From Wall Street to Web3: $770M in Capital Flows Into Tokenized Treasury Assets

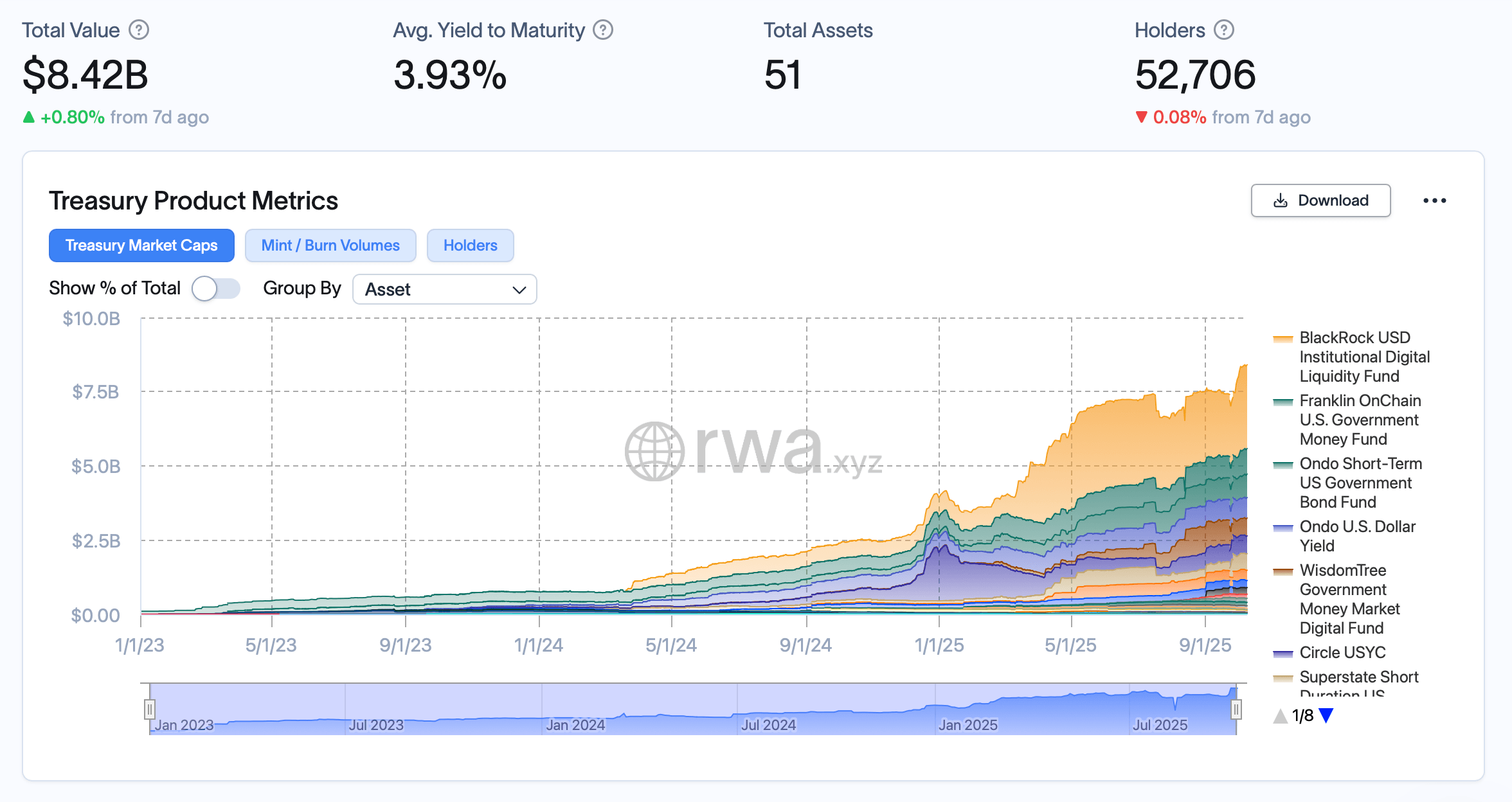

According to the latest market data from rwa.xyz, tokenized U.S. Treasury funds have attracted approximately $770 million in new inflows over the past 11 days — signaling growing investor confidence in digital real-world asset (RWA) products.

Investor Demand for Tokenized Treasury Funds Hits Record Levels in 2025

In 2025, tokenized treasuries have rapidly emerged as one of the most talked-about innovations in digital finance. These onchain instruments represent real-world U.S. Treasury securities issued and traded through blockchain networks, offering investors faster settlement, transparent ownership, and programmable yield access.

By bridging traditional finance (TradFi) with decentralized finance (DeFi), tokenized treasuries are redefining how investors access safe, yield-generating assets — transforming U.S. government bonds into digital, fractional, and globally tradable tokens. At present, the value locked in all the tokenized treasury funds stands at $8.42 billion.

Inside the $770M Tokenized Treasury Surge

Rwa.xyz stats show, among the top performers since our last update on Oct. 1, Blackrock’s USD Institutional Digital Liquidity Fund (ticker: BUIDL) recorded a $329 million surge during the same period, making it one of the largest single contributors to overall inflows.

This continued rise highlights the accelerating adoption of tokenized money-market and treasury products as institutional and digital asset investors seek stable, yield-generating onchain alternatives backed by U.S. government securities.

On Oct. 1, Ondo’s Short-Term U.S. Government Bond Fund (OUSG) ranked second behind Blackrock’s BUIDL fund. However, over the following eleven days, OUSG slipped to third place in total tokenized treasury total value locked (TVL), while still attracting a notable $62.4 million in new inflows.

Franklin Templeton’s onchain money market fund, BENJI, moved into the second position among tokenized treasury products, following a strong surge in TVL from $717.4 million to $861.05 million. In fourth place among tokenized treasury and yield products, Ondo’s U.S. Dollar Yield (USDY) maintained a flat range TVL of $689 million.

Rounding out the top five tokenized treasury products, Wisdomtree’s USD Institutional Digital Fund (WTGXX) grew its TVL from $557.2 million to $600 million over the past 11 days — an increase of $42.8 million. Among the remaining tokenized treasury products, Circle’s U.S. Treasury Fund (USYC) experienced a pullback, declining from $636.2 million to $597 million over the observed period.

As more investors seek stable, yield-bearing assets without the frictions of legacy intermediaries, tokenized U.S. Treasuries are proving to be more than a niche innovation. Market analysts anticipate the tokenized treasury market could soar into the trillions, marking a pivotal expansion phase for real-world assets (RWAs).

🔍 Quick FAQs: Tokenized U.S. Treasuries & RWA Market Growth

- What are tokenized U.S. Treasuries?They are digital representations of U.S. government bonds issued on blockchain networks, enabling faster, transparent, and programmable yield access.

- Why are investors moving into tokenized treasury funds?Investors are drawn to stable, yield-generating assets that combine traditional U.S. Treasury safety with onchain efficiency and liquidity.

- Which funds are leading the tokenized treasury market in 2025?Blackrock’s BUIDL, Franklin Templeton’s BENJI, and Ondo’s OUSG top the list for inflows and total value locked (TVL).

- 4. How large could the tokenized treasury sector become?Analysts expect the tokenized treasury market to scale into the trillions, signaling a massive growth phase for digital real-world assets (RWAs).