The U.S. central bank cut its target for the federal funds rate by 25 basis points on Wednesday for the first time this year.

BTC Hits $117K Following Fed Interest Rate Decision

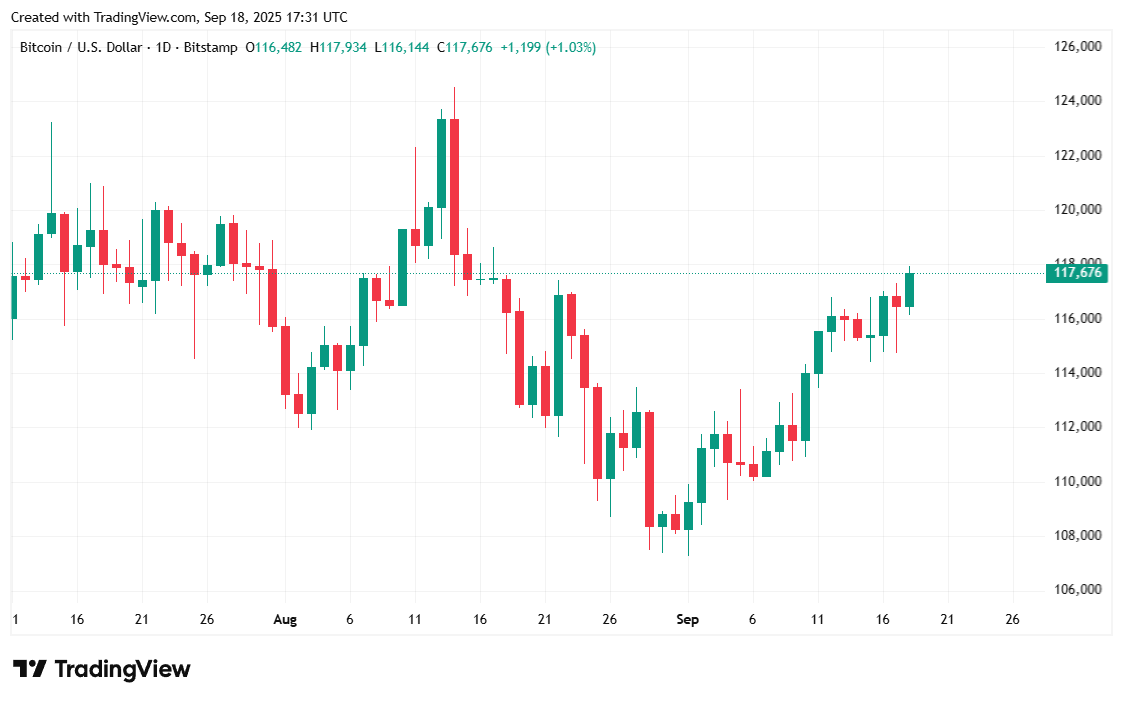

Many were left puzzled when bitcoin ( BTC) dipped to $115K almost immediately after the U.S. Federal Reserve finally cut interest rates by 25 basis points on Wednesday. But by Thursday morning, the cryptocurrency had climbed all the way back to $117K, much like stocks which also appeared to have a delayed reaction and are now on pace for another record close.

Perhaps there was an expectation of a 50-basis-point cut, although the CME Group’s Fedwatch Tool showed an unlikely 4% probability of such an outcome. It could also have been the market taking its time to digest the Fed’s more detailed analysis of the U.S. economy in its Summary of Economic Projections (SEP).

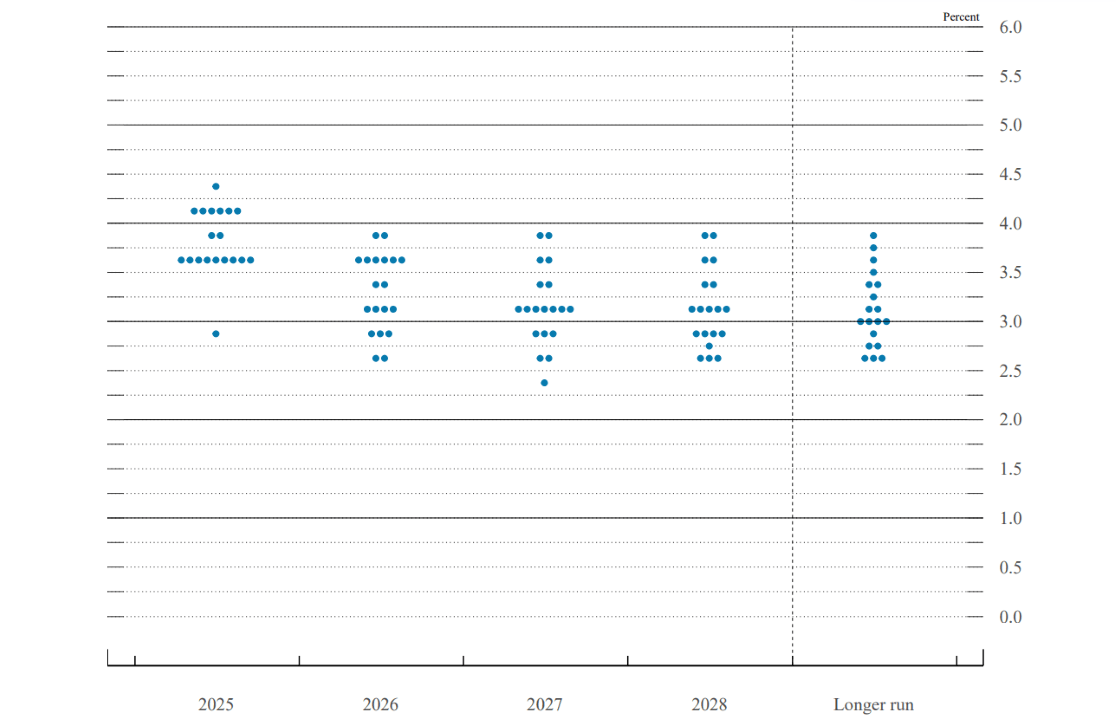

The so-called “dot plot,” a quarterly chart in the SEP with anonymized blue circles that represent individual interest rate projections by each member of the Federal Open Market Committee (FOMC) and all Federal Reserve Bank presidents, was also published yesterday and strongly suggests interest cuts all the way into 2027, at which point rates could bottom out at 3.1%. Maybe bitcoin investors took their time to mull over the dot plot’s dovish outlook before waking up slightly more bullish today.

Overview of Market Metrics

Bitcoin was trading at $117,740.20 at the time of writing, up 1.77% over 24 hours and 2.9% over seven days. Coinmarketcap data shows that the digital asset’s price has fluctuated between $114,794.97 and $117,860.80 since yesterday.

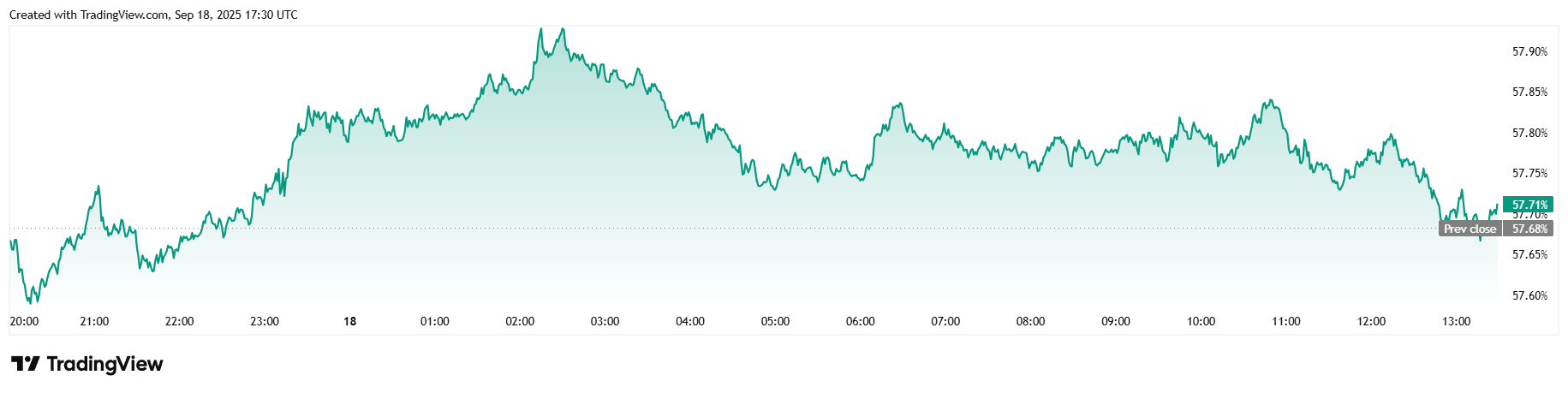

Twenty-four-hour trading volume climbed 32.73% to reach $64.81 billion at the time of reporting. Market capitalization grew 1.64% to $2.34 trillion and bitcoin dominance was mostly flat but edged up 0.02% over 24 hours and was sitting at 57.71%.

Total bitcoin futures open interest jumped 5.01% since yesterday and stood at $87.29 billion according to data from Coinglass. Bitcoin liquidations for the past 24 hours also surged to $105.42 million, mostly due to unsuspecting short sellers who were caught off guard and liquidated to the tune of $79.82 million. The remaining long liquidations were a significantly smaller but not trivial $25.60 million.