Bitcoin drop to $100,000 likely imminent as death cross pops up

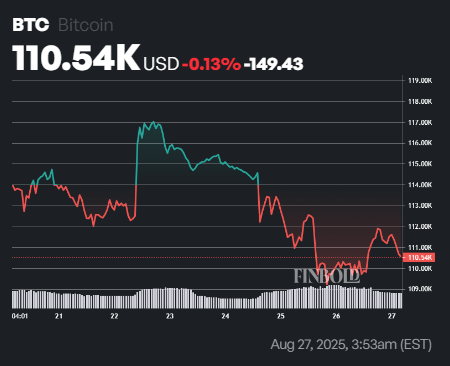

As Bitcoin (BTC) seeks to maintain its price above the $110,000 mark, technical indicators suggest further losses may be looming.

Specifically, the threat of an additional downturn is highlighted by a ‘death cross’ on the Moving Average Convergence Divergence (MACD) indicator, according to insights from cryptocurrency analyst Ali Martinez in an X post on August 27.

Notably, the MACD tracks momentum through two moving averages, and a death cross occurs when the short-term line falls below the long-term one, signaling bearish pressure.

Historically, this pattern has preceded sharp Bitcoin corrections, with the latest signal pointing to a potential drop toward the $100,000 support level.

According to the analysis, Bitcoin faced rejection at the $120,000 region after a strong rally earlier in 2025, a drop triggered mainly by whales offloading the asset.

The price has since slipped into a downward trend, losing more than 9% from its highs. Previous corrections, such as the -28.1% decline in February 2025, highlight how quickly selling pressure can intensify after momentum reversals.

Bitcoin social sentiment wanes

Beyond price action, sentiment indicators are also flashing red flags. Data shared by Martinez indicates that Bitcoin-related discussions on social media have taken a sharp turn, reaching their lowest level since June.

This shift in online mood points to a growing lack of confidence among retail traders and investors. Historically, such sentiment dips have coincided with heightened volatility and accelerated selling, compounding technical weakness.

Bitcoin price analysis

At press time, Bitcoin was trading at $110,526, up a modest 0.14% in the past 24 hours but down 1.55% over the past week.

Currently, Bitcoin is trading below its 50-day SMA of $116,564 but remains well above the 200-day SMA of $95,245. This suggests that, while the long-term trend remains bullish, short-term momentum has weakened as the price struggles to maintain its position above the intermediate average.

Meanwhile, the 14-day RSI stands at 42.71, just below the neutral 50 mark, indicating mild bearish pressure without entering oversold territory.

Featured image via Shutterstock