VC Roundup: VCs fuel energy tokenization, AI datachains, programmable credit

Real-world asset (RWA) tokenization has become a key focus for venture capital, as investors zero in on the intersection of two powerful trends: institutional adoption of blockchain technology and the search for alternative sources of yield.

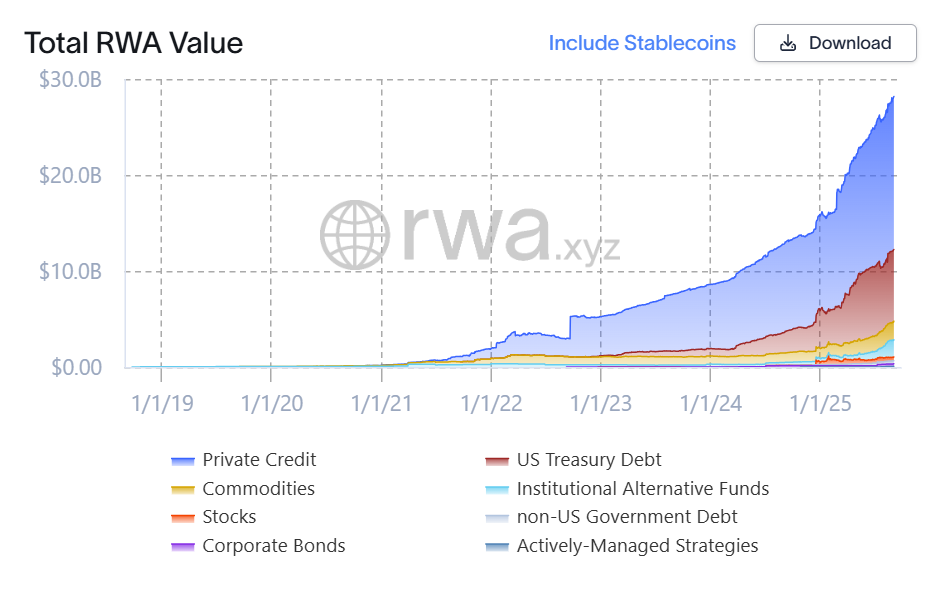

In 2025, tokenization has emerged as one of blockchain’s biggest growth areas, with the total value of onchain assets rising to $28 billion from $15 billion over the course of the year. As venture firms grow more selective with their capital allocations, tokenized assets have stood out as a clear area of opportunity.

So far, much of the activity has centered on private credit and US Treasury bonds, but the scope is steadily widening to include equities and even energy assets.

Reflecting this momentum, several major blockchain players — including Plume, Galaxy Ventures, Morpho, OKX Ventures, Anchorage Digital and Centrifuge — have launched a nine-week accelerator program called Ascend to support developers building tokenization infrastructure and applications.

This month’s VC Roundup spotlights several companies active in the space, including tokenization platform Plural, data chain Irys, programmable credit protocol Credit Coop, Web3 infrastructure provider Yellow Network and stablecoin infrastructure developer Utila.

Related: VC Roundup: Bitcoin DeFi surges, but tokenization and stablecoins gain steam

Tokenization platform Plural closes $7 million seed round

Plural, a tokenization platform that enables high-yield investments in energy assets such as solar, storage and data centers, has raised $7.13 million in a seed round led by Paradigm, with participation from Maven 11, Neoclassic Capital and Volt Capital.

The company brings energy assets onchain, a move it sees as critical as artificial intelligence reshapes global energy demand. According to the International Energy Agency, electricity consumption from AI-driven data centers is projected to more than quadruple by 2030, making energy infrastructure an increasingly vital investment category.

Plural’s approach aligns with the broader trend of asset tokenization in the blockchain industry, where more real-world assets are being brought onchain to open new sources of yield for investors.

Irys raises $10 million to build programmable data blockchain

Irys, a layer-1 blockchain designed for title=””>

Programmable credit protocol secures $4.5 million seed round

Credit Coop, a blockchain-based credit protocol, has raised $4.5 million from venture firms including Maven 11, Lightspeed Faction and Coinbase Ventures. The funding will support the company’s operational expansion.

The platform connects institutional lenders with yield opportunities backed by a borrower’s verifiable cash flows. For businesses, it enables traditional assets and projected cash flows to be used as collateral for credit.

To date, Credit Coop has processed more than $150 million in total volume, with $8.5 million in active loans outstanding.

Related: VC Roundup: Bitcoin DeFi surges, but tokenization and stablecoins gain steam

Ripple co-founder-backed Yellow raises $1M in token sale

Web3 infrastructure company Yellow Network has raised over $1 million from accredited US investors through a token sale on Republic. The Reg D-compliant offering of YELLOW tokens was oversubscribed, the company said.

Backed by Ripple co-founder Chris Larsen, Yellow Network is building infrastructure for digital asset trading, providing brokers, exchanges and institutions with back-end systems that enable secure cross-chain trading.

The company said the raise demonstrates that crypto fundraising can be conducted within regulated frameworks. “The US market is ready for regulated digital infrastructure, where institutions and creators can engage with confidence,” said Alexis Sirkia of Yellow Network.

Stablecoin infrastructure provider Utila raises $22 million

Utila, a blockchain infrastructure company specializing in stablecoin operations, has raised $22 million in a Series A extension round led by Red Dot Capital Partners, with participation from Nyca Partners, Wing VC and others. The company offers custody, wallet management and compliance solutions to help businesses integrate stablecoin operations.

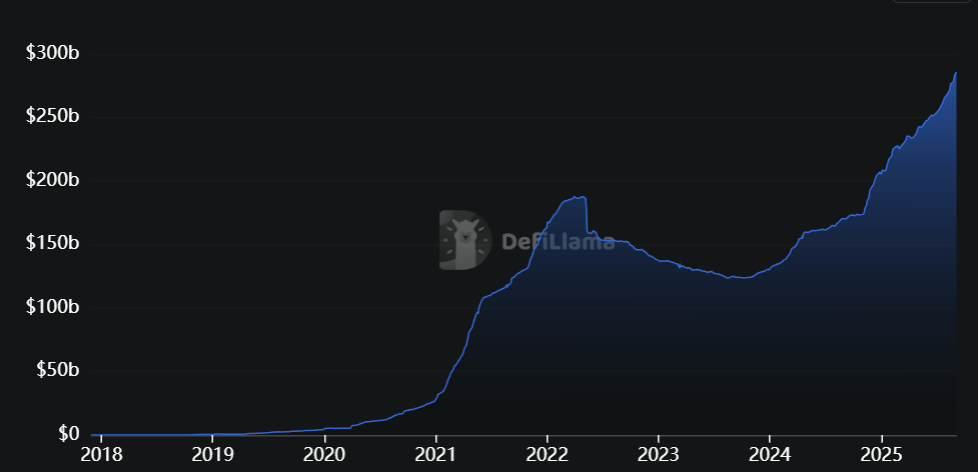

The funding comes amid rising adoption of stablecoins, which are approaching a combined market capitalization of $300 billion. Utila reports it has processed more than $60 billion in transactions as demand grows for stablecoin-focused operating systems.

Related: PayPal Ventures backs Kite AI with $18M to power AI agents