Businesses are absorbing Bitcoin 4x faster than it is mined: Report

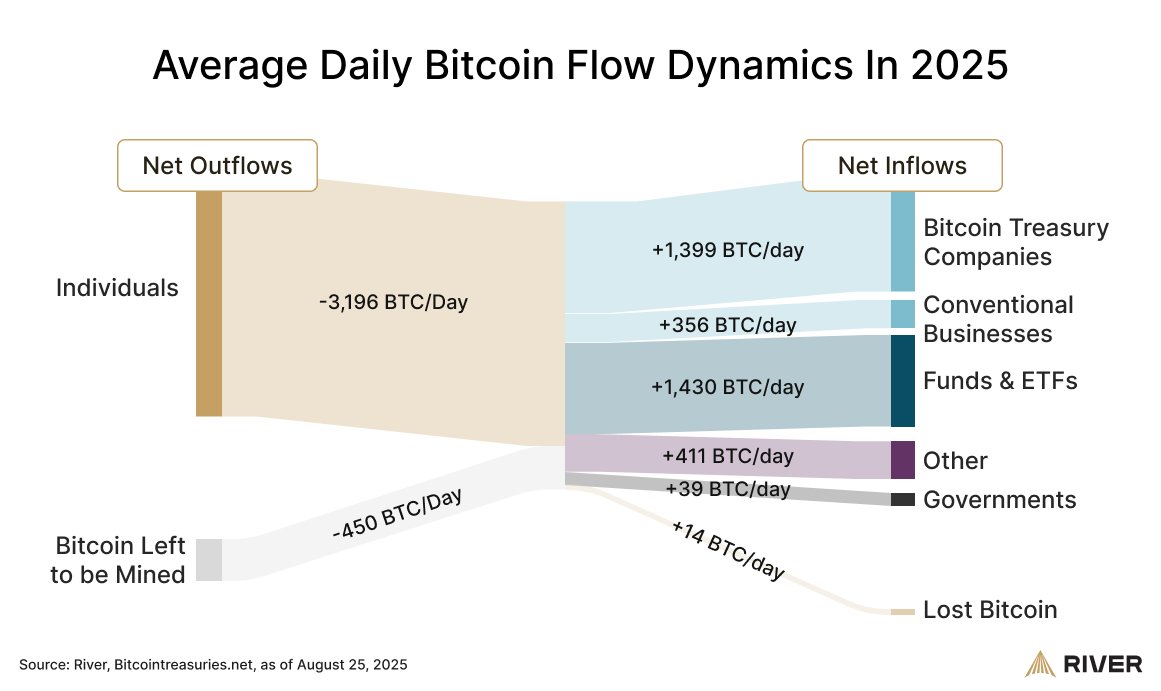

Private businesses and public companies are absorbing Bitcoin (BTC) nearly four times faster than the rate at which miners are producing new coins, according to Bitcoin financial services company River.

These businesses included publicly traded Bitcoin treasury companies and conventional or private businesses, which collectively purchased 1,755 BTC per day on average in 2025, according to River.

Exchange-traded funds (ETFs) and other investment vehicles also bought an additional 1,430 BTC per day on average in 2025, and governments purchased about 39 BTC per day, River’s data shows.

Bitcoin miners produce an average of about 450 new BTC per day, triggering a potential supply shock if exchange reserves continue to shrink and institutions continue to HODL their coins.

Analysts continue to speculate over the likelihood and potential impact of such a supply shock, with some predicting that it will be a bullish catalyst for Bitcoin’s price.

Bitcoin treasury companies generating massive demand for BTC

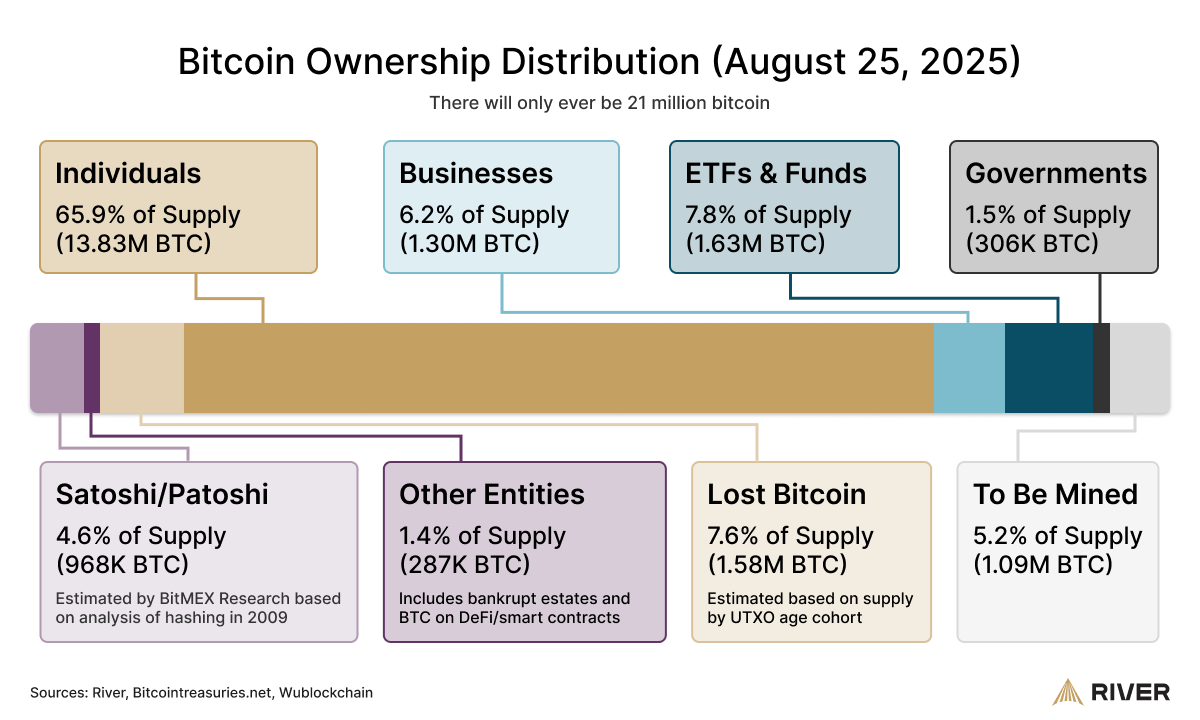

Bitcoin treasury companies acquired 159,107 BTC in Q2 2025, bringing the total amount of Bitcoin held by businesses to about 1.3 million BTC, according to River.

These holding firms are led by Michael Saylor’s Strategy, which is the largest known Bitcoin holder in the world, and holds a whopping 632,457 BTC in its corporate reserve, according to BitcoinTreasuries.

Adam Livingston, author of “The Bitcoin Age and The Great Harvest,” previously said that Strategy is single-handedly “synthetically” halving Bitcoin through its rapid accumulation.

Despite Strategy’s frenzied BTC buying, the company’s corporate treasury officer, Shirish Jajodia, says that Strategy does not impact short-term Bitcoin prices through its purchases.

Jajodia said that the company spreads out its buying through over-the-counter (OTC) transactions that occur off exchanges and do not impact spot markets or move prices.

“Bitcoin’s trading volume is over $50 billion in any 24 hours — that’s huge volume. So, if you are buying $1 billion over a couple of days, it’s not actually moving the market that much,” he also said.