Bitcoin Price Prediction: BTC Consolidates as Market Awaits THIS Next Big Move

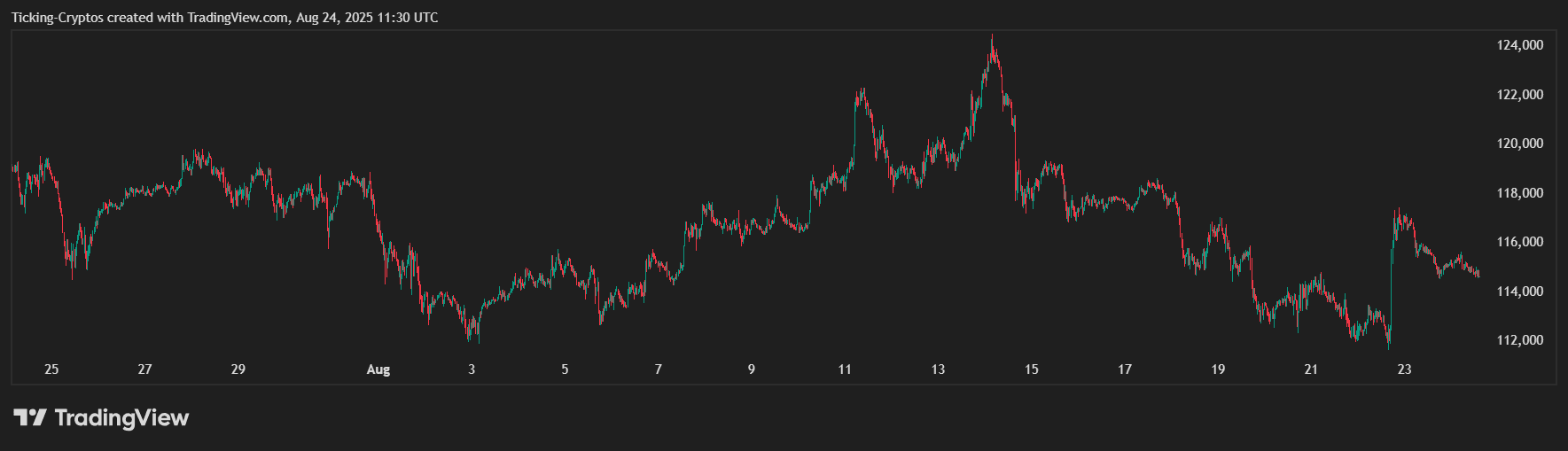

The $Bitcoin price is currently trading sideways, caught in a consolidation channel between $112,000 and $118,000. While a few breakout attempts pushed BTC briefly toward the $124,000 resistance, the market quickly adjusted lower, bringing the price back into its familiar range.

Bitcoin price in USD over the past month – TradingView

This zone has become the battleground between bulls defending support and bears trying to cap upside momentum.

Ethereum Nears ATH – But Bitcoin Leads the Market

$Ethereum is pushing closer to its $5,000 all-time high, fueling optimism across the crypto sector. However, history shows that Bitcoin usually leads the broader market. If BTC manages a decisive breakout above $118K and holds $124K, the momentum could ignite a fresh rally across altcoins.

On the other hand, a sharp rejection or breakdown could drag Ethereum and the rest of the crypto market lower. The Bitcoin price prediction in this context becomes critical not just for BTC holders, but for the entire digital asset space.

Bitcoin Price Analysis: Key Levels to Watch

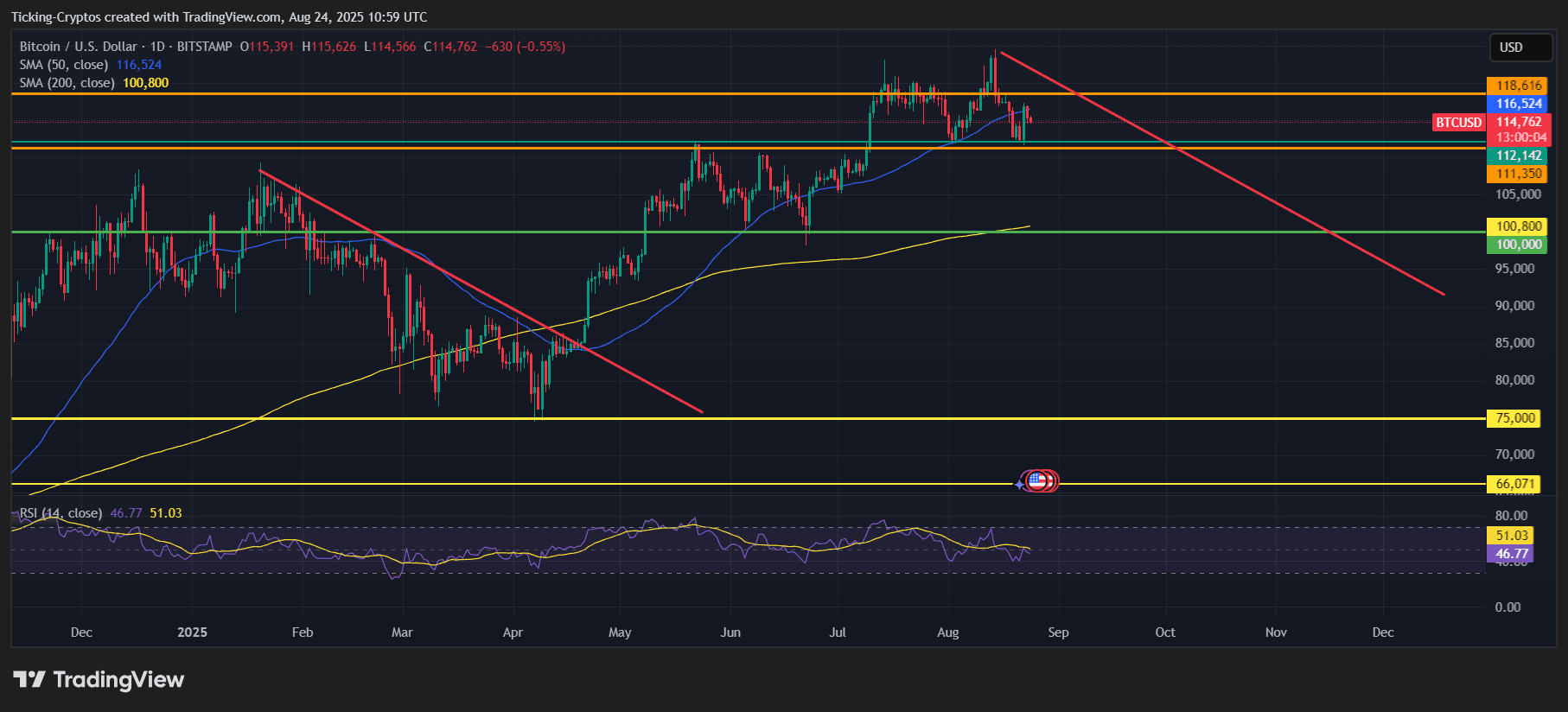

Looking at the below $BTC chart, we notice the following:

BTC/USD 1-day chart – TradingView

- Resistance Zone: $118,600 – $124,000 remains the overhead barrier. A close above this range would signal renewed bullish strength and open the door toward uncharted territory.

- Immediate Support: $112,000 is the line in the sand. Losing this level could accelerate downside pressure.

- Major Support: The 200-day SMA near $100,800 is the next critical safety net. If broken, sentiment could shift sharply bearish.

- Long-Term Risk Levels: $75,000 and $66,000 (highlighted as deeper support zones) would come into play in the event of a severe market correction.

Momentum indicators add weight to the cautionary stance: the RSI is hovering around neutral (46–51), showing indecision rather than clear bullish conviction. The short-term moving averages are still supportive, but a prolonged failure to break resistance could flip the trend bearish.

With $ETH testing historic highs and macroeconomic uncertainty still in play, Bitcoin is once again at the center of attention. Traders are eyeing whether the king of crypto will deliver a breakout or break down.

For now, the Bitcoin price prediction is clear: consolidation continues, but volatility is building. A move outside the $112K–$118K range will likely define the next big trend, not just for $BTC, but for the entire crypto market.