BIS warns about risks of stablecoin yield products 'exposing users' to losses

The Bank for International Settlements (BIS) warned about the risks of stablecoin yield products. The addition of yield blurs the line between payment tools and investments, the organization warned.

The Bank for International Settlements (BIS) issued warnings on the expansion of stablecoin yield products. The organization noted the current trend of stablecoin adoption, but warned about yield-based apps and products.

As Cryptopolitan reported, the BIS has been critical of stablecoins in the past, alongside a generally negative stance on crypto.

“These practices may blur the lines between payment instruments and investment products. They may compete with bank deposits but are often provided without equivalent prudential oversight, deposit insurance and transparency, exposing users to consumer protection gaps and losses,” warned BIS in a recent analysis.

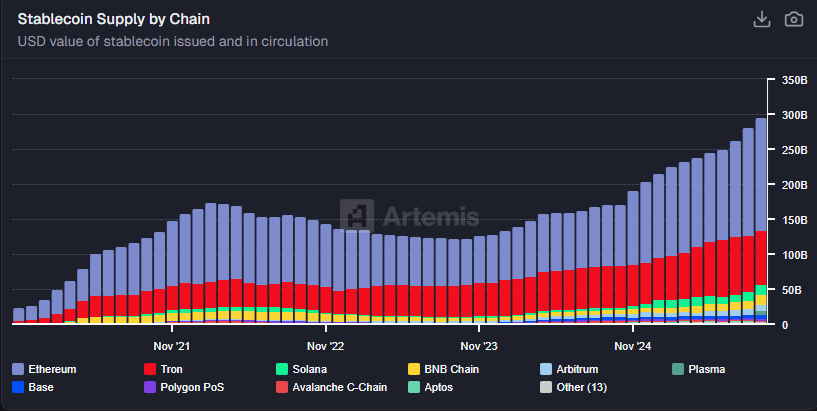

Stablecoins quickly expanded to a total supply of 305.9B tokens, split between general payment assets and specialized tokens linked to yield-based products. The stablecoins are held in 42.1M addresses, up 4% in the past month.

BIS warns against conflicts of interest for stablecoins and lending services

The BIS warned that the popularity of stablecoins can trigger conflicts of interest with traditional banks. Additionally, yield-bearing and lending apps can create conflicts of interest. The space is still unregulated when it comes to yield, despite the existing framework for stablecoin backing.

The BIS even called for additional regulations for decentralized crypto asset service providers (CASPs), which provide yields. For now, there are no specific restrictions against decentralized yield and lending protocols, and no protections for retail users.

One of the sources of conflict is the relatively higher savings rates for some stablecoins, which vastly exceed banking deposit rates for US customers. However, the BIS warned that those yield-bearing products were entirely unregulated and had no safety mechanisms for depositors.

“Yield-bearing products that mimic savings accounts can expose users to potential losses and adverse contractual outcomes, such as being treated as unsecured creditors, if the intermediary were to fail,” explained BIS in its recent report.

Some stablecoin protocols tap the yield from US T-Bills, either directly or through tokenized products like BUIDL. Unlike banks, the protocols are sharing more of their yields with users. There are exceptions like USDT, which mostly retains the interest on its T-Bills.

Aggressive yields depend on protocols, not stablecoins

Stablecoins are accepted by multiple protocols, and the final yield depends on those decentralized apps. Even regulated stablecoins like USDC have ended up in high-yield vaults or protocols.

Most of the liquidity is currently stored on Aave, Morpho, Maple Finance, and Sky Protocol. However, there is a long tail of smaller yield products, with APY above 100% or as high as 1,000%. Most traders still avoid those protocols for their unrealistic, unsustainable yields.

More commonly, yields on popular protocols range between 4% and 7%. Even those offers are more appealing compared to bank deposits.

Yield from stablecoins often has additional incentives, such as airdrop farming. For the past year, more users have chosen to farm new tokens, rather than trade riskier and more volatile crypto assets.