Solana treasury Forward Industries authorizes $1B share repurchase

Forward Industries, a digital asset–focused company that has built a significant position in Solana as part of its ongoing shift, has authorized a $1 billion share repurchase program — a move aimed at returning value to shareholders as it advances its transition into a digital asset treasury model.

The share repurchase program, authorized on Monday, allows Forward Industries to buy back its stock on an ongoing basis through open-market purchases, block trades or privately negotiated transactions, the company announced.

Forward said the authorization provides flexibility amid market volatility, though share repurchases are typically aimed at returning value to shareholders by reducing the number of shares outstanding and minimizing dilution.

“The authorization gives us flexibility to return capital to shareholders when we believe our stock trades below intrinsic value, all while continuing to execute our Solana treasury and operational initiatives,” the company said.

Forward Industries is currently the largest corporate holder of Solana (SOL), with more than 6.8 million SOL on its balance sheet, according to industry data. At current market prices, that stake is valued at roughly $1.1 billion.

As Cointelegraph recently reported, Forward has also launched a validator node on the Solana network, further deepening its involvement in the blockchain ecosystem.

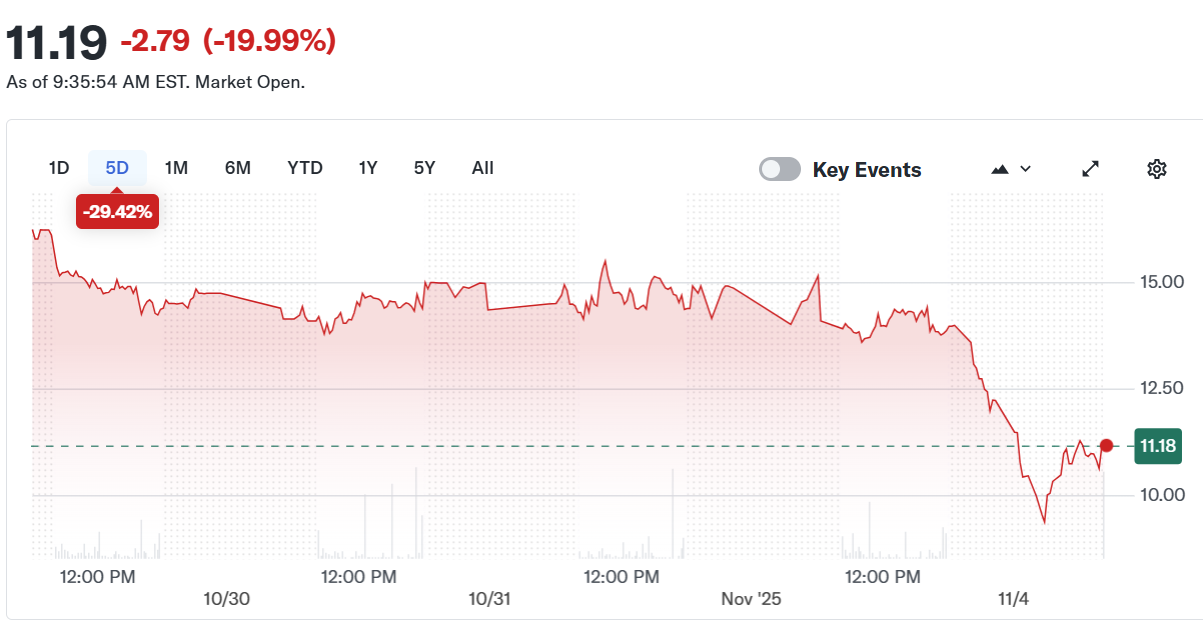

Forward’s stock slid almost 20% on Tuesday amid broader weakness in equities linked to the cryptocurrency sector.

Related: Citadel discloses massive stake in Solana treasury company

Crypto treasury companies face mounting valuation pressure

Several companies pivoted to a “crypto treasury” model during the bull market, aiming to revive their share prices and reposition their businesses toward higher-growth digital asset sectors. However, these firms have come under pressure recently.

Analysts at Standard Chartered have warned that many crypto treasury companies are experiencing a valuation crunch, as their enterprise values have fallen relative to the market value of their underlying crypto holdings — effectively reducing their market net asset value (mNAV).

The pressure isn’t limited to altcoin-focused digital asset strategies. In June, venture capital firm Breed warned that only a handful of Bitcoin (BTC) treasury companies are likely to avoid the “death spiral” triggered by collapsing NAVs.

Related: Mega Matrix files $2B shelf to build Ethena stablecoin governance treasury