Blockchain reorganizations, where networks discard recent blocks to follow a longer chain, have exposed weaknesses in proof-of-work (PoW) systems, highlighted by Monero’s August 2025 ordeal and earlier disruptions across other blockchains.

Decoding Chain Reorgs

A blockchain reorganization, or reorg, happens when a chain of blocks is abandoned in favor of a competing version with greater cumulative proof-of-work (PoW), effectively rewriting a piece of the ledger. Reorgs roll back transactions in orphaned blocks, sending them back into the mempool for possible inclusion—or omission—later.

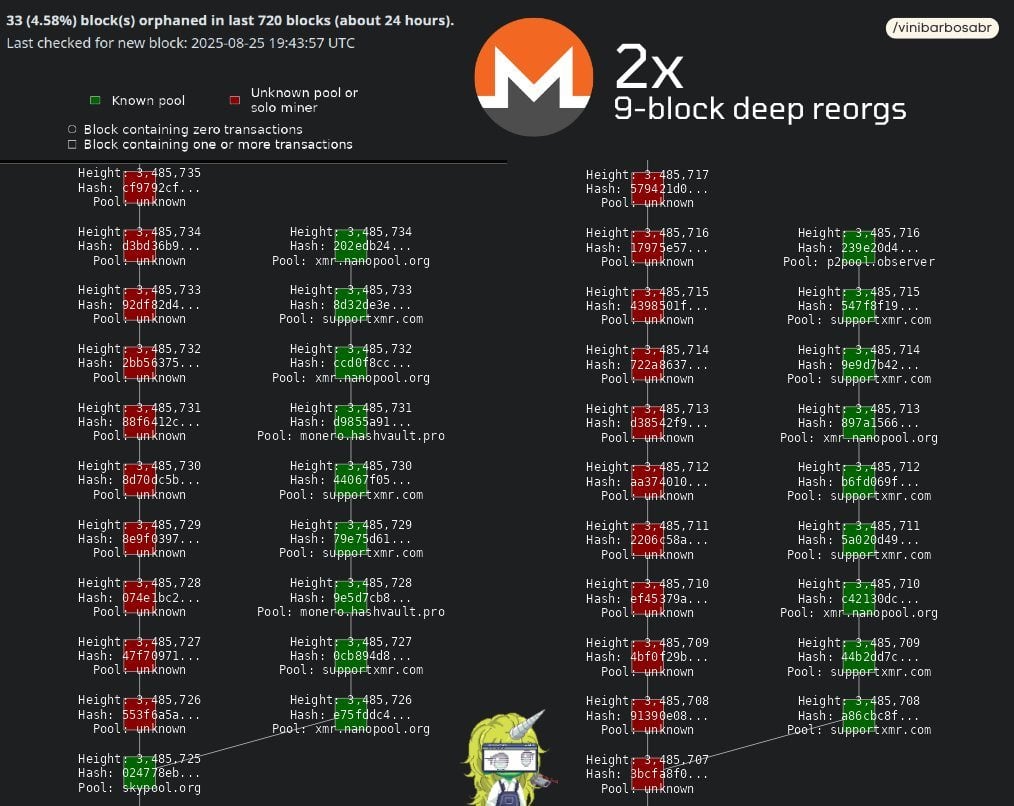

This creates openings for double-spending, where attackers can spend coins on a discarded chain yet still retain them after the reorg. In August 2025, Monero endured repeated reorgs tied to the Qubic mining pool, which amassed a dominant share of hashrate. Qubic publicly described the effort as an experiment, leveraging its PoW setup to mine Monero blocks and claim rewards.

That strength initially enabled a six-block reorg, showing how the ledger could be rewritten. Several more followed, including a recently reported nine-block reorg that took place two times. Monero’s reorgs stemmed from Qubic’s superior hashrate, allowing private mining of a longer chain before revealing it, which forced nodes to switch. The risks include double-spending, transaction censorship, and the headache of erased blocks.

Exchanges like Kraken suspended deposits, later demanding 720 confirmations—far beyond the usual 10—to guard against losses. The turmoil sparked debate over revamping Monero’s consensus, with proposals ranging from merge mining with Bitcoin, to geographically distributed hardware to weaken large pools, to Dash’s Chainlocks, where masternodes lock blocks to block reorgs.

In August 2021, Bitcoin SV faced a similar test when an unknown miner controlled over half its hashrate, pulling off a reported a massive 100-block reorg. The event splintered the chain into three versions, shaking reliability. The cause was traced to stealth miners building hidden chains, leading to familiar risks: double-spends, instability, and shaken confidence.

Reorgs highlight PoW’s probabilistic finality: Transactions become more secure with additional confirmations, but a 51% advantage can override them. Both episodes reveal reorgs as natural correction tools twisted into attack methods, fueling calls for stronger decentralization and hybrid protections.

Monero and BSV’s experiences reveal the two-sided nature of reorgs—ordinary in healthy operation but disruptive when weaponized—pointing to the importance of widely distributed hashrate to preserve a blockchain’s integrity.

Bitcoin ( BTC) is far more expensive to attack because of its sheer hashrate dominance compared to other PoW blockchains. The network runs on hundreds of exahashes per second (EH/s), powered by globally distributed mining farms operating specialized ASIC hardware.

To reorganize Bitcoin’s chain, an attacker would need to secretly marshal a majority of that hashrate, a feat that requires billions of dollars in mining rigs, industrial-scale infrastructure, and massive amounts of electricity. The level of investment needed makes such an attempt economically irrational.

Monero ( XMR) and Bitcoin SV ( BSV) are far cheaper to attack because their PoW systems operate on a fraction of Bitcoin’s hashrate, and the cost of entry for mining is drastically lower.