Polkadot has launched Polkadot Capital Group, bringing capital markets division to Wall Street

Polkadot has launched Polkadot Capital Group, a capital markets division that connects traditional finance with its blockchain ecosystem. This move positions it at the centre of tokenization and DeFi to attract institutional players as digital assets gain traction.

The division will showcase practical use cases in decentralized finance, staking and the fast-growing area of real-world asset (RWA) tokenization.

By spotlighting applications like RWA tokenization, staking, Primitives in DeFi, and both centralized/decentralized exchange infrastructure, Polkadot Capital Group is likely to spur use-case development among parachains. This enriches the ecosystem and builds tangible value around Polkadot’s technological strengths.

This initiative follows the regulatory clarity in the US, like the GENIUS Act and other bills on crypto market structure and anti-CBDC measures advanced by the House of Representatives. This project is one of the first fruits of the US government’s adoption of crypto.

Institutions benefit the most

This effort will make it easier for institutions to access the Polkadot ecosystem and provide them with expert-led educational resources and help in navigating the complicated rules surrounding digital assets. This proactive method aims to make it easier for institutions to learn about blockchain and to boost faith in the platform’s long-term viability.

Polkadot’s architecture, which features the Relay Chain, parachains, pooled cryptoeconomic security, and high interoperability via XCM/XCMP, sets a strong foundation. The network enhances transaction speed and lowers costs for builders, which could dramatically improve its appeal to institutional actors.

Polkadot is set to help institutions explore opportunities in asset management, banking, venture capital, exchanges, and over-the-counter trading. David Sedacca, the head of Polkadot Capital Group, says the team is already looking for partners among asset managers, brokers, and allocators.

Competition among blockchains

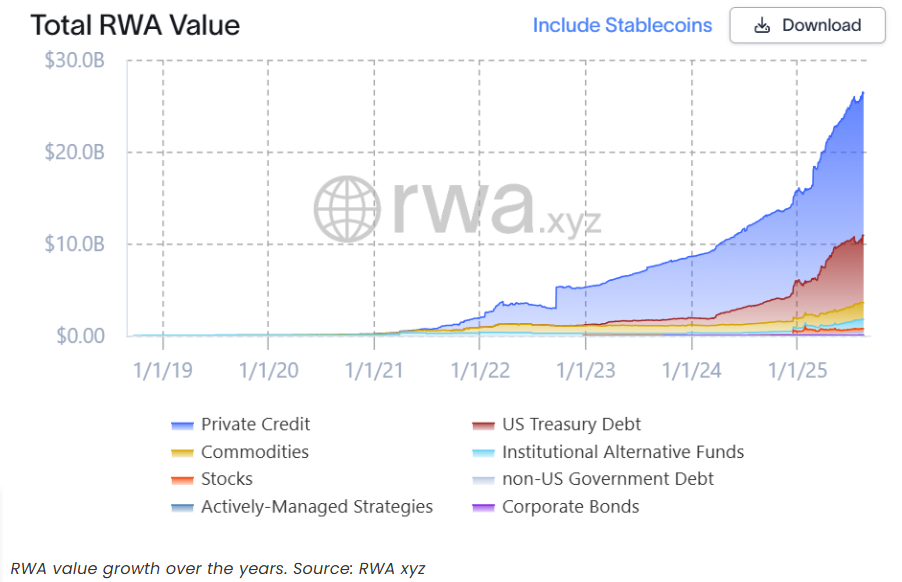

Meanwhile, several blockchain companies are changing their plans to meet the needs of institutions in areas like tokenizing assets, issuing bonds, and stablecoin payments. According to on-chain data, tokenized assets show around $26.42 billion in on-chain RWA value. There are nearly 365,000 asset holders and 262 issuers. This shows both participation and asset growth.

The real-world asset tokenization market has surged 380% over the past 3 years, now hitting around $24 billion as of June 2025. Standard Chartered forecasts up to $30 trillion by 2034, while BCG sees potential for an $18.9 trillion market by 2033.

For instance, Prometheum, a business that creates tokenized securities, raised $20 million in December to help bring more traditional securities onto the blockchain.

In addition, Digital Asset secured $135 million to scale its Canton Network, a blockchain built for regulated financial institutions that has already piloted the tokenization of bonds, gold, and other assets.

Polygon is also moving forward with its capital markets plan through Obligate, which worked with Capital Système Investissements to issue a bond on Polygon’s behalf using USDC. According to Obligate, it has cut down intermediaries by 75% and sped up issuance up to five times.

Still, Aaron Kaplan Prometheum co-CEO voiced concern over speculative tokenization, likening certain offerings that lack real asset backing to gambling. According to him, regulatory compliance and investor integrity are important.

Also, despite the hype, liquidity remains fragmented. Most tokenized RWAs still suffer from limited secondary trading, low participant counts, and high barriers such as custodial constraints, whitelisting, and limited regulatory frameworks.