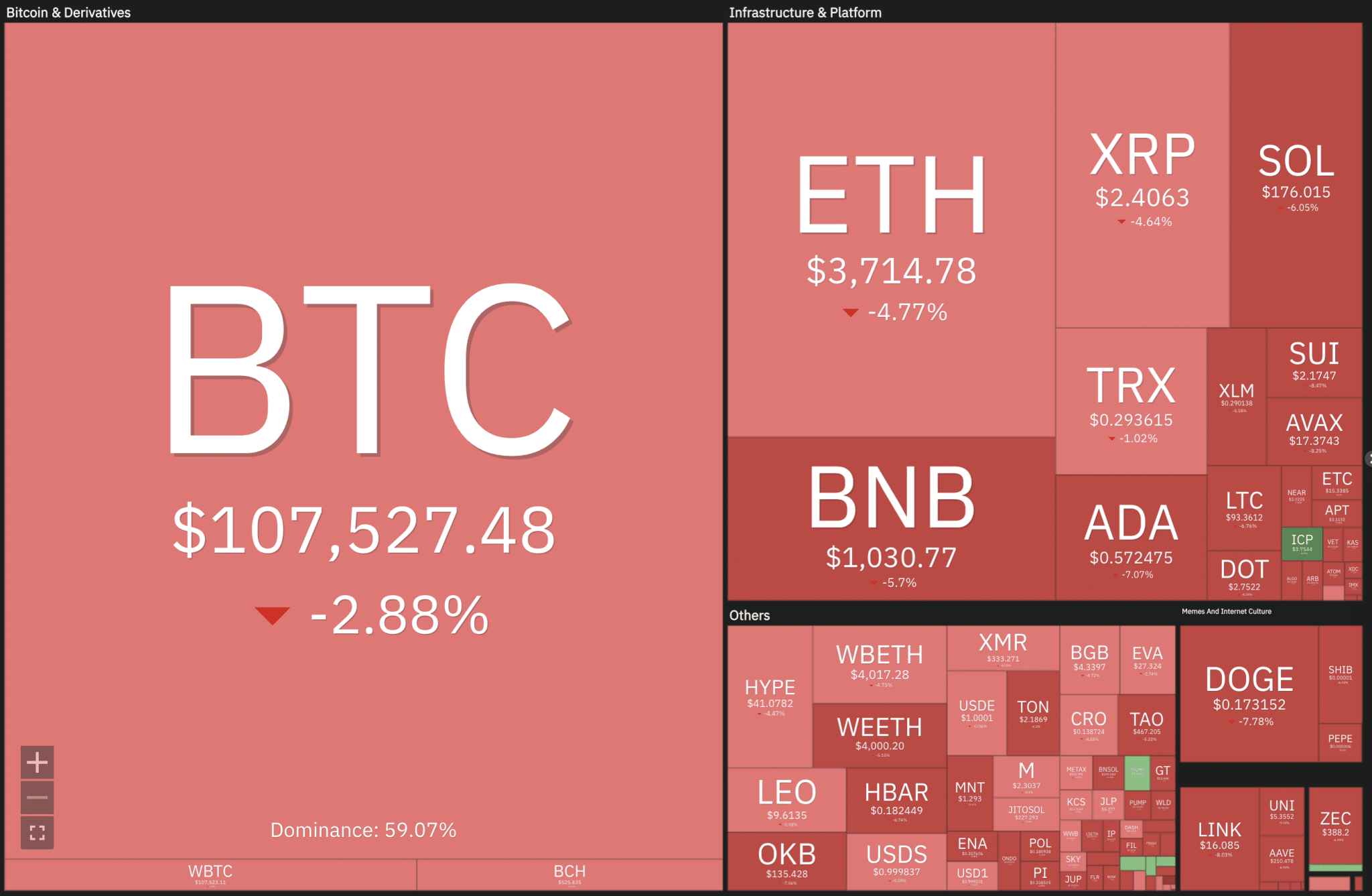

Bitcoin Price Dips Below $108,000 as $463 Million in Liquidations Sweep the Market

Bitcoin fell sharply below $108,000 on Monday, triggering one of the largest liquidation waves seen in weeks.

The move extended the weakness seen at the end of October, and reignited fears of short-term volatility in the broader crypto sector.

According to CoinMarketCap, Bitcoin was last changing hands near $107,482, down 2.85% over the past 24 hours. The move wiped out leveraged positions across exchanges, resulting in over $463 million in liquidations, according to Coinglass data.

Fed Uncertainty and Stronger Dollar Weigh on Crypto Market

Analysts attributed a mix of macroeconomic pressures to Bitcoin’s latest drop. A firmer U.S. dollar and reduced confidence in a faster Federal Reserve rate-cut cycle have weakened risk appetite across financial markets.

Last week, the Fed reduced its benchmark lending rate by 0.25 percentage points. This adjustment brought the rate to a range of 3.75%–4%, the lowest level in three years. However, Fed Chair Jerome Powell warned that an additional cut in December is “not guaranteed,” signaling a more cautious stance on monetary easing.

The rate decision came as the U.S. government shutdown reached its one-month mark, delaying key labor and inflation data. Economists described the Fed as “flying blind,” navigating policy decisions without updated figures on the job market.

Altcoins Follow Bitcoin’s Lead

Bitcoin’s slide rippled through the broader crypto market. Ethereum fell nearly 5% to $3,710, while XRP declined around 4% to $2.45. The total cryptocurrency market capitalization slipped by 3.64% to $3.59 trillion.

Market observers described the current weakness as a continuation of October’s soft close, not an isolated correction.

MicroStrategy Hints at Potential New Bitcoin Purchase

Despite the bearish tone, institutional activity remains a key talking point. MicroStrategy founder Michael Saylor once again sparked speculation about fresh Bitcoin accumulation by posting “November’s color is orange” on X (formerly Twitter).

MicroStrategy holds 640,808 BTC valued at around $70.7 billion as of November 2, 2025. The firm’s average purchase price stands at $74,032 per coin, resulting in an unrealized profit of approximately 49%, or $23.25 billion.

Based on historical trends, analysts anticipate a new purchase announcement will arrive soon.