Gold Slips Under $4,000; Silver Near $46 as Safe Haven Bid Eases

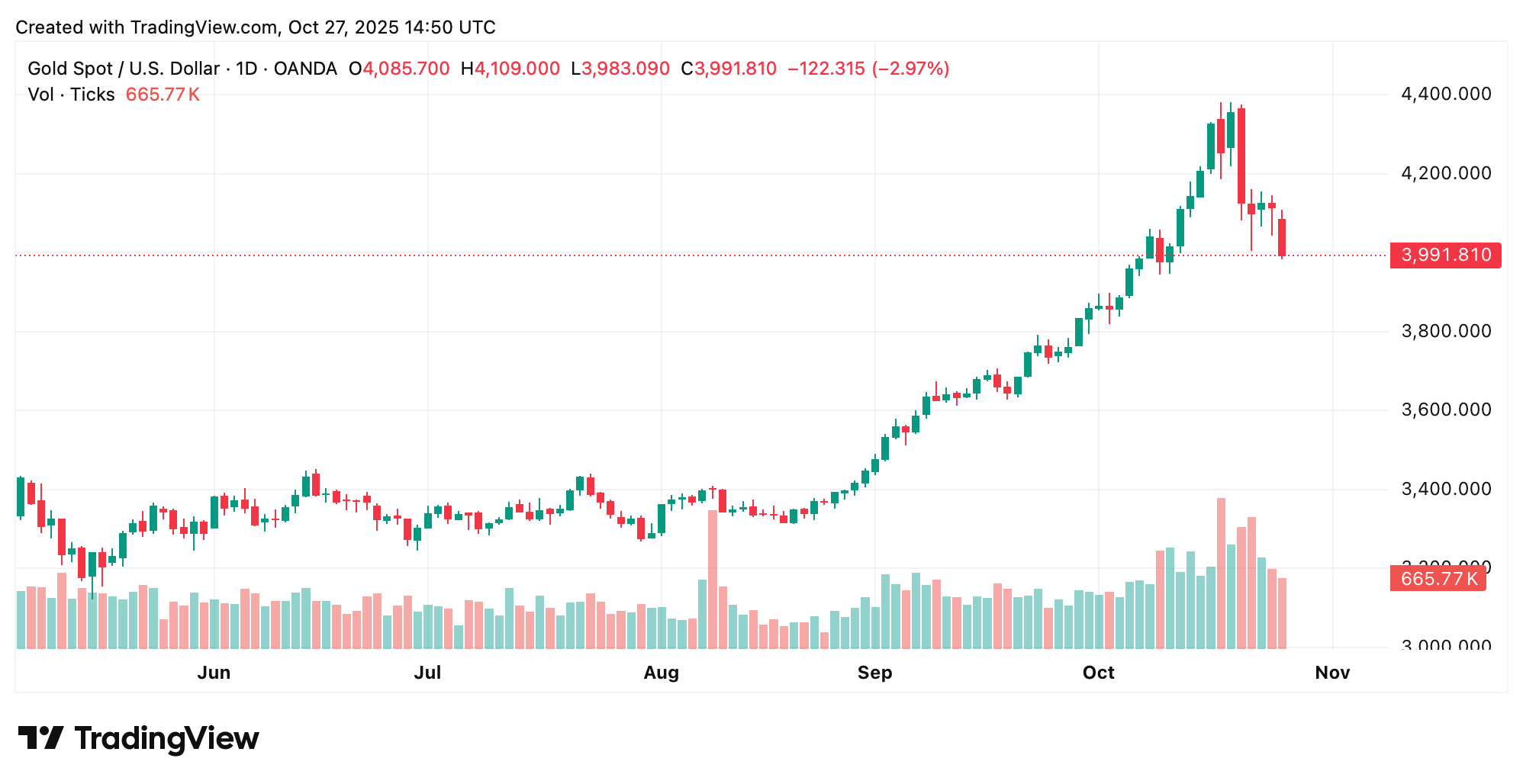

Spot gold tripped the $4,000 wire and landed at $3,991 per troy ounce, while silver parked at $46.47—two high-flyers finally catching their breath after brushing record altitudes.

Gold Dips to $3,991; Silver Steadies Around $46

Gold’s dip below the big round number came as U.S.-China trade chatter brightened and equities put on a sunnier face, shrinking the near-term appetite for safe havens. As Reuters noted Monday, the move reflected a market mood that’s a little less bunker, a little more brunch. At 11 a.m. Eastern time on Oct. 27, gold‘s price per troy ounce is $3,991.

Add in a sometimes-softer dollar and traders shuffling positions ahead of central-bank calls this week—plus bond desks tweaking duration with the Federal Reserve widely expected to cut—and you get a tidy headwind that cooled bullion’s recent vertical climb.

Silver, which was flexing earlier this month, has eased off the boil, too. Dealers point to some breathing room in London vaults—after sizable inflows from the United States and China—as one reason spot prices backed away from the peaks. On Oct. 20, Reuters had the benchmark near $52 after tapping $54.47 as borrowing strains loosened.

Zoom out and it’s still been a heater: gold cracked $4,000 for the first time and silver briefly cleared $50 on haven demand and policy-easing hopes. Even with today’s pullback, both contracts remain sharply higher on the year.

Looking ahead, forecasts stay constructive into 2026; a Reuters survey on Monday showed the first annual average north of $4,000 next year, with silver underpinned by ongoing deficits and solar demand.

Now the focus shifts to U.S. data, earnings, and policy decisions later this week—the tell for whether haven flows reignite or risk appetite keeps a lid on metals, at least for now.

FAQ 📉

- What are today’s spot levels? Gold is at $3,994 per ounce and silver at $46.47 per ounce.

- Why did gold fall under $4,000? Improved risk appetite tied to trade optimism reduced haven demand.

- What’s weighing on silver now? A recent easing of London tightness after fresh inflows tempered prices from records.

- What do forecasts say? A Reuters poll projects gold averaging above $4,000 in 2026, with silver supported by industrial demand.