How Deep Are Bitcoin Traders Hedging After Recent Price Dip Below $100K?

The Deribit-listed bitcoin BTC$102,019.12 options market is revealing growing caution among traders, with some prepping for a slide to $80,000, as spot prices show signs of weakness.

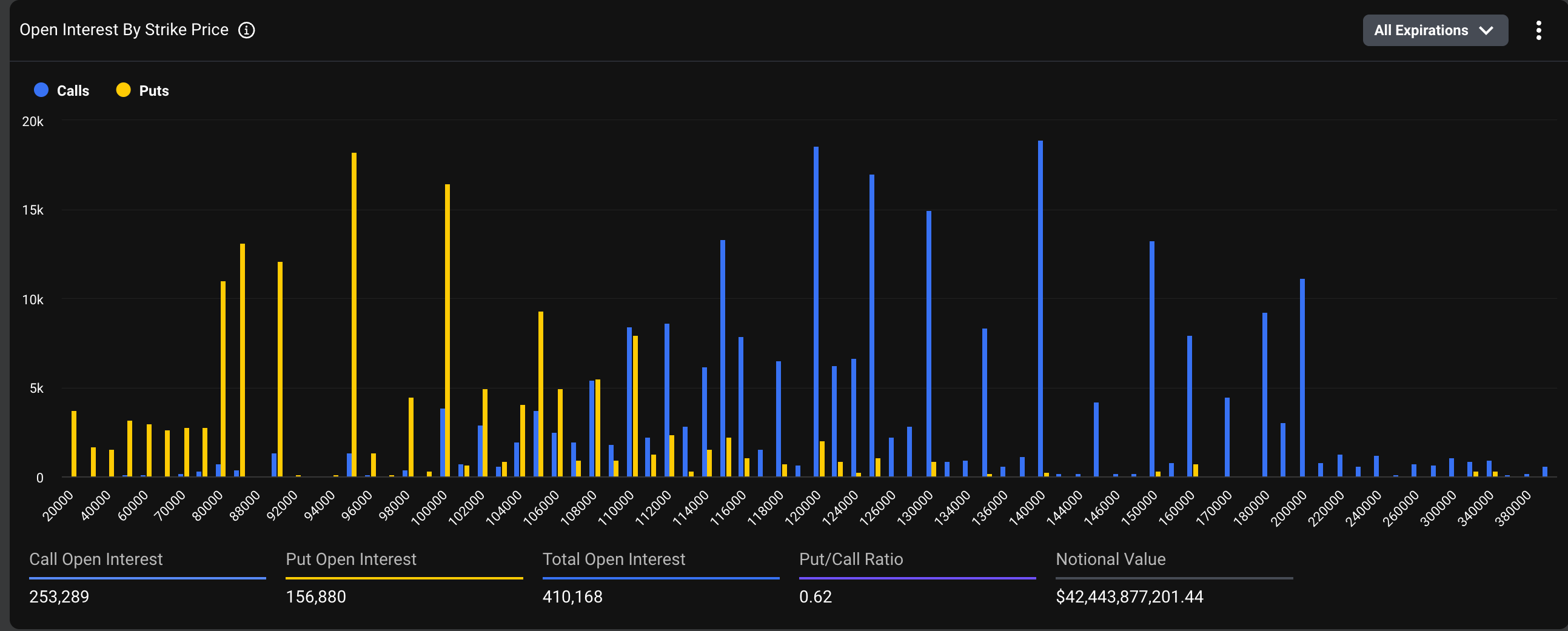

Notional open interest in BTC options, or the dollar value of the active contracts, remains elevated above $40 billion on Deribit, with activity concentrated in November and December strikes close to $110,000. However, at the same time, demand for the $80,000 strike has increased, a sign that traders are anticipating a continued sell-off in BTC.

“A notable surge in put options positioned near the $80,000 mark signals traders are increasingly hedging against a deeper slide,” Deribit said. Deribit, the world’s largest crypto options exchange, accounts for over 80% of the global options activity.

Options are widely used to hedge spot/futures market exposure and speculate on price direction, volatility and time. A put option gives the purchaser the right, but not the obligation, to sell the underlying asset at a predetermined price on or before a specified future date. A put represents an insurance against price drops, while a call represents a bullish bet.

The $80,000 put is a bet that the spot price will decline below that level by the option’s expiration date.

As of writing, the $80,000 put option on Deribit has open interest (OI) exceeding $1 billion, while the $90,000 put stands near $1.9 billion, nearly matching the combined open interest of the popular $120,000 and $140,000 call options.

Note that at least part of the OI in these higher strike calls stems from overwriting, or shorting against long spot bets, rather than outright bullish bets. BTC holders short higher strike calls to generate additional yield on top of their coin stash.

Down 18%

Bitcoin’s price has dropped by over 18% since reaching a record high of more than $126,000, roughly four weeks ago. At one point this week, prices briefly fell below $100,000.

The sell-off comes as macro pressures, particularly the recent hawkish commentary by Fed’s Chair Jerome Powell, have weakened demand for spot ETFs.

“Macro pressure filtered directly into crypto via four consecutive sessions of roughly $1.3 billion in net outflows from U.S. spot Bitcoin ETFs, a reversal that turned one of 2025’s strongest tailwinds into a near-term headwind,” Singapore-based QCP Capital, said in a market update Wednesday.

“The softer spot demand collided with forced deleveraging, with more than $1 billion in long liquidations at the lows,” the firm added.

Ecoinometrics warned in a recent report that the closer bitcoin’s price stays to the $100,000 level, the greater the risk of a feedback loop emerging, where price weakness triggers outflows from bitcoin ETFs, which in turn puts additional downward pressure on the spot price.

As of writing, bitcoin changed hands at $103,200, representing a 1.9% gain over the past 24 hours.