Both crypto and stock markets were down on Tuesday afternoon and the only metric rising was bitcoin’s correlation with the S&P 500.

Gloomy Sentiment Sends Bitcoin and Stocks Down Together

Bitcoin ( BTC) fell below $113K on Tuesday and stock markets were no better, plunging into the red across the board and hinting at a growing correlation between the cryptocurrency and traditional equities. The S&P 500, Nasdaq, and Dow all shed 0.53%, 1.27%, and 0.01% respectively, and the broader crypto market tumbled 3% according to Coinmarketcap.

Flagship chipmaker Nvidia (Nasdaq: NVDA) led the decline among stocks, shedding roughly 3% after the firm’s CEO Jensen Huang sold more than $27 million worth of his company shares, according to a regulatory filing submitted to the U.S. Securities and Exchange Commission (SEC) on Monday. The document shows that the 150,000 shares were all sold last week between Aug. 14 and 15.

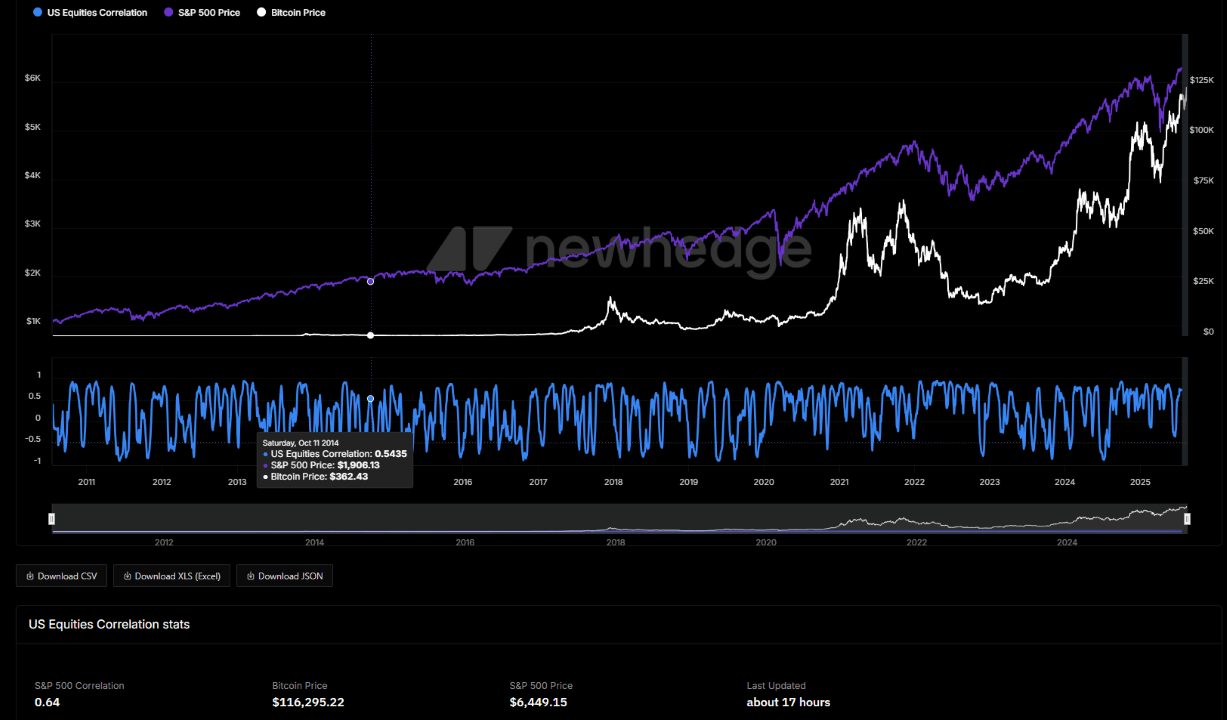

The $4.3 trillion firm wasn’t the only one on a downward slide; chief rival Advanced Micro Devices (Nasdaq: AMD) nosedived 5%, and other major tech companies such as Meta and Tesla also floundered. And now, it appears bitcoin, which is usually touted as an alternative to traditional assets, has once again found itself as a strange bedfellow to the status quo. The cryptocurrency’s correlation with the S&P 500 has shot up to 0.64 according to Newhedge, which partly explains BTC’s price decline today.

Overview of Market Metrics

Bitcoin was quoted at $113,377.52 at the time of writing, down 2.58% over 24 hours and lower by 5.39% for the week, according to Coinmarketcap. The digital asset’s price has been trading between $112,970.33 and $117,050.37 since Monday.

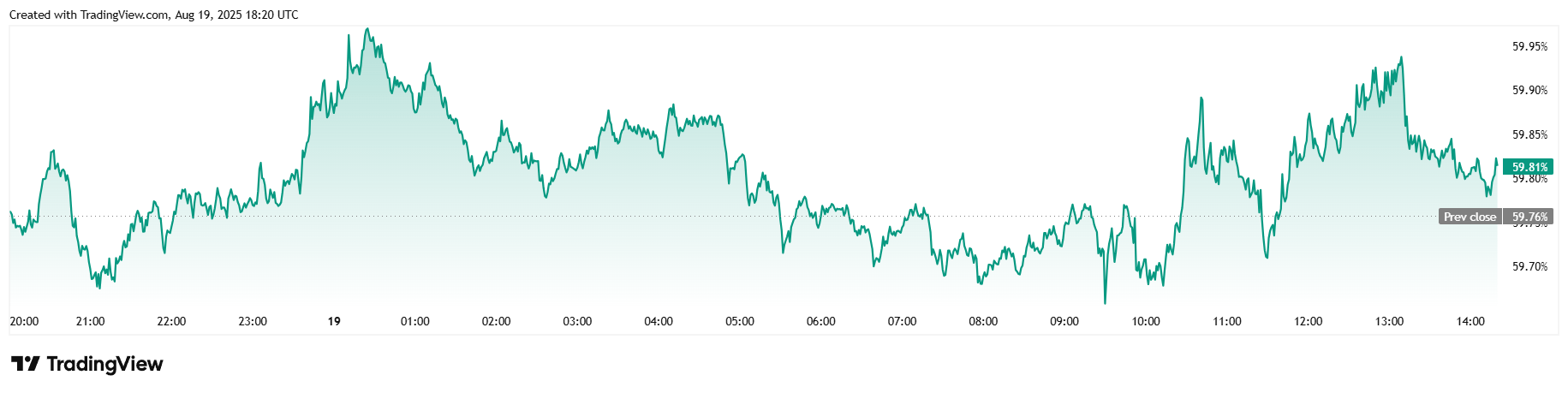

Twenty-four-hour trading volume fell 3.15% to $69.06 billion and market capitalization eased 2.51% to $2.25 trillion over 24 hours. Bitcoin dominance was mostly flat at 59.82%.

Total bitcoin futures open interest dropped by 1.94% and stood at $81.24 billion at the time of writing, according to Coinglass. BTC liquidations remained elevated since Monday, coming to a grand total of $96.37 million. Most of that was long liquidations at $91.03 million, and the rest consisted of shorts at $5.34 million.