Two Crucial Bitcoin (BTC) Levels: $100 Million Concentration

The stakes are extremely high, and Bitcoin is once again balancing on a tightrope. Bitcoin is once more teasing this crucial price level after breaking above the long-standing resistance of $120,000. The current retest represents bulls’ third – and potentially last – opportunity to regain control before sentiment turns south after two previous unsuccessful attempts to maintain a foothold above it.

Following a sharp breakout from a descending triangle pattern, Bitcoin has been consolidating on the price chart around the $118,000-$120,000 range. In recent weeks, there has been a noticeable shift in momentum toward bullishness, driven by high volume and a sustained upward trend in higher lows.

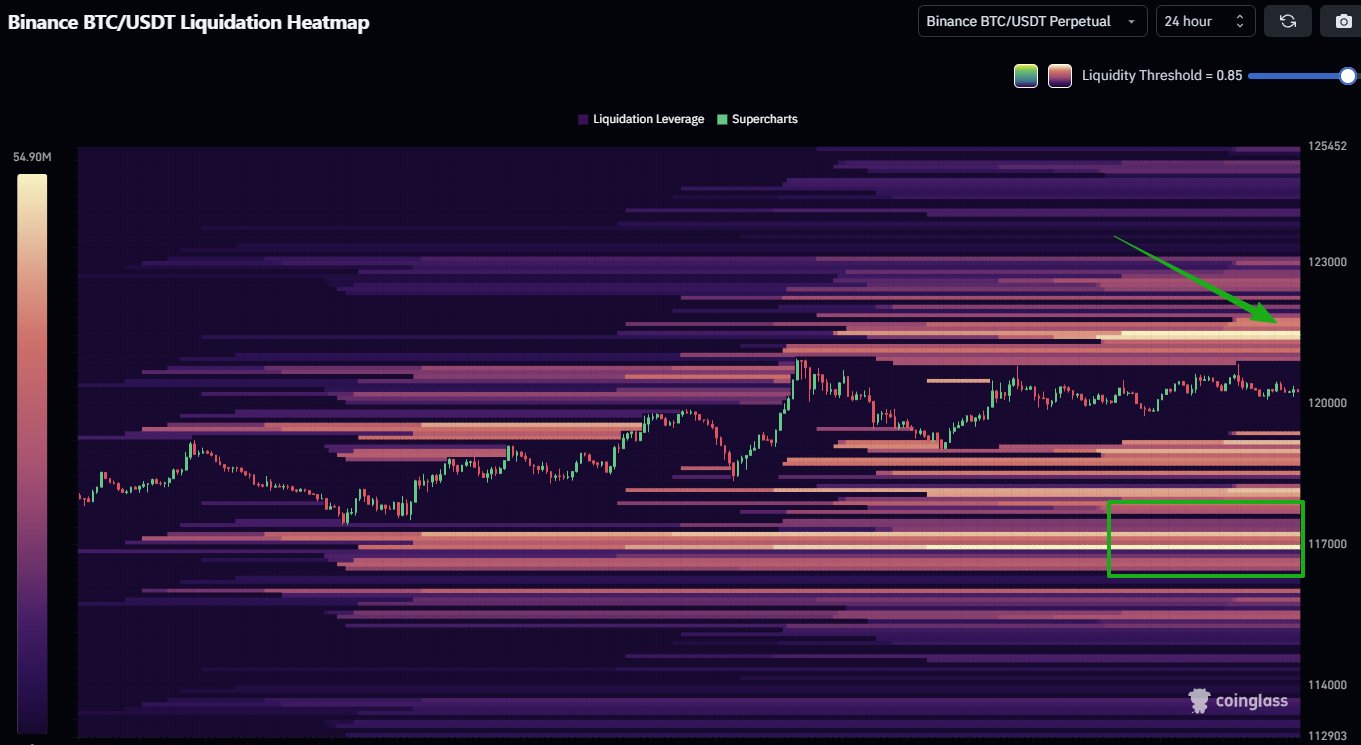

Price by itself, though, does not fully capture the situation. The most recent CoinGlass liquidation heatmap shows that two key zones – 11,700 and just over $122,000 – are stacked with more than $100 million in open interest. If Bitcoin falls below that support, the high-risk concentration of long positions in the dense liquidation layer around $117,000 will be activated.

This could trigger a cascade of liquidations, increasing downward pressure and possibly pushing Bitcoin back to the $110,000-$108,000 zone. The $122,000-$123,000 cluster, on the other hand, offers bulls a liquidity magnet. The market structure would completely change if the price were to successfully break through that resistance zone using volume and confirmation candles.

This would be the first meaningful foothold above $120,000. Traders might then start focusing on the $130,000-$135,000 range as the next important zone. For the time being, Bitcoin is still rangebound in a zone that is volatile and heavily liquid.

A confirmed breakout above $122,000 could lead to a new leg higher, but bulls must keep control above $117,000 to prevent a wipeout. It is a make-or-break moment. The heatmap alerts us to the areas of pain so either Bitcoin eventually reaches the $120,000 mark as support or it is brutally rejected once more.