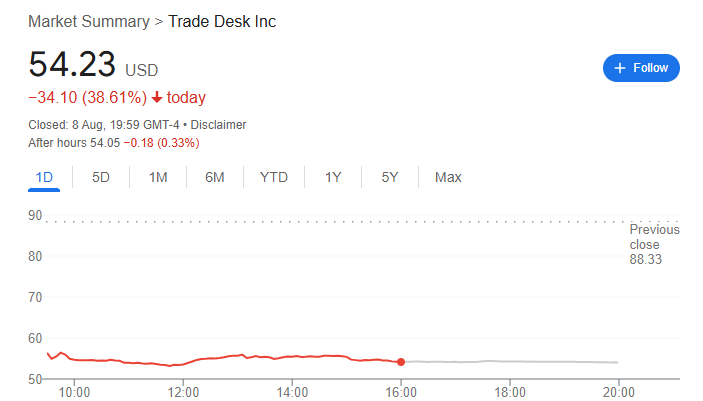

The Trade Desk (NASDAQ: TTD) shares suffered a brutal 38% plunge on Friday, closing at $54.23 in their steepest single-day drop on record. Year-to-date, the stock is now down 54%.

The selloff erased massive market value, delivering a blow to top shareholder BlackRock, which holds 26.87 million shares, about 6.05% of the company, worth roughly $1.46 billion as of March 31, 2025.

Why TTD share price is collapsing

The collapse came after The Trade Desk’s second-quarter results revealed slowing growth, rising competition from Amazon, and key leadership changes. Interestingly, the quarter marked the company’s first earnings release since joining the lucrative S&P 500.

Based on the results, Trade Desk’s revenue rose 19% year-over-year to $694 million, slightly above Wall Street’s $685 million forecast. Adjusted EBITDA came in at $270.8 million, topping expectations of $261 million.

However, the revenue beat contrasted with last quarter’s 7.1% outperformance, coming in at 1.3% this time. Management guided for at least $717 million in Q3 revenue.

It’s worth noting that Amazon’s ad-tech expansion is emerging as the most significant headwind for the firm. Notably, the e-commerce giant’s advertising revenue surged 23% year-over-year to $15.69 billion in Q2, aided by making ad-supported video the default setting for Prime Video users.

At the same time, leadership changes added to investor unease, where CFO Laura Schenkein will step down on August 21, moving to a non-executive director role, with board member Alex Kayyal set to take over. This comes as Rembrand CEO Omar Tawakol, an AI entrepreneur, joined the Trade Desk’s board.

Wall Street’s take on TTD stock

Meanwhile, Wall Street is also taking note of TTD’s short-term performance. In this case, RBC Capital Markets lowered its price target from $100 to $90 while maintaining an ‘Outperform’ rating, calling the Trade Desk’s results “solid” but warning that they fell short of lofty expectations.

On the other hand, MoffettNathanson’s Michael Nathanson cut the stock to ‘Sell’ from ‘Hold’ and slashed his price target to $45 from $75, arguing that with revenue growth decelerating and profit margins under pressure, The Trade Desk should be valued more like traditional companies, on actual earnings and cash flow, rather than on lofty growth expectations.

Adding to the bearish sentiment, Wedbush’s Scott Devitt and Citi’s Ygal Arounian both downgraded the stock to ‘Hold’. They cited weaker growth trends, limited forward visibility, and mounting competition from Amazon’s rapidly expanding demand-side platform.

Featured image via Shutterstock