Bitcoin Price Back Above $115K: Here’s What’s Driving the Surge

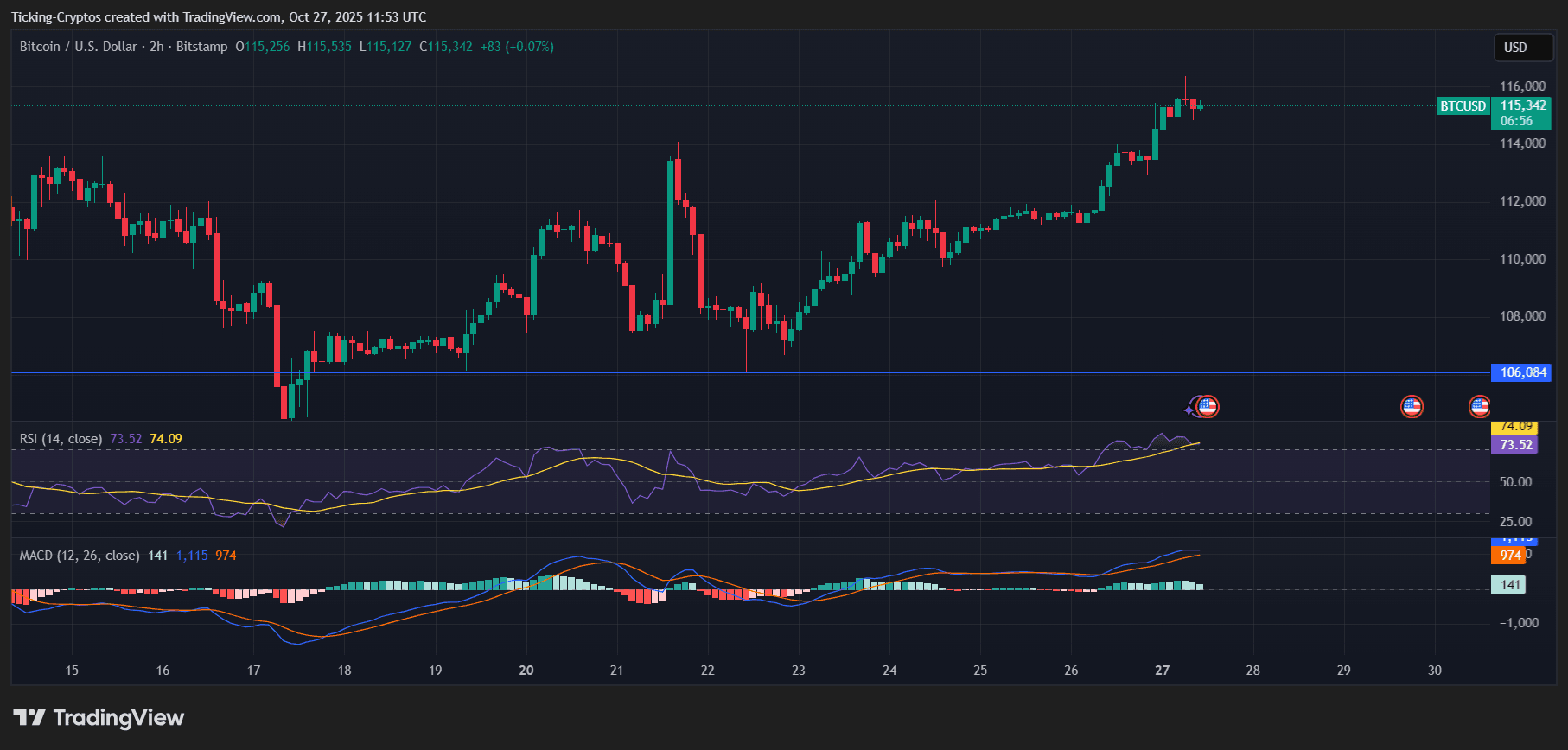

Bitcoin ($BTC) has reclaimed the $115,000 level, signaling renewed bullish momentum after weeks of choppy consolidation. On the 2-hour chart, BTC shows a clear breakout structure supported by strong momentum indicators.

BTC/USD 2-hour chart – TradingView

- RSI (Relative Strength Index) currently sits at 73.5, showing mild overbought conditions — a common signal in strong uptrends. The RSI remains above its moving average, confirming upward strength.

- MACD displays a positive crossover with widening histogram bars, suggesting the rally is gaining momentum.

The next resistance zone lies near $116,500, while support is at $113,000 and major support at $106,000 — the latter serving as a strong accumulation level during previous pullbacks.

If $Bitcoin holds above $115K through the week, the bullish structure could extend toward $118K–$120K, confirming the return of market confidence.

Mt. Gox Repayments Delayed — Less Selling Pressure Ahead

In a major relief for the crypto market, Mt. Gox has announced a delay in Bitcoin repayments until next year. This development significantly reduces the immediate selling pressure many feared would hit the market in late 2025.

The Mt. Gox wallet holds more than 140,000 BTC. With repayments postponed, billions of dollars’ worth of potential sell-side liquidity are now off the table, allowing Bitcoin to continue its rally unimpeded.

This is undeniably bullish for market sentiment, as it eases short-term supply concerns and supports continued upward momentum.

Trump Family-Backed Miner Buys $163 Million in Bitcoin

Adding to the bullish momentum, American Bitcoin, a mining company backed by the Trump family, has just purchased 1,414 BTC worth $163 million.

The move signals renewed institutional confidence in Bitcoin amid improving U.S. economic conditions and favorable policy direction from President Trump’s administration. Market observers suggest that this purchase reflects insider confidence — “they know something” — particularly as energy policy and crypto mining regulations in the U.S. turn more supportive.

Such large-scale strategic buys often precede major rallies, as they tighten supply and reinforce long-term holder conviction.

U.S.–China Deal Optimism Boosts Risk Assets

In another macro tailwind, President Trump confirmed ongoing progress toward a trade deal with China, stating that both nations “will come away with a deal.”

Markets reacted positively, with risk assets — including Bitcoin — benefiting from renewed optimism in global trade stability. Historically, easing trade tensions have led to stronger capital flows into alternative assets such as crypto and gold. This reinforces the narrative of Bitcoin as a geopolitical hedge and a preferred asset in uncertain macro environments.

Bitcoin Price Prediction — Bulls in Control for Now?

With favorable macro developments, delayed Mt. Gox repayments, and strategic institutional accumulation, Bitcoin’s technical and fundamental picture has aligned bullishly.

- Key Support: $113K and $106K

- Immediate Resistance: $116.5K and $120K

- Trend Bias: Bullish while above $113K

- Momentum Indicators: RSI and MACD both confirm strength

If Bitcoin maintains its position above $115K through the week, the next major breakout could push BTC toward $118K–$120K, potentially setting the stage for another all-time high retest before year-end.