Bitcoin Price Prediction: BTC Holds $111K As ETF Demand And Corporate Buying Absorb Supply

Bitcoin price today is trading near $111,900 after slipping from the $114,000 zone earlier this week. The rejection at the 20- and 50-EMA cluster near $113,200 has kept upside attempts capped, while immediate support remains at $111,000. Traders are now focused on whether this consolidation turns into a rebound or if deeper retracement risks emerge.

Bitcoin Price Struggles Below EMA Resistance

The 4-hour chart shows Bitcoin caught in a downward retracement from its mid-September peak near $118,000. Price is currently holding just above the 32.8% Fibonacci retracement at $111,800, which aligns with trendline support from the early September rally.

The 20, 50, and 200 EMAs are stacked near $113,186 to $114,156, creating a heavy resistance block. Until BTC reclaims this zone, momentum remains under pressure. The Parabolic SAR has also flipped bearish, keeping short-term bias tilted lower.

If buyers defend $111,000, a rebound toward $114,200 and $117,000 is possible. A breakdown beneath $111,000 would risk exposing $109,000 and the deeper $107,500 demand zone.

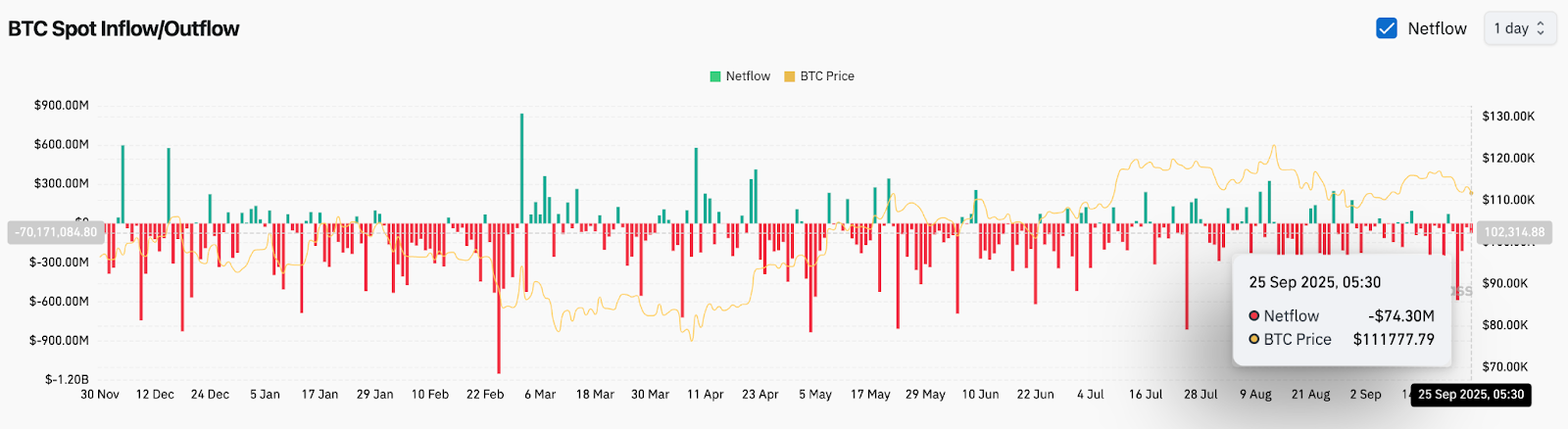

On-Chain Flows Show Net Outflows

Spot exchange flow data continues to highlight cautious positioning. On September 25, Bitcoin recorded a $74.3 million net outflow, reflecting investor preference for holding assets off exchanges. While this indicates reduced selling pressure, it also points to fragile spot demand as accumulation has yet to gain consistency.

Futures positioning remains modest, with open interest cooling after last week’s $2 billion liquidation event. The flush-out forced capitulation across leveraged long positions, leaving traders hesitant to commit fresh capital until technical clarity returns.

For now, on-chain signals suggest Bitcoin price action will remain range-bound until stronger inflows reappear.

Institutional And Corporate Demand Provide Tailwind

🇺🇸 MICHAEL SAYLOR SAYS HAL FINNEY WAS RIGHT, #BITCOIN IS GOING TO $10,000,000 PER COIN

IT’S COMING!!! 🚀 pic.twitter.com/1J6vPlTP19

— Vivek Sen (@Vivek4real_) September 25, 2025

Despite short-term weakness, the broader narrative continues to favor Bitcoin. Michael Saylor, executive chairman at Strategy, reiterated that corporate adoption and ETF buying are absorbing more Bitcoin than miners produce daily. Miners generate roughly 900 BTC per day, while companies and ETFs are acquiring over 3,000 combined, according to River.

This persistent buy-side imbalance is expected to create upward pressure once macro headwinds ease. Saylor emphasized that Bitcoin is being used both as a treasury reserve asset and as a form of digital capital to back credit instruments, strengthening balance sheets and expanding institutional use cases.

The presence of at least 145 companies holding Bitcoin on their books underscores this shift, providing long-term support even as short-term traders remain cautious.

Technical Outlook For Bitcoin Price

Bitcoin price prediction for September 26 points to a narrow range with downside risks if $111,000 fails to hold. Upside targets remain capped by EMA resistance until momentum buyers step in.

- Upside levels: $113,200, $114,200, and $117,000.

- Downside levels: $111,000, $109,000, and $107,500.

- Trend support: $106,000 as the final defense line.

Outlook: Will Bitcoin Go Up?

The immediate question is whether buyers can hold the $111,000 floor long enough to stage a recovery. On-chain outflows suggest reduced selling pressure, but inflows remain too weak to fuel sustained rallies.

Institutional accumulation and corporate adoption provide a powerful tailwind for year-end, aligning with Saylor’s view that Bitcoin will “move up smartly again” once macro headwinds subside.

In the short term, Bitcoin price today looks vulnerable below the EMA cluster, but the broader bullish structure holds as long as $109,000 remains intact. A decisive push above $114,200 would restore momentum toward $117,000 and reopen the path toward $120,000.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.