Solana leads all blockchain networks in revenue with $1.25 billion in 2025

Solana has generated $1.25 billion in revenue year-to-date, enough to make it the clear leader for revenue among blockchain networks. Crypto media platform Milk Road shared the data, noting that Solana has 2.5x of Ethereum revenue.

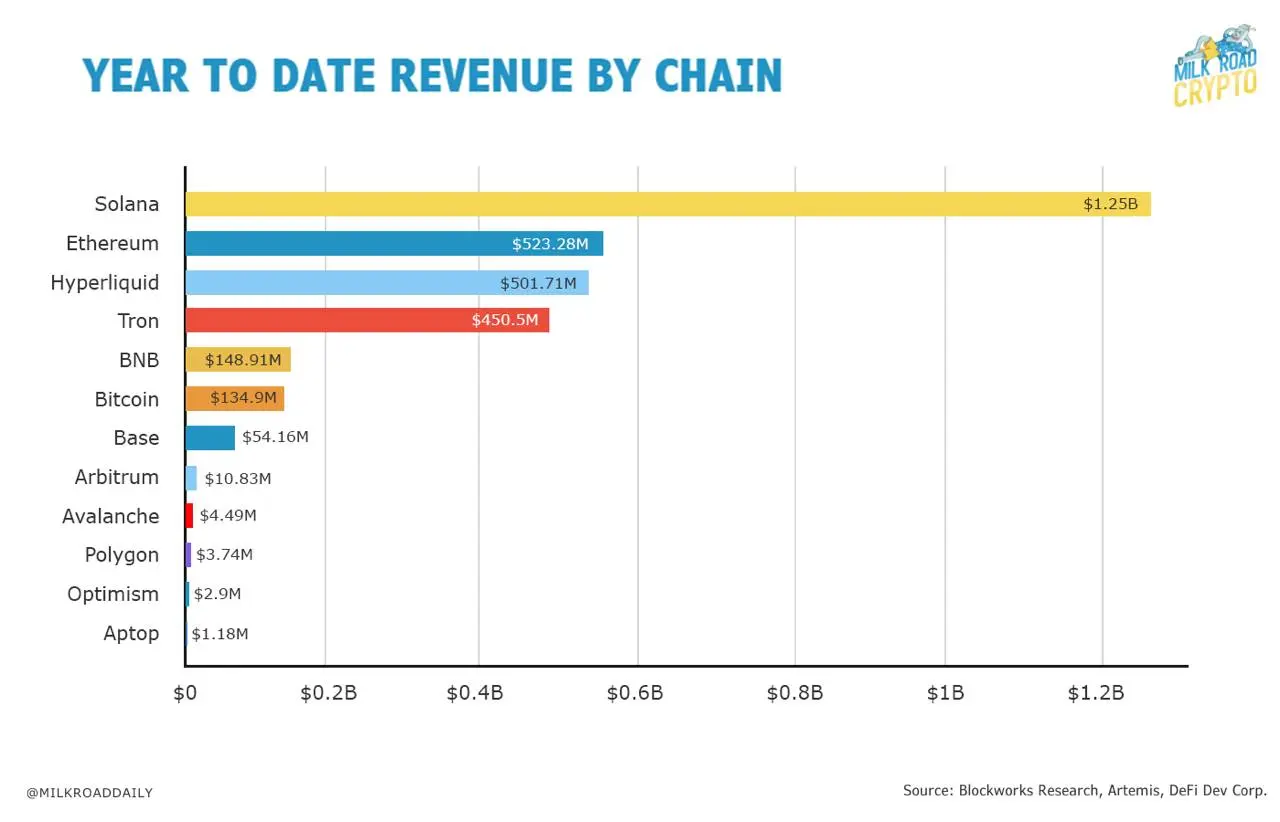

According to the data, Ethereum, while being the closest to Solana in revenue, has only $523.28 million this year. Other networks that come close are decentralized perps blockchain Hyperliquid, and the TRON network, with $501.71 million and $450.5 million, respectively.

Milk Road post stated:

$SOL is in a league of its own. Solana has generated $1.25B in revenue YTD… That’s real demand for blockspace and right now, no chain comes close.

Outside of Solana at the top and the other three networks, only two other chains have generated over a hundred million dollars in revenue. These are BNB Smart Chain with $148.91 million and Bitcoin with $134.9 million. Coinbase layer-2 network Base also has $54 million to make it the L2 network with the most revenue. Its competitors, such as Arbitrum, Polygon, and Optimism, only have revenue ranging between $10.83 million and $2.9 million.

Solana’s leadership in 2025 revenue continues a trend that started in November 2024. In the first quarter of 2025, the network recorded more revenue than all other L1 and L2 Chains combined, which has continued throughout the year.

Solana’s revenue is mostly going to apps

Unsurprisingly, Solana also leads in monthly revenue, with the network generating more than $210 million in the last 30 days. However, what is more interesting is that most of the revenue goes to the decentralized apps based on the network.

In the past month, memecoin launchpad Pump.fun and trading bot Axiom Pro account have generated $52.83 million and $50.79 million in revenue on Solana. Decentralized exchanges Jupiter and Meteora, as well as crypto wallet Phantom, are among Solana’s top ten revenue generators.

Interestingly, Solana itself ranks eighth in revenue over the past 30 days, with the chain only generating $4.56 million. While this is still significant, it is small compared to what other Layer-1 and Layer-2 networks, such as Hyperliquid, Ethereum, and even Base, generate in chain fees.

However, Solana proponents such as Helius Labs CEO Mert Mumtaz believe that what makes Solana special is how decentralized apps thrive in the ecosystem. Mumtaz believes many dApps builders are coming to Solana because the ecosystem supports fast revenue-generating apps.

Signs of this are evident with the trading bot, Axiom Exchange, recently becoming the fastest app to reach $200 million in revenue in August in just 202 days. The platform reached $200 million in revenue on August 4 and generated over $50 million in the past 30 days. It reached the milestone even faster than Pump.fun, which took 303 days.

SOL reaches $216 as the crypto market sees a resurgence in value

Meanwhile, SOL is currently on the uptrend, with the altcoin emerging as one of the top performers today after seeing more than 7% rise in value to reach $216. The token has been one of the best performers in the past 30 days, picking up from where other altcoins such as Ethereum and XRP appear to have lagged after their earlier gains.

According to CoinMarketCap, SOL is up 19% in the past 30 days, even as it continues to underperform other major cap tokens such as Bitcoin, Ether, XRP, and BNB in year-to-date performance.

However, sentiments around Solana are currently bullish, especially in light of recent milestones. Beyond its sizable revenue, the network also recently hit $100 billion in market cap again, drawing comparisons with major tech companies such as Google, Meta, and Nvidia for taking a much shorter period (4.5 years) to hit the milestone.

There are reports that Solana could soon have its own digital assets treasury heavyweight, with Forward Industries announcing plans to spend $1.65 billion in private placement cash and stablecoin commitments to acquire SOL.

While other publicly traded companies, such as Sol Strategies and DeFi Development Corp, have already created SOL treasuries, this marks the first time a Nasdaq-listed company will deploy institutional capital directly towards buying SOL.