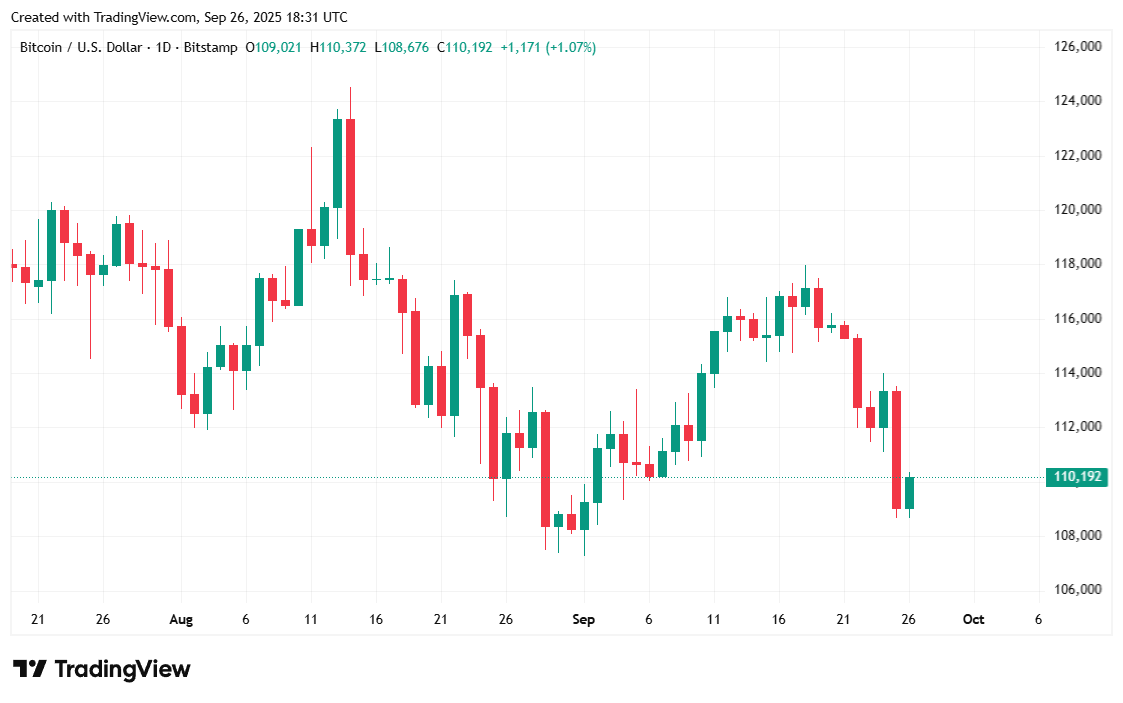

The cryptocurrency climbed to $110K after the U.S. Bureau of Economic Analysis published its personal consumption expenditures report on Friday.

BTC Inches Upward After Tepid Inflation Report

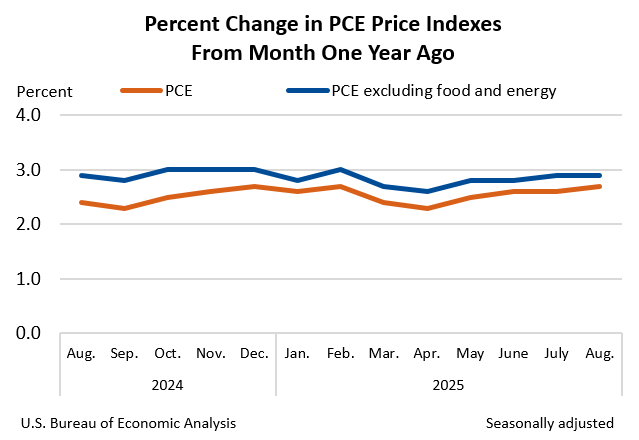

The Bureau of Economic Analysis released a relatively uneventful personal consumption expenditures (PCE) report on Friday, showing a 0.3% rise in prices for August, bringing the annual inflation rate to 2.7%, in line with economists’ predictions. July’s rate was 2.6% and bitcoin reacted little if at all to the news at first, but eventually cleared the $110K threshold later in the afternoon.

Core inflation, which removes the volatile categories of food and energy, showed a slightly smaller 0.2% increase in prices last month, and a corresponding annualized PCE rate of 2.9%. The U.S. Federal Reserve considers the PCE price index its “preferred measure of inflation.” The central bank’s mandate calls for maintaining price increases at around 2% annually, but troubling employment data in early September has resulted in an expectation of two more interest rate cuts before the year concludes, despite today’s report of sticky inflation.

Although bitcoin’s reaction to the PCE data was initially muted, the cryptocurrency eventually mimicked the trajectory of stocks, which rose on the news. The S&P 500, Nasdaq, and Dow, had all climbed 0.56%, 0.31%, and 0.81% respectively, at the time of writing.

“This isn’t really good news for the Fed,” said Former Cleveland Fed President Loretta Mester during a CNBC interview. “They have a very narrow lane to be in. They want to support the labor market, but they’re going to need to keep some restrictiveness in their policy stance in order to bring inflation down.”

Overview of Market Metrics

Bitcoin was trading at $110,205.45 at the time of writing, up very slightly by 0.57% over 24 hours but down 4.97% over seven days, according to Coinmarketcap. The cryptocurrency has fluctuated between $108,713.39 and $110,275.44 since yesterday.

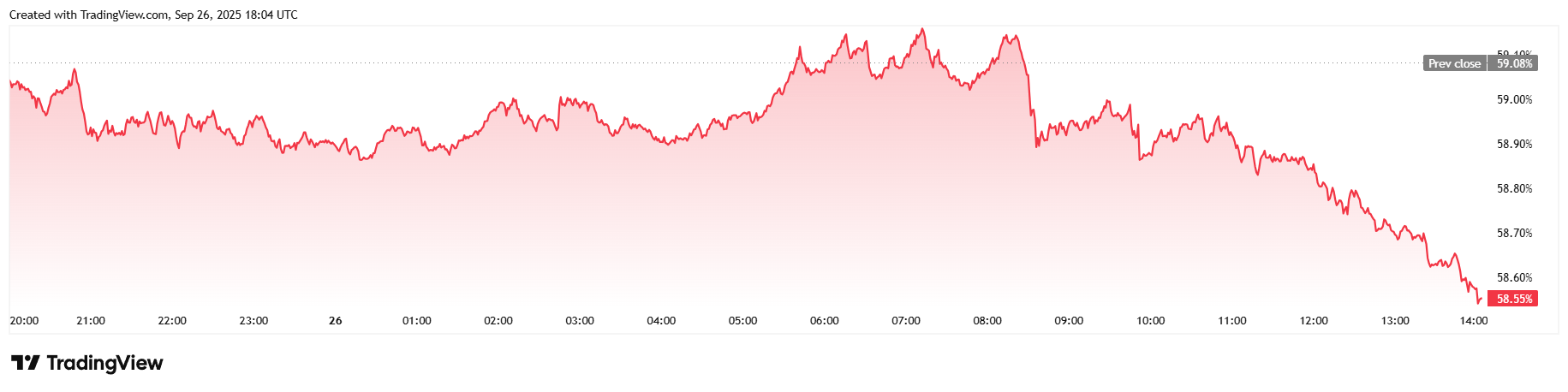

Twenty-four-hour trading volume fell 2.22% to reach $66.03 billion at the time of reporting. Market capitalization inched up 0.56% to $2.18 trillion, and bitcoin dominance edged lower by 0.90% over 24 hours, sitting at 58.55%.

Total bitcoin futures open interest climbed 1.45% since Thursday to $79.07 billion, according to data from Coinglass. Bitcoin liquidations for the past 24 hours totaled $32.53 million, with long liquidations comprising $20.77 million of that total and shorts making up the remaining $11.77 million.