Bitcoin loses 1,000 millionaires a day since start of the week

Bitcoin’s (BTC) latest slide has not only rattled traders but also reshaped its wealth distribution at a breathtaking pace.

Finbold research, drawing on data acquired from BitInfoCharts and verified via the Wayback Machine web archive tool, shows that between September 22 and September 26, the network shed 7,699 millionaire addresses, 1,116 wallets Bitcoin millionaires wiped out every day on average.

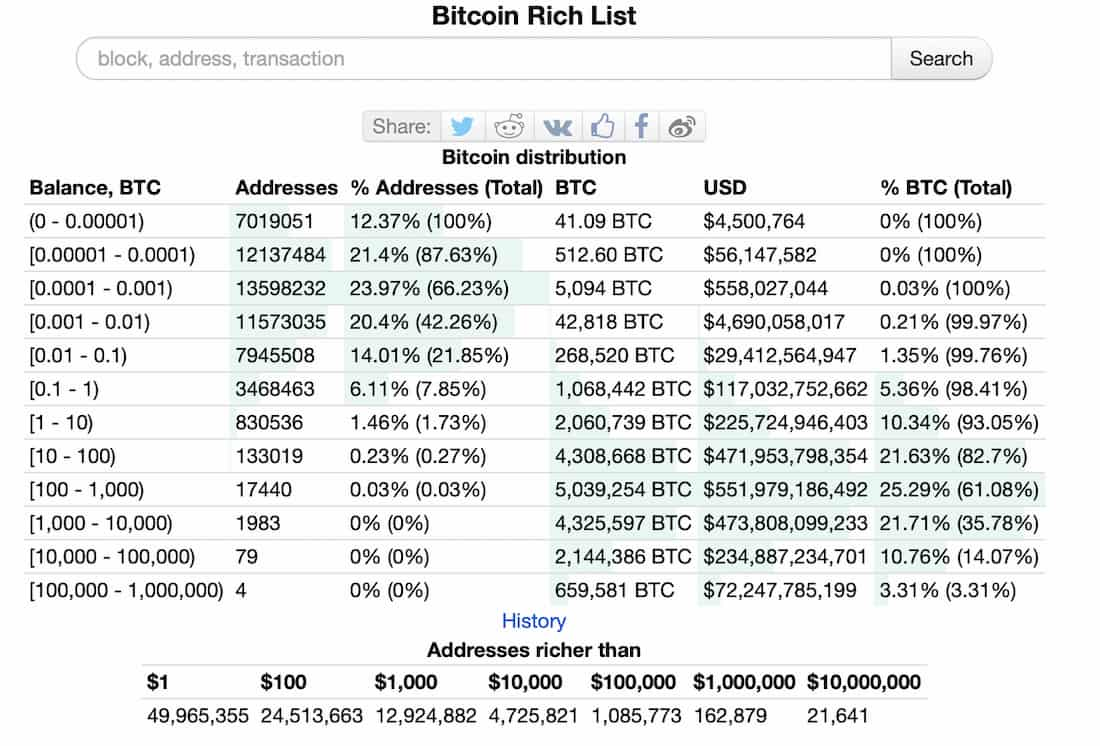

On September 22, the count of millionaire wallets stood at 167,278. Four days later, that number had collapsed to 162,879. Even at the higher tiers, erosion was visible: multi-millionaire wallets (worth over $10 million) fell from 21,952 to 21,887, suggesting that even whales were not fully insulated from the downturn.

Bitcoin price correction

The wipeout ties directly to Bitcoin’s sharp correction this week. After starting September 22 near $116,000, BTC has since slipped to just above $109,000, erasing roughly $150 billion from its market capitalization. Every leg lower brought a wave of addresses beneath the $1 million mark, underscoring how closely the millionaire count is tethered to price thresholds.

Interestingly, this latest drop also comes against a broader backdrop of altcoin underperformance and a $150 billion wipeout across the entire crypto market. Bitcoin’s dominance has firmed slightly as smaller assets bled more heavily, but that has done little to cushion the blow for high-value holders.

For context, millionaire Bitcoin wallets were around 170,578 in late July, meaning the September collapse is part of a longer downtrend. That context matters: Bitcoin millionaire counts are not simply a function of price; they are also shaped by distribution trends. Consolidation among whales, ETF inflows and outflows, and exchange custody shifts all play a role in whether addresses appear or disappear from the $1 million club.

Finally, while wallet-based counts are not a perfect proxy for individual holders, since a single investor may control multiple addresses, while exchanges often pool customer funds in shared wallets, they remain one of the clearest indicators of how wealth concentrations shift during Bitcoin’s volatile cycles. The contraction illustrates how quickly “on-paper” wealth evaporates when prices buckle.