-$375,00,000 Bitcoin in 24 Hours: Institutional Whales Go Negative

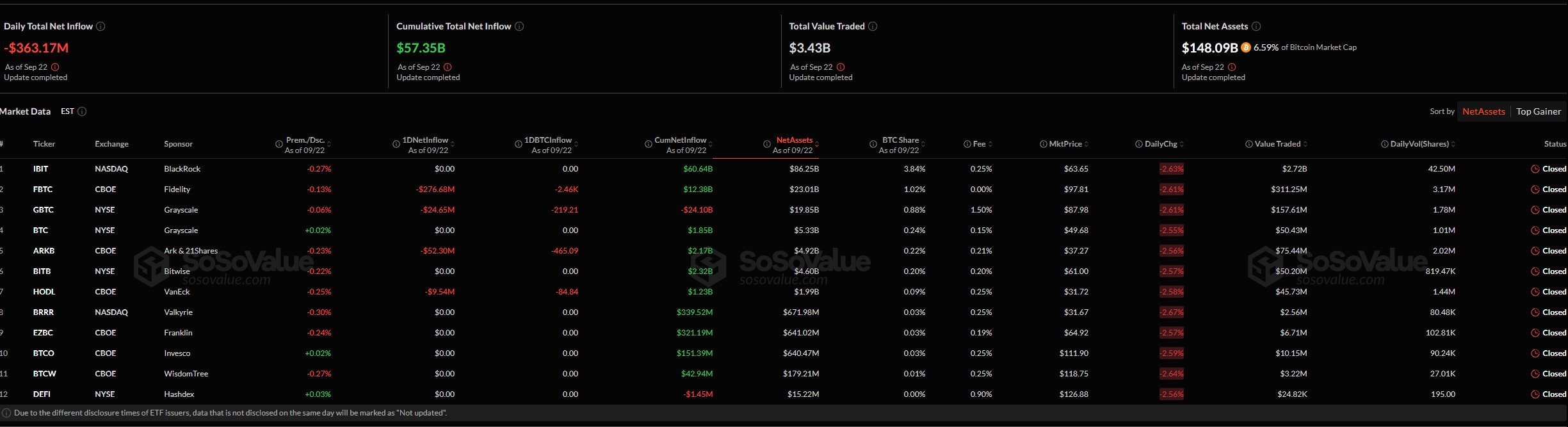

Bitcoin is still under pressure, and this time, institutional activity is the source of the pressure. Statistics indicate that on Sept. 22, 2025, Bitcoin spot ETFs saw one of the biggest daily drawdowns of the year, with an outflow of an astounding $363.17 million. The price of Bitcoin is currently hovering around $113,000, holding onto support but reflecting a lack of confidence among larger market participants.

Bitcoin ETFs bleeding

This sudden movement coincides with ETF breakdowns revealing that there were large redemptions at several major issuers. In one day, Fidelity’s FBTC lost $72.68 million, Grayscale’s GBTC saw a $24.65 million outflow, and Ark and 21Shares’ BITB saw $52.30 million depart. VanEck’s HODL ETF, on the other hand, suffered the biggest loss: $94.54 million were withdrawn. The 12 ETFs did not record net inflows, indicating a consistent shift in capital away from institutional exposure to Bitcoin.

The fact that cumulative net inflows for Bitcoin ETFs are still at $57.35 billion despite the significant outflow shows that, despite recent bearish sentiment, longer-term institutional commitment has not been lost. Short-term fluctuations, however, are major causes of price volatility, and since there are not any fresh inflows, Bitcoin is more susceptible to selling pressure.

Bitcoin’s price bleeding

This uncertainty is seen on the price charts. Although Bitcoin briefly hit $111,900, the 200-day EMA is still at $105,000, providing a buffer before the psychologically crucial $100,000 level is reached. Although the Relative Strength Index (RSI) indicates neutral momentum, if outflows continue and institutional selling is present, the market could break lower.

In the larger picture, institutional outflows point to a growing sense of caution in the face of market-wide liquidations and macroeconomic worries. If redemptions persist into the upcoming week, the bullish narrative that has been established throughout mid-2025 may be undermined, and Bitcoin may test deeper support levels.

Although Bitcoin is currently above $113,000, stability is shaky due to institutional waves opposing it. The possibility of a correction to $105,000 or less is very real unless inflows start up again.