Solana ETF Could Spark Major Institutional Inflows, Says Pantera Capital

Pantera Capital believes an approved solana spot ETF in the fourth quarter could trigger a surge in institutional demand. The firm argues institutions are currently under‑allocated to solana compared with bitcoin and ether.

Pantera Capital Forecasts Institutional Stampede for Solana

According to Pantera Capital, a blockchain-focused asset manager, a solana ( SOL) spot exchange-traded fund (ETF)—which it expects to be approved in the fourth quarter—could trigger an institutional stampede for the digital asset. Pantera believes this will inevitably lead to a rise in SOL’s price and market capitalization, which stood at just under $121 billion as of Sept. 22 at 5 a.m. EST.

In a post on X explaining why it expects SOL to have its “institutional moment” in the coming quarter, Pantera highlighted asset managers’ current allocation to SOL compared with Bitcoin ( BTC) and Ethereum ( ETH).

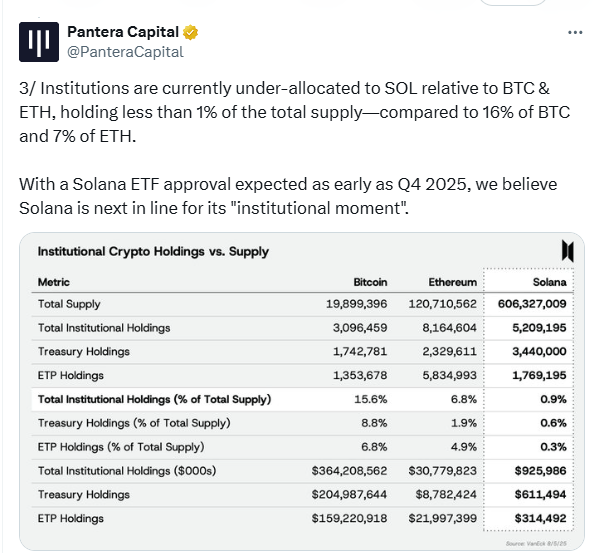

“Institutions are currently under-allocated to SOL relative to BTC & ETH, holding less than 1% of the total supply—compared to 16% of BTC and 7% of ETH,” Pantera stated in its Sept. 18 post.

This imbalance is also evident in the U.S. dollar value of institutional holdings. According to a table shared by Pantera, institutions currently hold $364.2 billion in BTC and $30.7 billion in ETH, reflecting a preference for the top two digital assets.

By contrast, institutional holdings of SOL—via treasuries and exchange-traded products (ETPs)—amount to less than $1 billion. Pantera argued that this level of allocation does not reflect SOL’s key usage metrics, which it claims surpass those of BTC and ETH. The firm added:

“We believe Solana’s adoption story is just beginning, offering greater asymmetric upside potential.”

To demonstrate its confidence in SOL, Pantera recently led a private investment in public equity (PIPE) offering for the purchase and sale of Helius Medical Technologies’ common stock. The Nasdaq-listed company plans to use the net proceeds to implement a digital asset treasury strategy and acquire SOL as its primary reserve asset.

At the time of the offering’s announcement, Pantera Capital founder and Managing Director Dan Morehead described Solana as “a category-defining blockchain and the foundation on which a new financial system will be built.” He also predicted that Helius would significantly expand both institutional and retail access to the Solana ecosystem, helping to accelerate its global adoption.

Following a period of surging institutional interest, SOL experienced a meteoric rise, with its price rocketing from approximately $144 around July 24 to a new peak of $251 on Sept. 18. However, the token has since retreated, declining in tandem with a broader market pullback. As of Sept. 22, SOL was trading just above $220, suggesting a temporary cooling-off period after its explosive run.