Crypto Inflows Near $2 Billion as Fed Rate Cut Sparks Renewed Demand

Crypto inflows climbed toward the $2 billion mark last week, with positive sentiment drawing from the Federal Reserve’s (Fed) decision to cut interest rates.

Amid strong crypto inflows, the total AuM hit a YTD high of $40.4 billion, putting the market on track to match or slightly exceed last year’s $48.6 billion positive flows.

Fed Rate Cut Pushed Crypto Inflows Past $1.9 Billion Last Week

BeInCrypto reported the Fed’s move to cut interest rates last week, with chair Jerome Powell framing the rate cut as a risk management decision

Against this backdrop, the Dollar weakened while equities and Bitcoin rallied on liquidity-driven optimism.

This translated to a notable surge in crypto inflows, reaching $1.913 billion last week.

“Digital asset investment products saw $1.9 billion of inflows last week, marking a positive response to the ‘hawkish cut’ by the FED last week,” James Butterfill wrote in the latest CoinShares report.

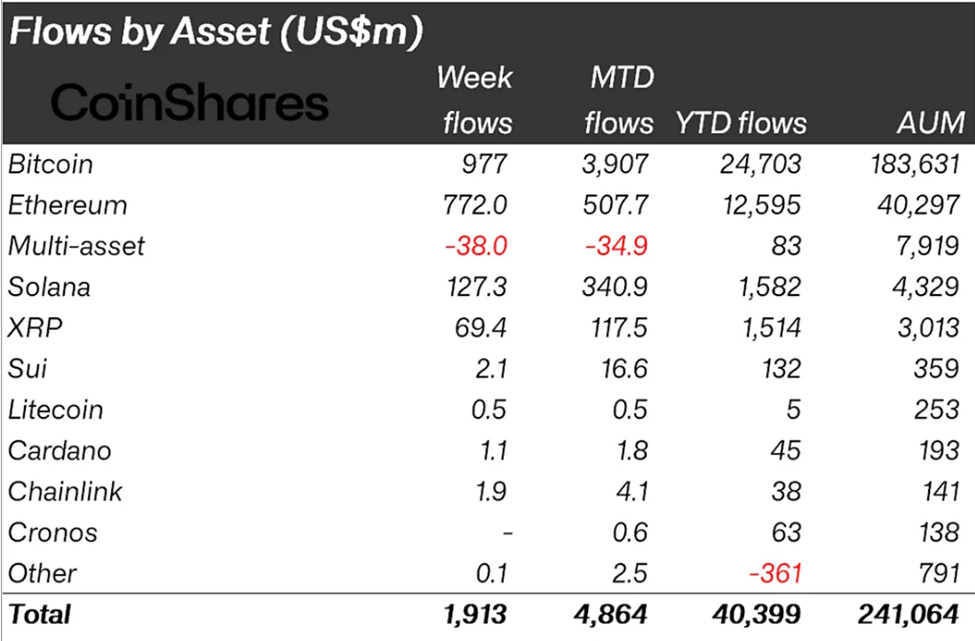

The data show that Bitcoin and Ethereum led with inflows of $977 million and $772 million, respectively. Meanwhile, Solana and XRP registered similar sentiment, attracting positive flows of $127.3 million and $69.4 million, respectively.

Meanwhile, this marked the second consecutive week of positive flows, after the $3.3 billion recorded in the week ending September 13.

However, comparing the two successive weeks shows that while investment into Bitcoin products reduced from $2.4 billion to $977 million, Ethereum registered a notable surge, moving from $645 million to $772 million last week.

With the surge in crypto inflows ascribed to the Fed’s interest rate cut decision, Butterfill acknowledged initial caution among investors.

“Although investors initially reacted cautiously to the so-called hawkish cut, inflows resumed later in the week, with $746 million entering on Thursday and Friday as markets began to digest the implications for digital assets,” Butterfill added.

On regional metrics, sentiment was broadly positive, save for Hong Kong, which recorded minor outflows. Meanwhile, the US, Switzerland, and Brazil all recorded notable crypto inflows.

If anything, last week’s positive flows suggest that US economic data continue to elevate Bitcoin and crypto as an alternative asset class.

They point to an abounding role of crypto and digital assets as portfolio diversifiers and hedges against economic uncertainty.

With multiple Fed officials, including Powell and Stephen Miran, set to speak this week, any indications of continued traditional finance (TradFi) market uncertainty could also bode well for crypto inflows this week.

The post Crypto Inflows Near $2 Billion as Fed Rate Cut Sparks Renewed Demand appeared first on BeInCrypto.