Bitcoin May Face Major Correction, Max Keiser Suggests Likely Trigger

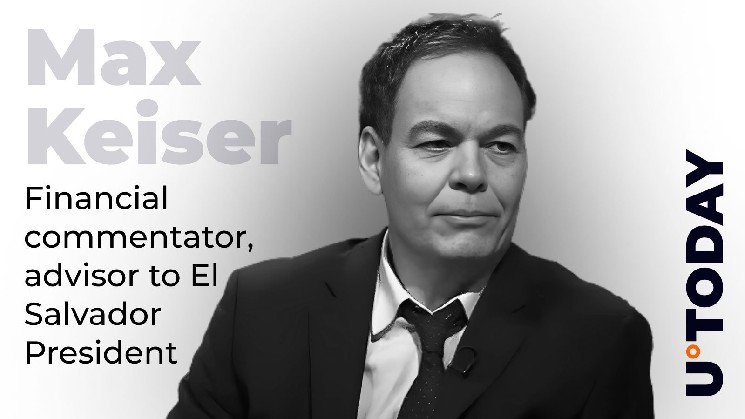

Bitcoin advocate and financial journalist Max Keiser has commented on a recent X post published by BTC maximalist Pierre Rochard, in which the latter stated that Bitcoin’s four-year cycles are over.

Are Bitcoin 4-year cycles over? Keiser predicts Bitcoin correction

To support his argument about Bitcoin’s four-year cycles getting done with, Rochard said that 95% of BTC has been mined already, halvings are immaterial to trading volume, and new inflows to the market take place with OG start selling their Bitcoin.

The demand in the market now is formed mostly by “spot retail, ETPs getting added to wealth platforms, and treasury companies.”

Commenting on that, Max Keiser, who is currently also the Bitcoin advisor to the El Salvador BTC president Bukele, said that he expects a major price correction to hit BTC. According to Keiser, it is likely to be triggered by the market of leveraged BTC derivatives.

The Bitcoin related, leveraged derivatives market is also expanding Pari-Passu and this is where the next major correction might spring from. https://t.co/S7exzkYC5M

— Max Bitcoin (@maxkeiser) August 11, 2025

X user Sergio Bermudez responded in the comments that this was what happened in 2021. Back then, $10 billion in leveraged Bitcoin positions were wiped out within just a week, pushing the price significantly down. Currently, Bitcoin is trading at $120,726 after recovering almost 1% today.

On Sunday, BTC faced a decline of 2.21% as it went down from $122,300 to $119,590 per coin.

Strategy takes in 155 Bitcoins

Michael Saylor’s treasury company Strategy has spread the word about acquiring another portion of Bitcoin. This time, the Bitcoin chunk was smaller than the previous multibillion-dollar one – Saylor’s firm bought 155 Bitcoins for roughly $18 million.

Strategy has acquired 155 BTC for ~$18.0 million at ~$116,401 per bitcoin and has achieved BTC Yield of 25.0% YTD 2025. As of 8/10/2025, we hodl 628,946 $BTC acquired for ~$46.09 billion at ~$73,288 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/bx0814RI1w

— Michael Saylor (@saylor) August 11, 2025

Strategy now holds a massive 628,946 BTC acquired for $46.09 billion at approximately $73,288 per Bitcoin. The amount of Bitcoin held by Strategy now is valued at $75,748,809,664.