Bitcoin finally escapes ‘fear’ as confidence tiptoes back into crypto

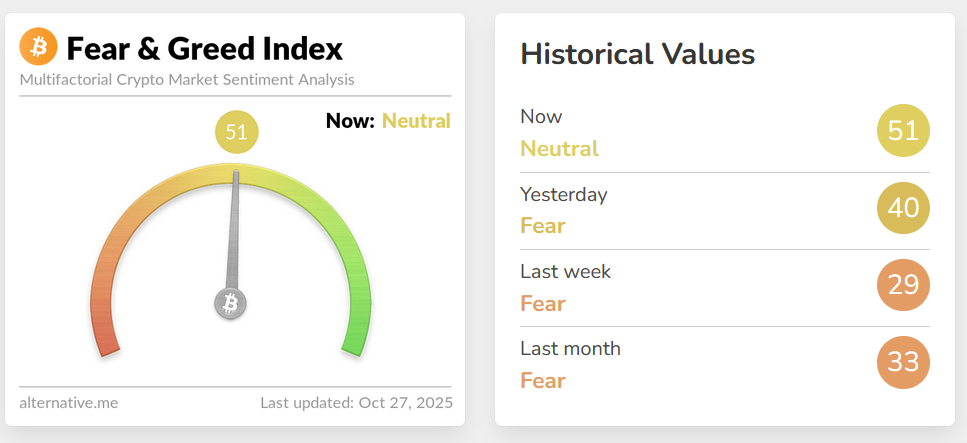

The Bitcoin Fear & Greed Index has finally clawed its way out of the “fear” zone on Sunday, resolving to neutral for the first time in more than two weeks as the price of Bitcoin surged back to around $115,000 over the weekend.

The Bitcoin Fear & Greed Index, which measures overall market sentiment, is currently sitting in the “neutral” zone with a score of 51 out of 100.

It’s up 11 points from the fearful score of 40 on Saturday, and also up over 20 points since last week, marking a sharp change in tune over the past few days.

Trump’s China tariff announcement on Oct. 10 had plunged the index from a “greed” score of 71 to a yearly low of 24 as $19 billion of crypto leveraged positions were liquidated.

“Aggressive” BTC selling is waning

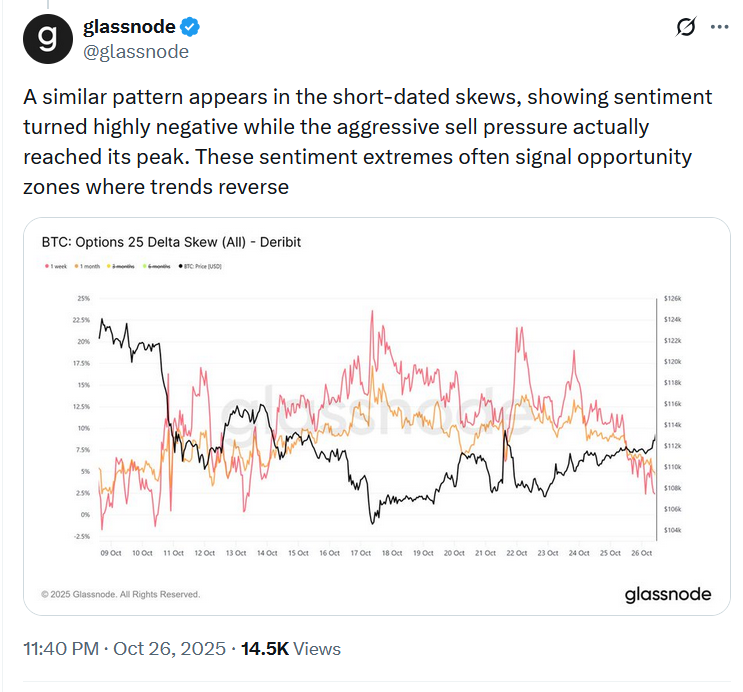

The shift in sentiment comes amid a recent decline in Bitcoin (BTC) selling pressure, according to Bitcoin analytics platform Glassnode.

In an X post on Sunday, Glassnode suggested a trend reversal is in the works, as selling pressure and negative sentiment appear to have already peaked to their extremes.

Related: Bitcoin is no inflation hedge but thrives when the dollar wobbles: NYDIG

“For the first time since the October 10th flush, spot and futures CVD [Cumulative Volume Delta]have flattened, indicating that aggressive selling pressure has subsided over the last several days,” the post reads, adding:

“Funding rates remain below the neutral level of 0.01%, indicating no excessive long positioning or froth. In fact, we can see that funding flipped very negative several times over the last 2 weeks showing that participants lean towards caution.”

Looking ahead at other potentially bullish indicators, the market is seemingly anticipating another interest rate cut by the US Federal Reserve at its Oct. 29 meeting.

At the time of writing, data from CME Group’s FedWatch tips a 96.7% chance that the Fed will cut rates by 0.25% this week.

Magazine: Bitcoin flashing ‘rare’ top signal, Hayes tips $1M BTC: Hodler’s Digest, Oct. 19 – 25