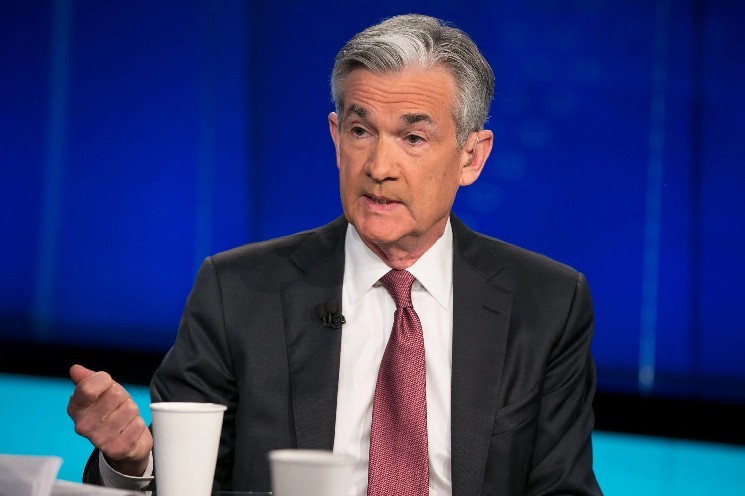

Chief Economists Predict What Will Happen Next After Fed Chair Jerome Powell’s Dovish Speech

Fed Chair Jerome Powell announced today an updated monetary policy approach that prioritizes price stability and leaves some elements of the previous framework behind.

Powell’s speech at the annual conference in Jackson Hole indicated that the Fed’s new framework moves away from its “make-shift” strategy and emphasis on low interest rates in 2020. The new strategy includes a return to flexible inflation targeting.

In his speech, Powell stated, “We believe monetary policy should be forward-looking and take into account lags in its impact on the economy,” adding that the balance of risks would be considered between both employment and inflation targets. He also stated that setting numerical employment targets “doesn’t make sense.”

Nationwide Chief Economist Kathy Bostjancic noted that Powell’s remarks were distinctly dovish. “Powell said that downside risks to employment have increased significantly and left the door wide open for a September rate cut,” she said. “This supports our expectation of a 25 basis point cut next month. We continue to forecast a total rate cut of 75 basis points by year-end.”

Powell announced that the language regarding the low interest rate environment was removed from the framework and the Fed returned to flexible inflation targeting, and the compensation strategy introduced in 2020 was removed.

Joe Brusuelas, Chief Economist at RSM US LLP, said the new framework could signal higher interest rates in the long term. “A return to price stability and a 2% inflation target means we should be prepared for an extended period of high interest rates, despite the possibility of rate cuts in the near term,” Brusuelas said.

*This is not investment advice.