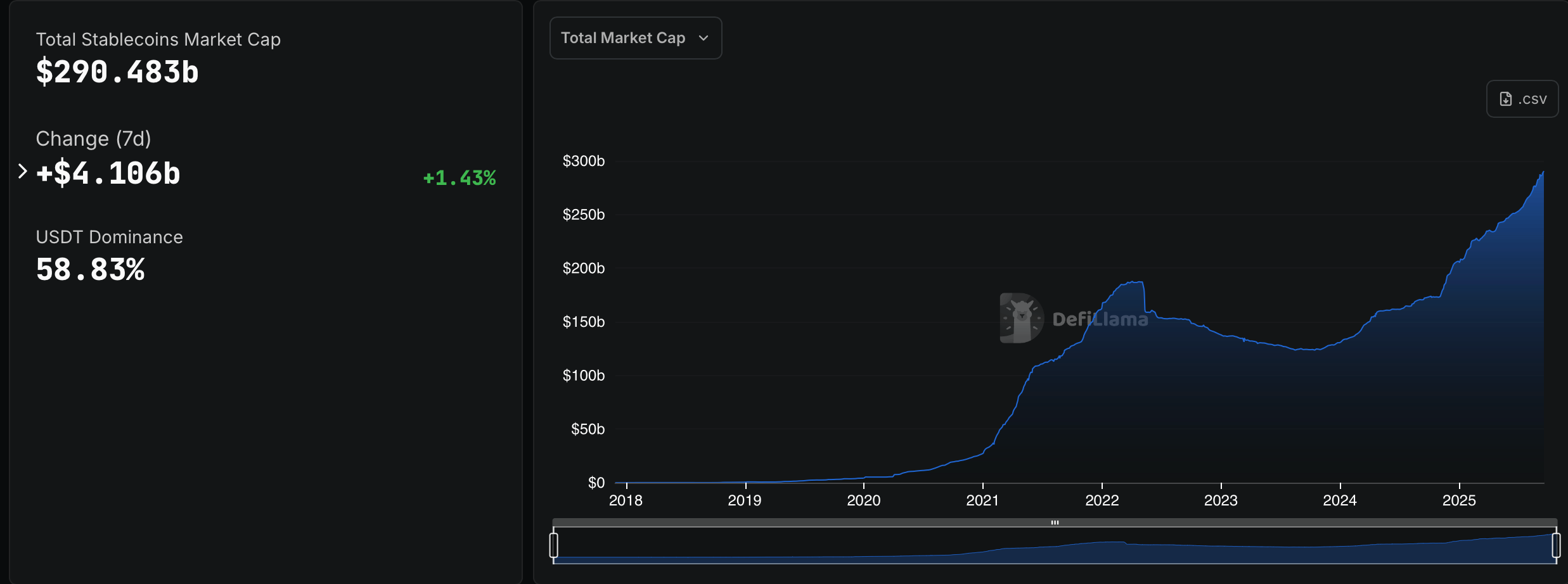

Stablecoin Sector Smashes Past the $290 Billion Milestone

On Wednesday, the stablecoin market cracked into uncharted territory, vaulting past the $290 billion mark for the first time ever after padding its coffers with more than $4 billion in fresh capital over the past week.

From USDT to RLUSD, Every Fiat-Pegged Token Joins the $290B Stablecoin Party

Stablecoins are stealing the spotlight, complete with highs and hiccups. Leading the cast is tether ( USDT), strutting in with a hefty $170.9 billion market cap and a 2.33% bump this month, based on data from defillama.com. With the stablecoin market sitting at $290.483 billion, tether reigns supreme, commanding 58.83% of the entire pie.

Circle‘s USDC isn’t shy either, clocking a 7.74% monthly gain and holding $73.1 billion in clout. The second-largest stablecoin by market cap bulked up this week, stacking an extra $879 million onto its supply in just seven days. Ethena’s USDe has been a rising star these days, leaping 20.46% to $13.6 billion. USDe’s stash swelled by roughly $2.31 billion over the past month, padding its coffers in style.

Meanwhile, Sky’s DAI notched an 8.65% lift over the month. At the same time, Sky’s sky dollar (USDS) pulled off a flashy 2.48% pop in a single day, though it’s still limping with a -6.24% slide for the month. World Liberty Finance’s token, USD1, is the stealth climber, posting a 20.54% monthly lift without much fanfare.

DAI’s market cap has climbed past $5 billion, USDS holds steady at $4.65 billion, and USD1 is clocking in at roughly $2.66 billion. Blackrock BUIDL got humbled, sinking nearly 10% this month, proving Wall Street gloss doesn’t guarantee blockchain glory. Right now, BUIDL is holding a market valuation of $2.146 billion.

Ethena’s USDTb is still flexing, boasting a 24.92% gain that pushed it to $1.817 billion. Not to be outdone, Falcon’s USDf pulled off a hefty 41.48% monthly climb, swinging well past its $1.75 billion weight class. Paypal’s PYUSD delivered a respectable 7.87% gain, while First Digital’s FDUSD tripped hard with a -13.02% faceplant.

Ripple’s RLUSD, now the 12th largest stablecoin, capped things off with a neat 9.46% lift, securing its spot in the lineup. Translation: Tether still wears the crown, Ethena and Falcon are the wild cards, Blackrock slipped a notch, and the rest are just hustling to keep their groove on the dance floor. $290 billion is nothing to sneeze at, and with just $10 billion to go, the $300 billion milestone is practically within arm’s reach.