BlackRock, Securitize Reduce BUIDL’s Market Cap on Ethereum by 60%

BlackRock and its tokenization partner Securitize have redistributed a large chunk of the asset manager’s tokenized fund BUIDL across several blockchains, quietly reducing its market cap on Ethereum by about 60%.

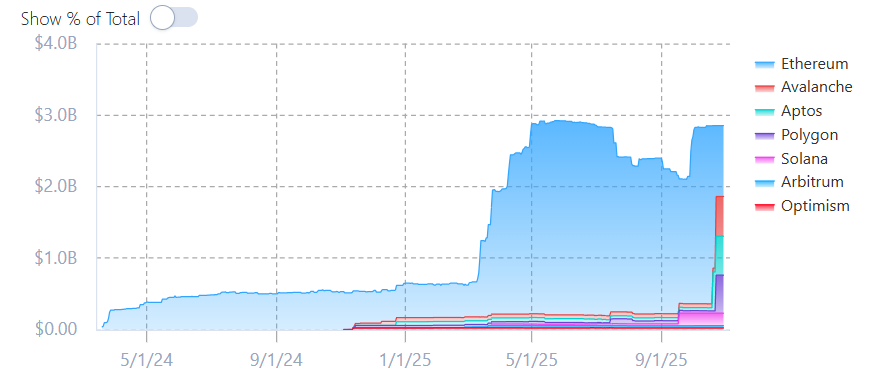

Data from RWAxyz shows that the $2.8 billion fund’s holdings on Avalanche, Aptos, and Polygon jumped to around $554.7 million, $544.1 million, and $530.9 million as of Oct. 30, up from just $54.3 million, $43.4 million, and $30.7 million respectively as of Oct. 19. Over the same time period, the $2.4 billion of the fund held on the Ethereum network dropped to about $990 million.

BUIDL was originally launched only on Ethereum in March 2024, before beginning its expansion to other blockchains just under a year ago, with the vast majority of the fund remaining on Ethereum until this month. Both BlackRock and Securitize did not immediately respond to The Defiant’s request for comment on the move by press time.

BlackRock is the world’s largest asset manager with over $13.4 trillion in assets under management as of Q3. BUIDL remains the largest tokenized real-world asset (RWA) product, holding over $2.85 billion in assets.

BUIDL’s network diversification comes as the total value of tokenized RWAs continues to surge this year, currently at more than $35.6 billion, up about 8.8% over the past 30 days, according to RWAxyz.

Ethereum remains the most popular blockchain for RWAs, with nearly $12 billion in tokenized RWA value, or about 53% of the sector.

Launched by BlackRock in partnership with Securitize, BUIDL lets qualified investors hold and earn dividends on blockchain‑based tokens backed by U.S. Treasuries, cash, and repurchase agreements.

Earlier this week, Securitize announced plans to become a publicly listed company via a business combination with Cantor Equity Partners II, Inc., a SPAC backed by Cantor Fitzgerald, a firm formerly led by Howard Lutnick before he became U.S. Secretary of Commerce.

The deal values the company at about $1.25 billion, and the combined entity is expected to trade on Nasdaq under the ticker SECZ.