Bank of America Survey Reveals Big Money Keeps Dodging Crypto

A recent Bank of America (BofA) Global Fund Manager Survey shows that institutional investors remain largely absent from crypto discussions.

The BofA survey polled 211 managers overseeing $504 billion in assets, suggesting that crypto allocations remain more symbolic than strategic.

Bank of America Survey: 97% of Big Money Still Dodges Crypto

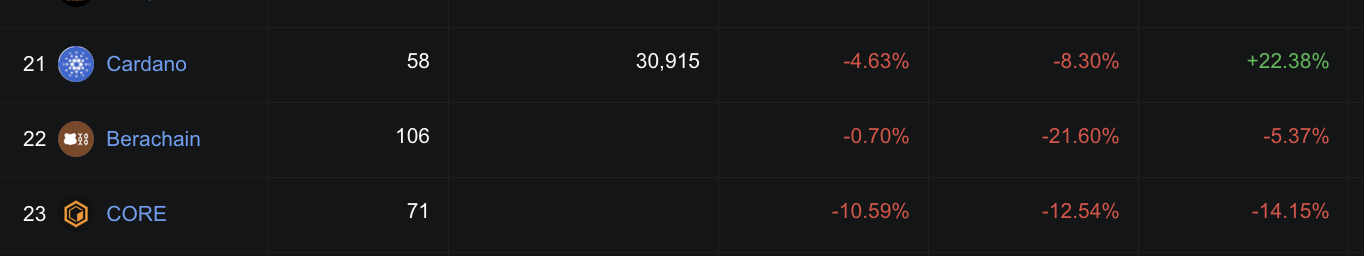

According to the August survey, an overwhelming majority of fund managers reported zero crypto exposure. Among the small fraction who do hold digital assets, the average allocation was just 3.2% of their portfolios.

Vast majority of investors in BofA global fund manager survey have *zero* crypto exposure…

Of small % who do have exposure, average portfolio allocation = 3.2%. pic.twitter.com/84WGVl2ntU

— Nate Geraci (@NateGeraci) August 17, 2025

The average allocation dropped to only 0.3% when weighted across the entire survey group.

According to ETF analyst Eric Balchunas, the participants, mostly institutional investors with minimal crypto exposure (75% at 0% and an average 3.2% allocation), may lack foresight.

His remark comes given their past misjudgment of selling US assets in Q1 2025, a period when US markets later rebounded strongly.

“Aren’t these the same ‘global managers’ who said they were selling America in Q1? Maybe they should start surveying people with better returns,” Balchunas remarked.

The lack of institutional conviction comes even as crypto adoption gains traction in mainstream finance. Earlier this month, new 401(k) offerings added Bitcoin exposure for retirement savers in the US.

Despite such developments, BofA found that only 9% of fund managers have structurally allocated to crypto, reflecting Wall Street’s cautious stance.

By contrast, equity sentiment improved notably in the August survey. A net 14% of portfolio managers were overweight global equities, compared to just 2% the previous month.

Allocation to global emerging markets climbed to the highest level since early 2023. Meanwhile, US equities remained broadly underweighted amid record concerns about overvaluation.

Should Macro Caution Shape Portfolios?

Beyond crypto, the survey showed broad caution among institutional investors. 41% of respondents expected weaker global growth over the next year, up from 31% in July.

Inflation fears also ticked higher, with 18% forecasting stronger price pressures than 6% the prior month.

Cash levels remained steady at 3.9%, just below the 4.0% BofA previously flagged as a “sell signal” for US equities. Such signals have preceded a median four-week S&P 500 decline of 2%.

The survey also identified the biggest perceived risks. Among them are renewed global recession triggered by trade wars (29%), inflation derailing Federal Reserve (Fed) rate cuts (27%), and a disorderly rise in bond yields (20%).

While equities and bonds remain the traditional focus, crypto continues to sit on the fringes of institutional portfolios.

With Wall Street seemingly comfortable watching from the sidelines, experts allude to crypto’s steadily outpacing traditional markets.

According to Ryan Rasmussen, head of research at Bitwise Invest, fund managers could soon be forced to reconsider their 3.2% problem.

We’re just getting warmed up https://t.co/EERyMdQ7vF

— Ryan Rasmussen (@RasterlyRock) August 17, 2025

The post Bank of America Survey Reveals Big Money Keeps Dodging Crypto appeared first on BeInCrypto.