Bitcoin Sees Long-Term Holders Sell As Short-Term Buyers Step In – Sign Of Rally Exhaustion?

As Bitcoin (BTC) continues to set new all-time highs (ATH) – reaching $123,218 on Binance on July 13 – on-chain data reveals a shift in holder behavior that could threaten the cryptocurrency’s bullish momentum.

Bitcoin Holder Rotation May Derail Rally

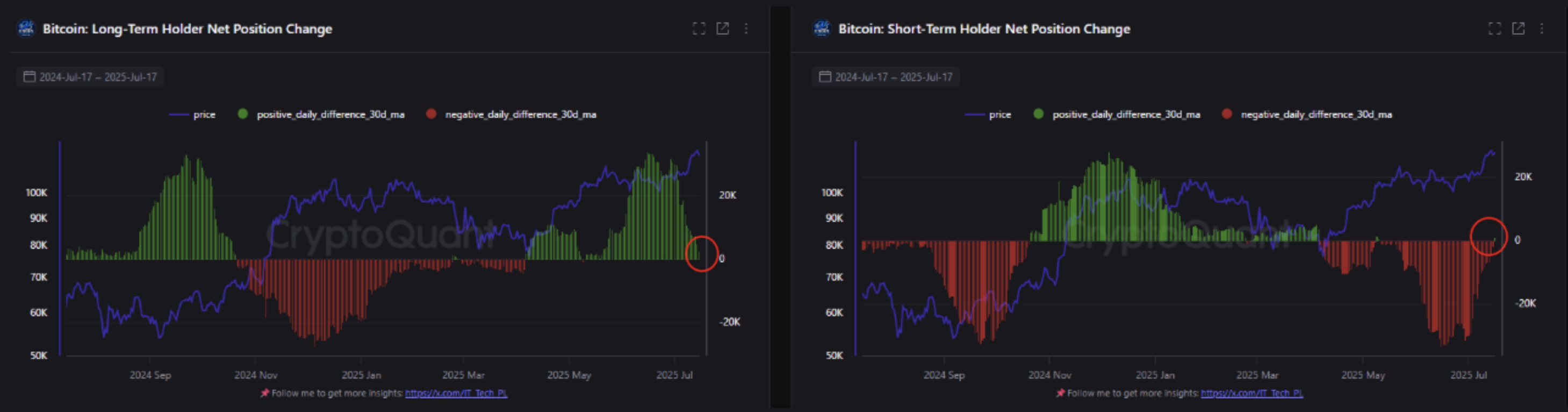

According to a CryptoQuant Quicktake post by contributor IT Tech, long-term Bitcoin holders (LTH) – those holding BTC for over 155 days – have transitioned into net distribution, suggesting seasoned investors are engaging in profit-taking.

Meanwhile, short-term holders (STH) – those who have held BTC for less than 155 days — have recently turned net positive, indicating they are buying into BTC’s current rally in anticipation of further gains.

Historical data shows that similar trends among LTH and STH were observed back in April 2021 and November 2023. During both these instances, BTC witnessed a cooling phase or a local top when spot demand faded.

In their analysis, IT Tech suggested keeping an eye on exchange inflows and funding rates for confirmation. If spot BTC inflows to crypto exchanges surge, it could hint that sell-pressure is likely to increase, which may derail the digital asset’s bullish trajectory.

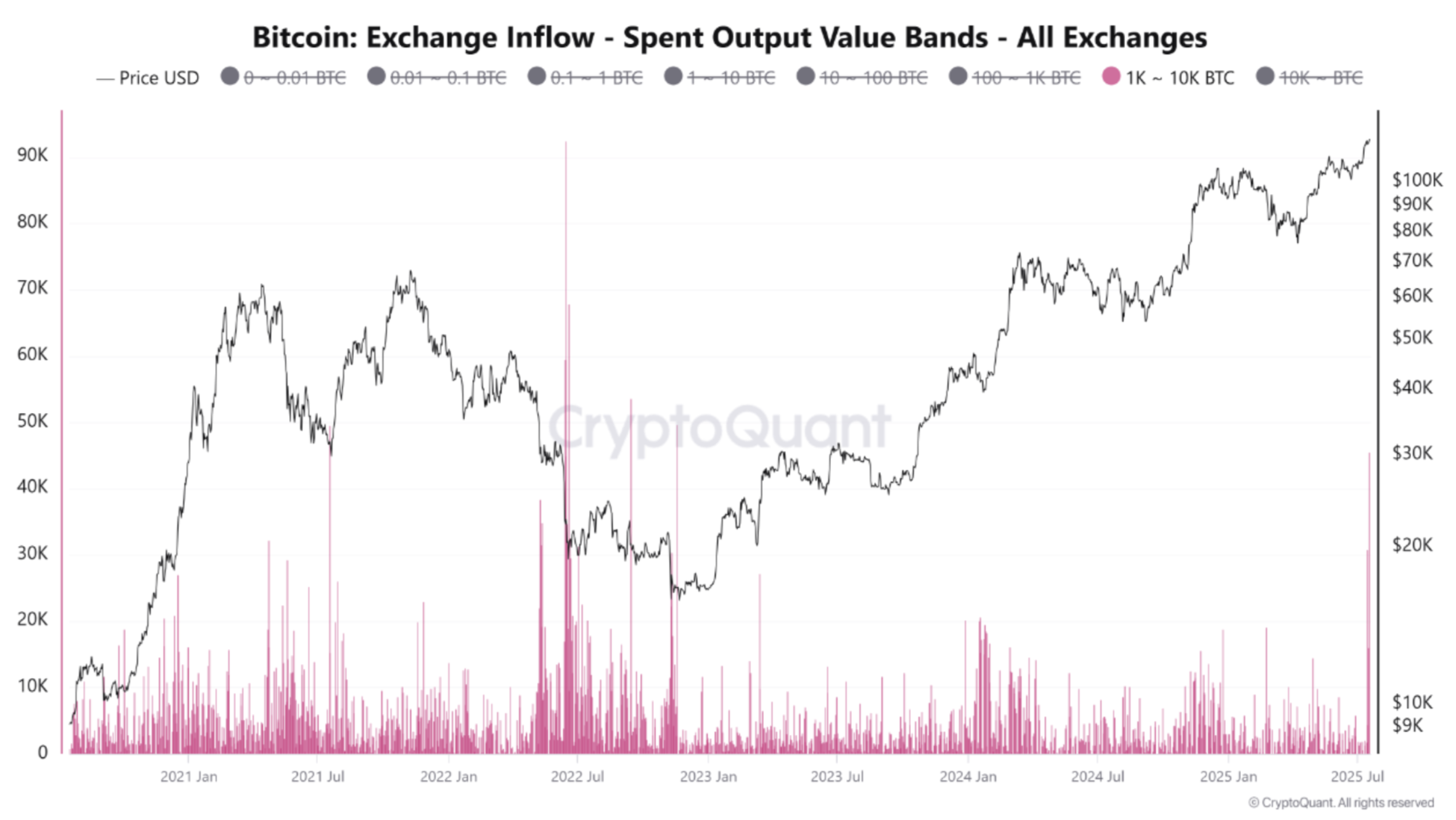

Supporting this view, CryptoQuant contributor Arab Chain noted that the Spent Output Value Ranges (SOVR) indicator shows a spike in BTC transfers to exchanges from wallets holding 1,000 to 10,000 BTC – typically associated with whales.

For the uninitiated, the SOVR indicator tracks on-chain BTC transfers by value buckets to identify which investor segments are active. It helps reveal whether retail, mid-sized, or institutional players are driving market activity.

This aligns with IT Tech’s observations on long-term holders. If selling pressure intensifies, BTC could correct down to a support level near $111,800.

Not All Analysts See Rally Exhaustion

Although Bitcoin LTH entering distribution phase, and whales increasing their deposits to crypto exchanges may point toward a potential end for the current rally, not all analysts share the same sentiment.

For instance, the STH Market Value to Realized Value (MVRV) suggests BTC may still be undervalued, indicating potential for further upside. If that holds, Bitcoin could climb as high as $150,000 before any major pullback.

Additionally, a fresh injection of $2 billion in liquidity to major crypto derivatives platforms could help reignite bullish momentum. However, caution remains warranted.

The Bitcoin NVT Golden Cross has been climbing steadily, giving early signs of an overheated market. At press time, BTC trades at $118,754, up 0.4% in the past 24 hours.