Bitcoin daily transaction fees hit lowest since 2011, Fed rate cut talk signals a local top

Bitcoin transaction fees have plummeted to their lowest levels in over a decade, as social sentiment around Federal Reserve rate cuts reaches a fever pitch, raising questions about market sustainability.

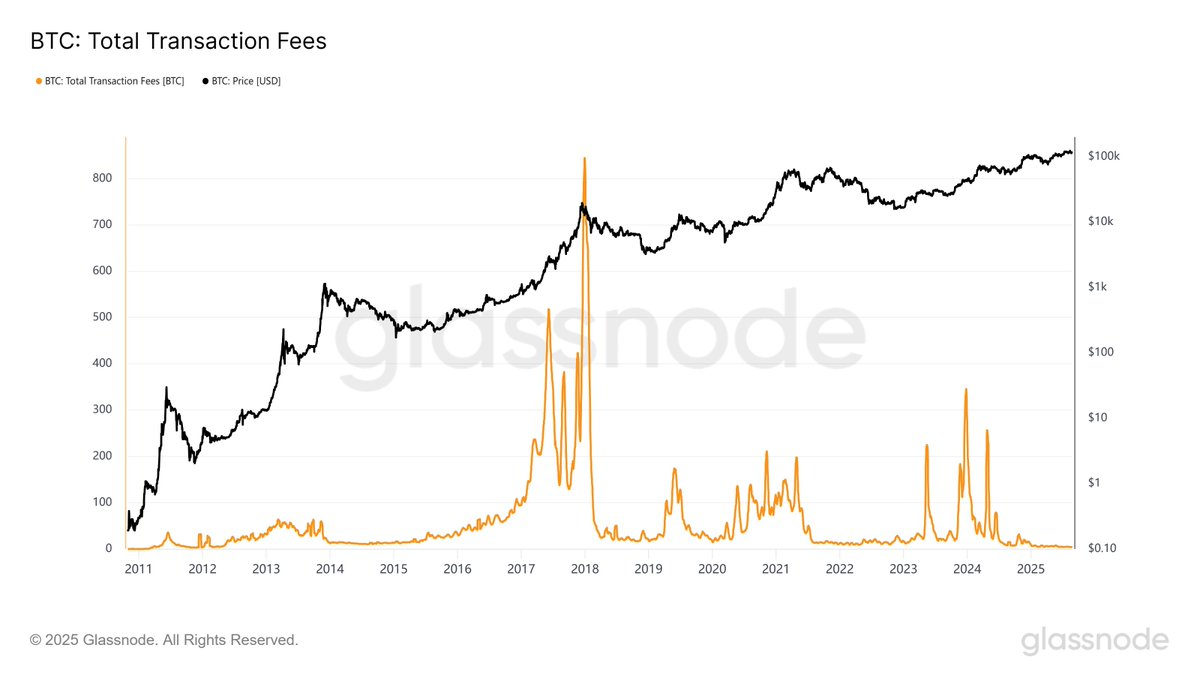

- Bitcoin fees fall to lowest levels since 2011 at 3.5 BTC daily average

- Fed rate-cut hype hits 11-month high, echoing past euphoric market tops

- Exchange BTC balances up 70K since June, signaling possible sell pressure

According to Glassnode data, daily transaction fees on the Bitcoin (BTC) network (14-day SMA) recently dropped to 3.5 BTC. This is the lowest level since late 2011.

The primary driver behind recent market strength was Fed Chair Jerome Powell’s speech at Jackson Hole, where he hinted at potential rate cuts by stating that the “shifting balance of risks may warrant policy adjustments.”

Social sentiment reaches dangerous territory for bulls

Mentions of keywords such as “Fed,” “rate,” and “cut” across social media platforms have surged. Santiment data shows that this surge is the highest in the last 11 months.

This massive spike in discussion around a single bullish narrative historically means that euphoria may be getting too elevated.

When social sentiment around a specific catalyst reaches extreme levels, it often coincides with local price tops.

Glassnode’s analysis is a concerning setup for Bitcoin holders. A dense cluster of supply accumulated between $113,000 and $120,000 since early July belongs to investors holding less than three months.

The SOPR by Age metric for these short-term holders currently ranges from 0.96 to 1.01. This data indicates a mild decline in recognition.

Exchange inflows paint a worrying picture for Bitcoin

One concerning trend is Bitcoin’s rising supply on exchanges. Since early June, the amount of BTC held on exchanges has increased by nearly 70,000 coins.

This reverses the long-term trend of coins moving into cold storage and suggests more holders are positioning to sell.

Historically, rising exchange balances have preceded selling pressure, as investors move coins to platforms in preparation for liquidation.

Bitcoin’s on-chain health metrics show a neutral-to-cautious picture, with daily active addresses and transaction volume cooling off from recent highs.

The long-term MVRV ratio sits at 18.5%, which is a slightly risky zone for new investments.