Bitcoin is entering what analyst Rekt Capital calls the ‘banana zone,’ the parabolic phase of its market cycle. This is the stage where prices typically rise sharply, but with smaller pullbacks than earlier in the cycle.

How Are Bitcoin Cycles Structured?

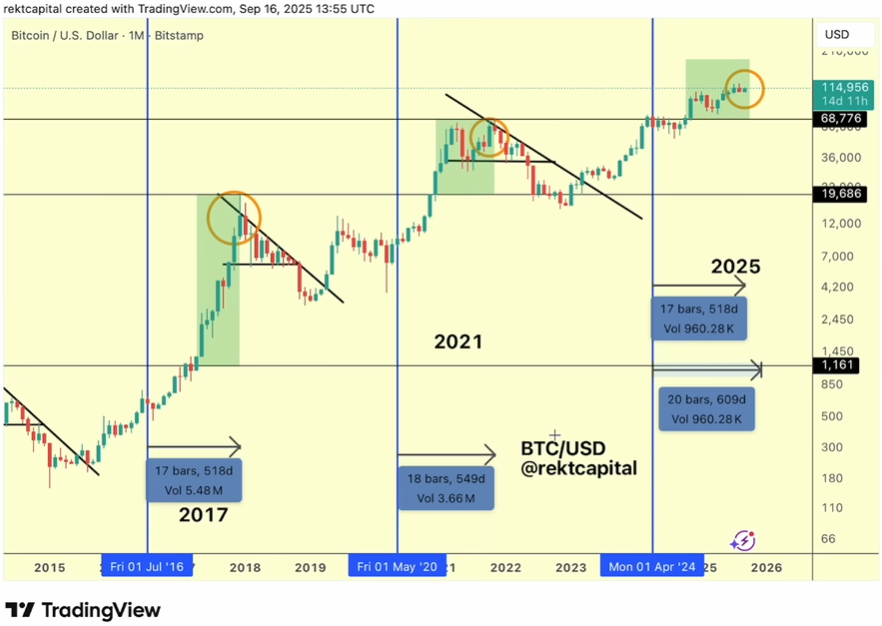

Every Bitcoin cycle has a few important phases. After a halving, the market usually sees three main price discovery uptrends, each followed by corrective pullbacks. In the current cycle:

- Pullbacks are becoming shallower: Early corrections dropped as much as 33%, then 31%, and the latest retracement is just 13%.

- Uptrends are smaller but steady: The first uptrend lasted about seven weeks. The second uptrend achieved roughly 20–25% of the first, showing diminishing returns.

- Price clustering occurs after breakouts: Unlike previous cycles where Bitcoin surged quickly after a breakout, this cycle shows periods of sideways consolidation before moving higher.

Related: Fed’s First Rate Cut of 2025 Lifts DeFi: Ondo, Hyperliquid, and Uniswap Stand Out

When Could Bitcoin Reach Its Peak?

These patterns show that Bitcoin’s next uptrend may still produce new all-time highs, but the move may not be as parabolic as past cycles. Looking at historical data:

- In 2017, Bitcoin peaked 518 days after the halving.

- In 2021, the peak occurred 550 days after the halving.

Source: RektCapital

Current observations show a slight extension, possibly adding 30–60 days to the cycle. This places the potential peak between mid-October and mid-November 2025.

How Is Price Reacting Now?

Bitcoin’s price has reacted positively after the recent rate decision, showing a clear attempt to move higher. The market experienced some initial volatility, but support levels around $113,500 to $114,900 have held firm.

What does this support zone indicate?

This zone has repeatedly prevented the price from dropping further, and current price action shows that the bullish structure remains intact.

What are the near-term targets?

In the short term, Bitcoin is testing higher levels while staying within a defined upward channel. If the price can push past $118,500 and then form a higher low, it could mean further gains toward the next target zone.

The immediate upside levels to watch are between $117,600 and $118,500.

Related: Bitcoin (BTC) Price Prediction For September 19

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.