Bitcoin Price Analysis: BTC Unlikely to Revisit ATH Before Testing $111K Support

Bitcoin’s impulsive bullish leg has paused upon reaching the critical $123K level, signaling potential profit-taking and distribution.

A corrective move toward the $111K support zone is now expected before the next leg higher.

Technical Analysis

By Shayan

The Daily Chart

After breaking above the previous all-time high at $111K and triggering a notable short squeeze, BTC surged to set a new ATH at $123K, a move underscoring strong market demand and investor confidence.

However, the upward momentum has temporarily paused at this crucial resistance, resulting in a period of sideways consolidation likely driven by increased sell-side pressure.

A corrective pullback toward the significant 0.5–0.618 Fibonacci retracement zone between $107K and $111K is now anticipated before the next impulsive move. Until then, a period of consolidation appears likely.

The 4-Hour Chart

In the lower timeframe, BTC’s consolidation is more pronounced, reflecting ongoing profit realization. What initially resembled a head and shoulders reversal has evolved into a descending wedge, a typically bullish continuation pattern.

The price continues to trade within this wedge, supported by a key ascending trendline currently positioned around $116K. This trendline has acted as a major support throughout the recent rally.

As long as the price remains confined between the wedge’s boundaries and this trendline, a consolidation range is in play.

A break below the line could trigger a deeper correction toward the $111K support. Conversely, a breakout above the wedge’s upper boundary would signal the continuation of the bullish trend, potentially targeting the $123K ATH and beyond.

On-chain Analysis

By Shayan

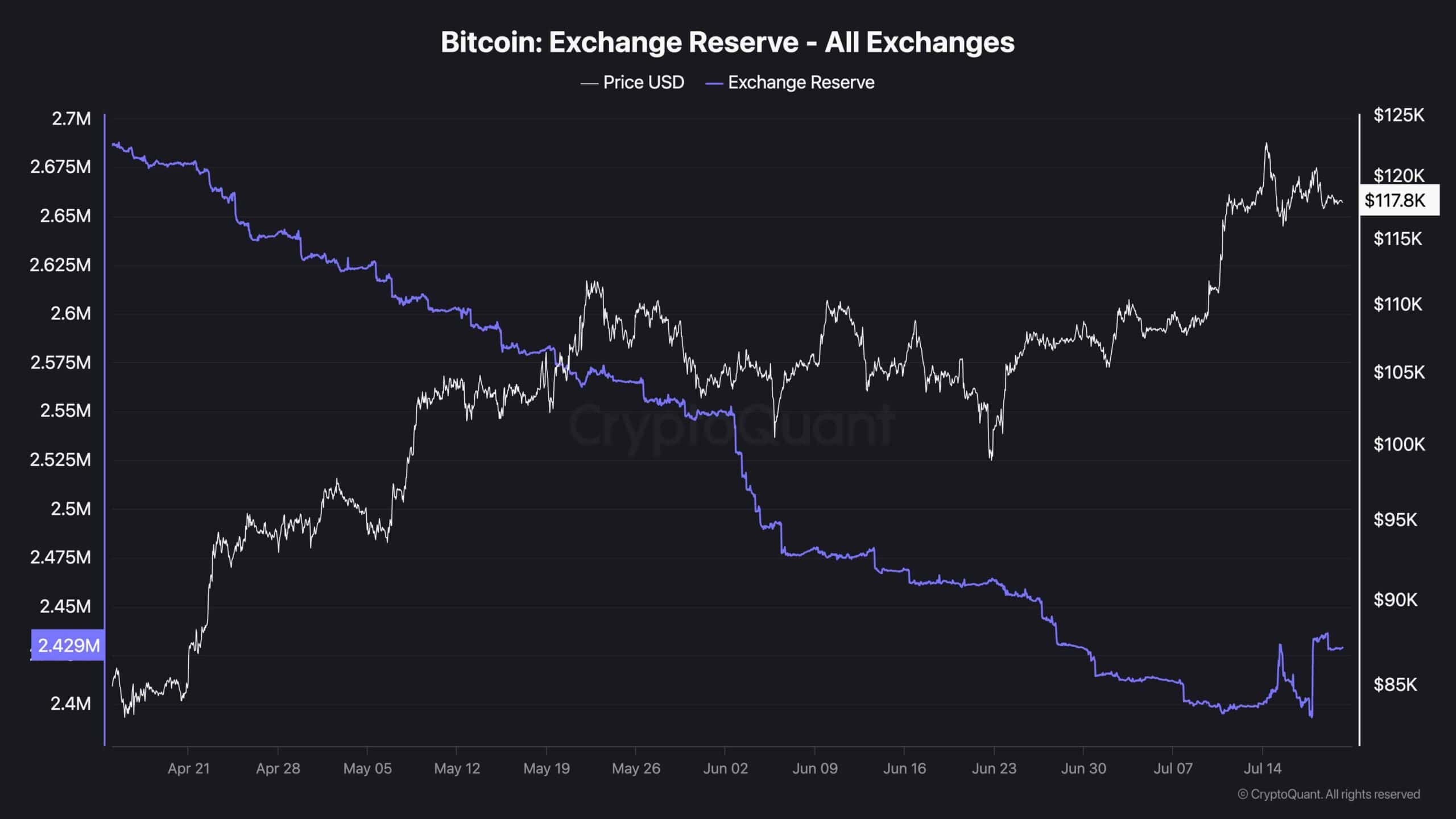

On-chain data from CryptoQuant indicates a notable increase in Bitcoin reserves on centralized exchanges, reaching their highest level since June 25th. This sustained inflow reflects ongoing profit-taking and distribution by investors, a dynamic that often signals weakening buy-side pressure and hints at a potential corrective phase.

Historically, rising exchange reserves are associated with local market tops, as more BTC becomes available for potential sale. However, this metric alone should not be seen as a definitive trigger for immediate price drops. Broader market liquidity, sentiment, and demand dynamics remain key.

In essence, while elevated exchange reserves may introduce short-term selling pressure, the broader market structure for BTC remains bullish. Any corrective pullbacks should be viewed within the context of a still-intact longer-term uptrend, unless macroeconomic or technical conditions shift significantly.