Michael Saylor’s Strategy, the flagship company of the corporate Bitcoin (BTC) journey, allocated a massive 632,457 Bitcoins (BTC) to its balance. This gargantuan amount allowed Strategy to become the first corporation to reach 3% of BTC supply threshold.

Strategy holds 3% of net BTC supply

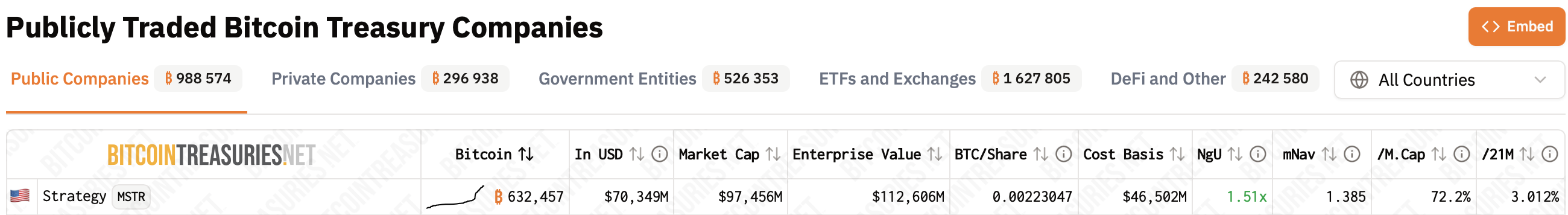

Strategy (MSTR), a U.S. public company, increased its Bitcoin (BTC) holdings to 632,457 BTC, with $73,527 per Bitcoin (BTC) as the average purchasing price. As a result, its Bitcoin (BTC) bags exceeded 3.012% of all 21 million Bitcoin (BTC) ever existed, as per Bitcoin Treasuries tracker.

Strategy — formerly known as MicroStrategy — is therefore operating $70.4 billion in Bitcoin (BTC). This equals 72.2% of the company’s market cap.

As covered by U.Today earlier today, on Aug. 25, 2025, Strategy has acquired an additional 3,081 BTC — $356.9 million in equivalent — at an average price of $115,829.

To provide context, Marathon Holdings (MARA), Strategy’s closest rival in the corporate BTC holding segment, operates a 12.5x smaller Bitcoin (BTC) stake.

In total, corporations allocated almost $110 billion worth of Bitcoin (BTC), or 4.7% of its total supply. The best ROI so far gas been accomplished by Riot Platforms and ProCap BTC corporations.

Bitcoin (BTC) price retraces: Peak in?

Accumulators who joined the race later demonstrate modest results. For instance, “Japanese Strategy” Metaplanet Inc. allocated almost 19,000 BTC, with 1.09x ROI at current prices.

Bitcoin (BTC), the largest cryptocurrency, is changing hands at $112,236, down 2% in last 24 hours. While some speakers are pessimistic about the potential of a further rally, Glassnode demonstrates the chart that shows that the biggest gains are yet to come for BTC.

Relative to prior cycles, #Bitcoin’s all-time highs in 2017 and 2021 were reached just 2–3 months ahead of today’s point in the cycle. While history is a limited guide, it’s a noteworthy context given recent profit-taking and elevated speculative activity. pic.twitter.com/HvgM7RFHwq

— glassnode (@glassnode) August 25, 2025

Based on data from 2017 and 2021 rallies, the peak phase might arrive 2-3 months from today. However, cycles in crypto are getting longer with the growing capitalization of crypto markets.