Raoul Pal Says This Is a 5-Year Market Cycle—Here’s The Exact Time Bitcoin Will Peak

Global Macro Investor CEO and founder Raoul Pal has explained why Bitcoin is not yet off to the races, as seen during this time in previous cycles.

In his podcast yesterday, Pal claimed that it is because this cycle is different. The market strategist claimed that Bitcoin is in a “business cycle,” which he believes is a 5-year period. This is in contrast to the conventional four years that market participants are accustomed to.

Why Bitcoin Will See an Extended Market Cycle Period

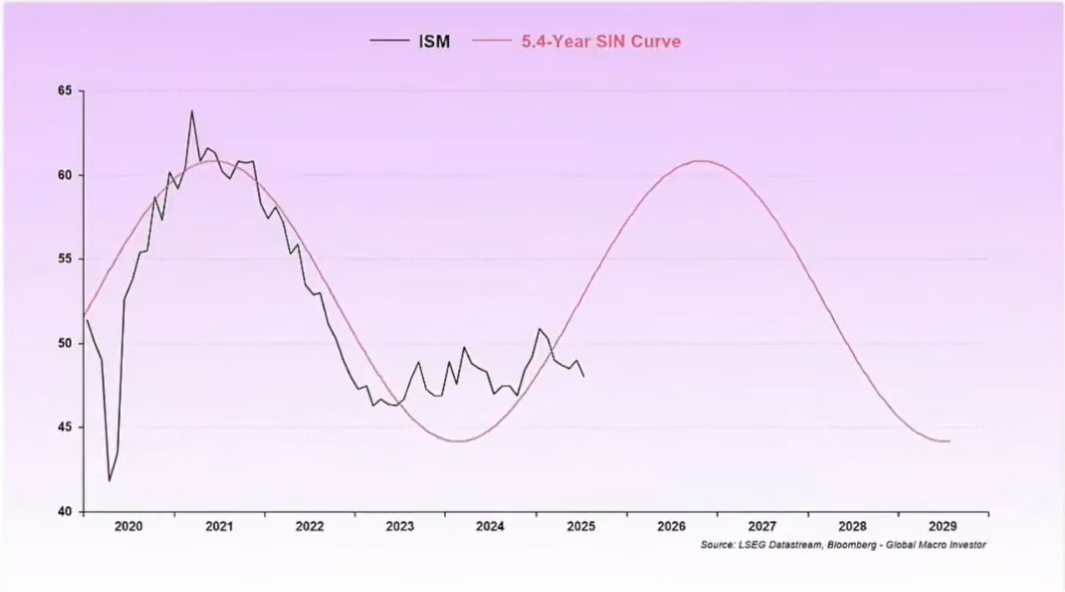

Specifically, Pal noted that Bitcoin has been following the ISM, with a shared chart highlighting the close correlation between the two. The Bitcoin implied ISM pricing has trended in line with the ISM, supporting his thesis.

Pal Reveals New Timeline for Bitcoin to Peak

With the new 5.4-year debt maturity period, an accompanying SIN curve chart shows that the ISM should now peak in 2026. Specifically, Pal projected the best possible timeline to be around the second quarter of next year.

Remarkably, Bitcoin is closely following the ISM, as the charts earlier highlighted. As a result, Pal also expects Bitcoin to peak alongside the metrics by Q2 2026.

Moreover, Pal predicted that liquidity should reach its peak before the ISM does. Notably, the US M2 supply reached a new all-time high of $22.2 trillion on Wednesday, and the global M2 supply has continued to lead Bitcoin. This means that they would peak at some point before Q2 2026, and Bitcoin will catch up, bearing its correlation.

Growing Sentiments That Bitcoin Cycle Will Extend Beyond 2025

Pal’s analysis contributes to the growing sentiment regarding the extinction of the four-year cycle. Historically, each cycle has ended a year after the Bitcoin halving, but many believe this theory is becoming obsolete.

CryptoQuant CEO Ki Young Ju first shared this sentiment in July, when he claimed that the four-year cycle no longer applies to Bitcoin. Supporting his belief is the increasing presence of institutions and nation-states in the market, which has altered existing dynamics.

Bitwise CIO Matt Hougan also shared this claim, insisting that the traditional four-year cycle is dead. He predicted a sustained market boom well into 2026, aligning with the outlook from Brandon Green and Michael Saylor.