Bitcoin Options Open Interest Hits Lifetime High as Traders Load up on Calls

Bitcoin’s derivatives traders are having a field day — even as spot prices cool near $113,500, roughly 10% shy of the $126,000 record.

Futures Frenzy: CME Still the Kingpin

Futures and options markets are flashing signs of heavy positioning and cautious optimism. Bitcoin futures open interest (OI) now sits around $73.8 billion, according to coinglass.com stats, showing traders are anything but disengaged despite the mild pullback in spot.

The CME retains its title as the heavyweight in futures OI, commanding $16.79 billion or 22.7% of the total. Binance trails with $12.69 billion, followed by OKX at $3.84 billion, Bybit at $7.59 billion, and Gate with $7.67 billion. The rest of the leaderboard — Kucoin, Bitget, WhiteBIT, BingX, and MEXC — round out a tightly contested second tier.

Over the past 24 hours, most major exchanges saw modest OI contractions between 1.6% and 10%, suggesting a wave of profit-taking. But BingX and MEXC defied the trend with jumps of 28.5% and 5.25%, proving there’s still plenty of speculative juice left in the market.

Across all exchanges, bitcoin futures OI has risen steadily since June, mirroring last year’s bullish setups. The metric’s steady climb alongside price reflects a market thick with conviction — and leverage. Traders are clearly leaning into the volatility as they await clarity from both macro catalysts and Fed policy moves.

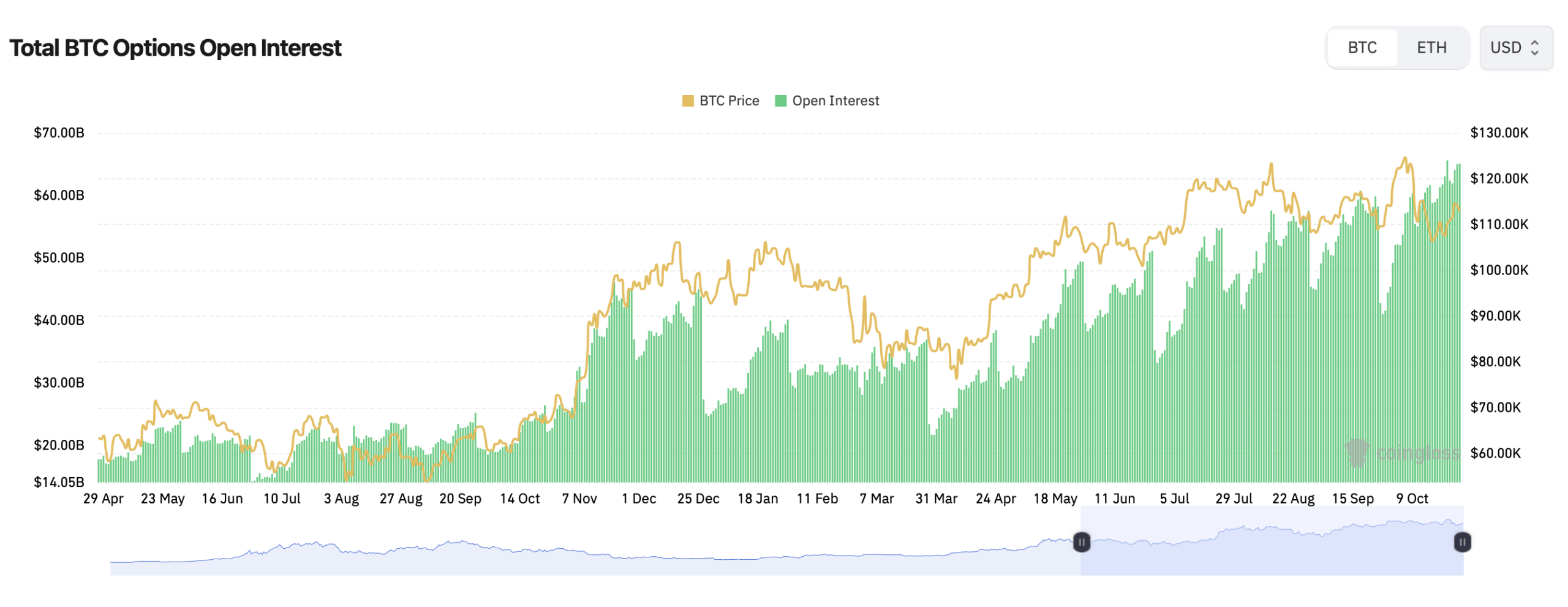

Options Open Interest Blasts to Lifetime High

Bitcoin’s options market is now more alive than ever, clocking in at an all-time high at $65 billion in notional OI. Deribit, which dominates over 90% of this market, shows a healthy tilt toward calls (60.2%) over puts (39.8%), meaning most traders are betting prices will rise rather than fall.

In simpler terms, a call is a bullish contract that profits if bitcoin climbs, while a put is a bearish one that gains if prices drop. The ratio suggests a bullish lean, but not without caution — traders still hold roughly 200,000 BTC worth of puts, a hefty hedge in case the rally fizzles.

The biggest bets in the bitcoin options market are stacked far into the future, with contracts that don’t expire until December 2025. Traders are eyeing price targets as high as $140,000, $150,000, and even $200,000 per coin — clear signs that some market heavyweights are thinking long term.

The single most popular bet right now is the $140,000 call option on Deribit, which alone accounts for more than 12,000 BTC in open interest. In plain English: big players are positioning for the next major rally, not just the next week’s bounce.

On the other hand, shorter-term activity shows strong volume around $114,000 to $118,000 calls, hinting that traders are positioning for a possible rebound before the month closes.

Bitcoin’s max pain — the price where option buyers lose the most and sellers (usually the institutions) benefit — hovers around $114,000. That’s just about where spot prices are coasting, implying a battle of wills between bulls defending the $113K range and option writers smiling all the way to expiry.

Bitcoin may be off its highs, but its derivatives ecosystem is hotter than ever. Futures positions remain near record territory, and options traders are loading up on long-term calls like they’re collectibles. Whether bitcoin’s next move is up or down, one thing’s certain — Wall Street and crypto natives alike are neck-deep in the derivatives arena.

FAQ 🧠

- What is bitcoin’s total futures open interest right now? Bitcoin futures OI is roughly $73.8 billion across all exchanges, led by CME and Binance.

- Why are options OI levels important?They show how much capital is tied up in bitcoin’s options market — a key gauge of speculative activity and sentiment.

- What does “max pain” mean in bitcoin options?It’s the price level where most options traders lose money at expiry, and market makers tend to profit.

- Are traders more bullish or bearish right now?Overall sentiment leans bullish, with about 60% of open options being calls betting on higher prices.