CleanSpark secures second BTC-backed credit line this week without share dilution

Bitcoin mining company CleanSpark secured its second $100 million credit line this week without issuing new shares, highlighting the growing role of digital assets as collateral in mainstream finance.

The latest facility, disclosed Thursday, was arranged with Two Prime, an institutional Bitcoin (BTC) yield platform, and is backed entirely by CleanSpark’s Bitcoin treasury. With this agreement, CleanSpark’s total collateralized lending capacity is now $400 million.

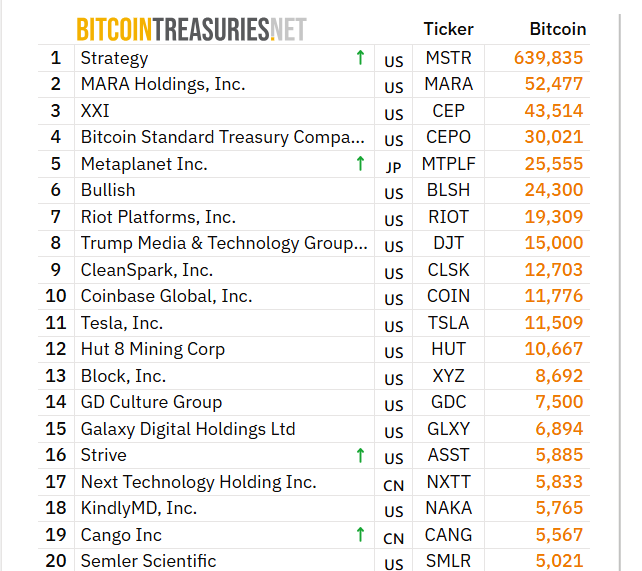

The non-dilutive nature of the financing is particularly notable. Public companies often raise growth capital through equity offerings, which can dilute existing shareholders’ stakes. By using its nearly 13,000 BTC holdings as collateral instead, CleanSpark gains access to liquidity while preserving shareholder value.

This deal follows another $100 million credit facility announced earlier in the week with Coinbase Prime, also secured against Bitcoin reserves. A company representative clarified to Cointelegraph that the Two Prime and Coinbase Prime facilities are separate arrangements, both contributing to the firm’s expanding financial flexibility.

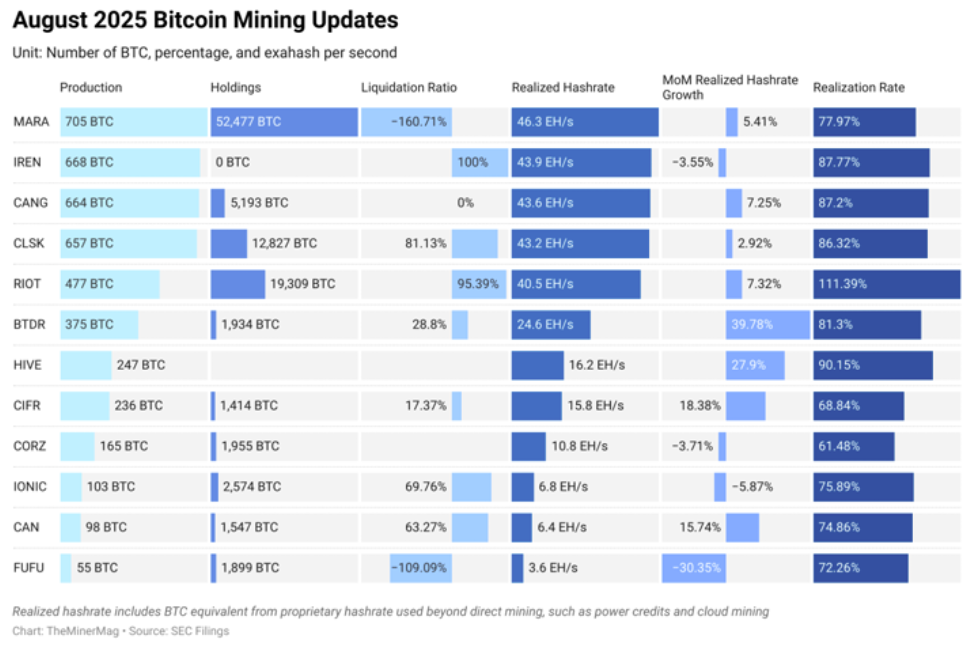

The funding provides CleanSpark with added flexibility to deploy capital quickly while avoiding excessive leverage. The company plans to use the credit to expand data centers, increase Bitcoin hashrate capacity and scale its high-performance computing infrastructure.

CleanSpark isn’t alone in tapping Bitcoin reserves for financing. Riot Platforms, which holds more than 19,300 BTC, secured a $100 million credit facility from Coinbase Prime earlier this year — the company’s first Bitcoin-backed loan.

Related: Twenty One Capital eyes Bitcoin-backed USD loans: Report

The growth of Bitcoin-backed financing

Bitcoin’s rising value and the wealth it has created for both companies and individuals have fueled demand for Bitcoin-backed loans — with some investors even using them to purchase real estate without selling their BTC, a strategy that also helps avoid triggering capital gains taxes.

For Bitcoin miners, this trend has changed treasury management. Instead of immediately selling their mined BTC to cover operating costs, more miners are holding Bitcoin on their balance sheets. As a result, collateralized lending has become an attractive option.

Such financing offers miners a non-dilutive way to raise capital while preserving exposure to Bitcoin’s potential upside. For miners with sizable BTC treasuries, borrowing against their holdings can sometimes be cheaper than traditional debt financing.

Magazine: 7 reasons why Bitcoin mining is a terrible business idea